Lesson 7: Credit Cards and Credit

How Do Credit Cards Affect My Credit Score?

Just having your name on a little plastic card isn’t going to affect your credit score by much. It’s how you use them that counts. There’s a big difference between using a credit card for everyday spending and paying it off weekly or monthly and using it to buy a new car and letting the balance sit there unpaid. Lenders don’t mind that you have credit cards, but they are very interested in how you handle them.

How can I use credit cards to improve my credit score?

Overspending with a credit card can be disastrous for your credit. Still, a disciplined strategy can help you make credit cards a tool to improve your credit score. These include:

- Don’t spend more than you have; use your credit card like a debit card, and only spend what you have in the bank

- Avoid making luxury purchases with your credit card

- Pay off your card immediately; you don’t have to wait until your bill is due!

- Use your card only for expenses that you know you can pay off within the current month

The reason credit cards expire is because the magnetic strip gets a lot of abuse and needs to be replaced. A magnetic strip is good for only about three to four years of swiping.Fun fact:

Secured vs. Unsecured Credit Cards

Unsecured Cards

Using an unsecured credit card is like taking out a loan. Credit card companies allow customers to borrow their money, but everything must be paid back in full and on time by the end of the month. Using an unsecured credit card is like paying for the convenience of using money you don’t have, but the credit card company can charge interest and limit your spending.

Secured Cards

With a secured credit card, the credit limit is paid in advance. You deposit a given amount of money with your credit card company to open a card. This deposit is typically the same as your credit limit. If you do not pay your bills on time, your creditor uses this deposit to cover the bill. If you consistently pay your bills on time, you can receive your deposit back, get an increased limit, or upgrade to an unsecured credit card. This is a good way to build your credit score if you have no credit history or a poor credit score.

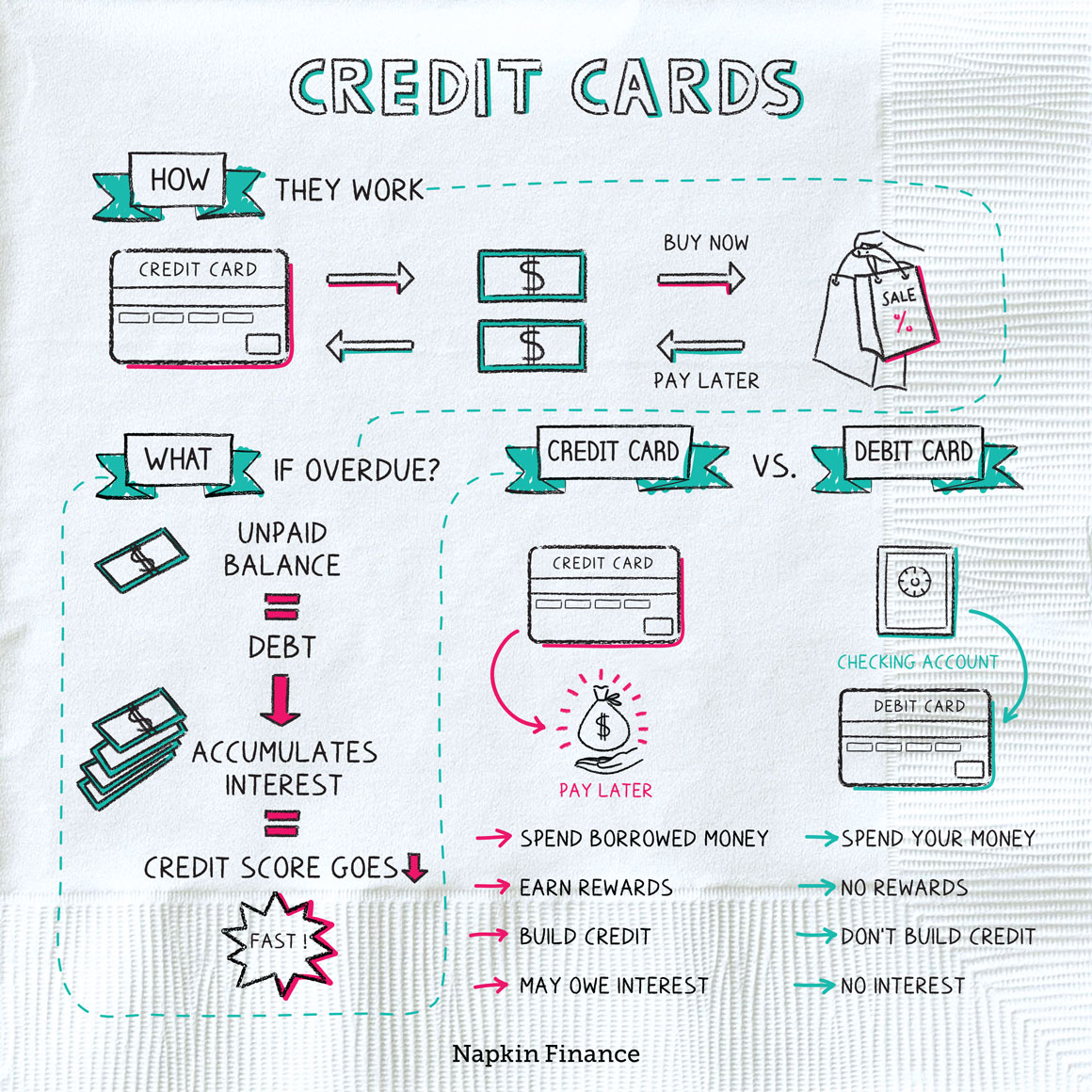

Credit Cards vs Debt Cards

| Credit Cards | Debit Cards | |

| Interest / Charges | You must pay interest on any outstanding debt. You also have to pay penalty fees if you make a late minimum payment. | There are no interest charges. |

| Debt | You are provided a line of credit, which is the maximum you are allowed to charge, but this limit is flexible and could allow you to take on too much debt. | Your card is linked to money you actually have in your account, so you can’t spend any more than you actually have and go into debt. |

| Membership | A plethora of membership rewards are available. | Few membership rewards are available, but you can earn some eventually. |

| Purchase Protection | They offer protection of purchases from theft, loss, and accidental damage. | Limited purchase protection compared to Credit Cards |

| Acquisition | You fill out an application to determine if you are approved for the credit card. | They are provided with almost all checking accounts. |

| Credit History | You are required to have a positive credit history to obtain a credit card and late payments can affect your credit score. | No investigation into your credit history is required to obtain a debit card. |

What is APR?

Annual Percentage Rate (APR) is a way to evaluate the full amount of interest and fees you will pay on borrowed money in a given year. It provides you with the all-in annual cost of borrowing money, including any fees as well as the interest, and it’s a simple way to compare loan options.

APR is a flexible tool. You can use it to evaluate the total cost of just about any debt, from an unsecured credit card to a 30-year mortgage.

Unlike the interest rate, APR factors the effects of compounding. As a result, it’s typically higher than the stated annual interest rate and is a more accurate reflection of how much it will cost to borrow money.