2nd Period: Getting Money

When you think about ways to get money, probably the first thing that comes to mind is working.

You might already be working your first (or second) job. Many people start out by babysitting or mowing lawns, becoming a lifeguard at the local pool, working at a local store, or helping out in other ways in your community.

In addition to working, you may already receive some money from:

- Allowances

- Gifts

Upping your game

As you get older and become financially independent, you’ll have more opportunities to take on different (and probably higher-paying) jobs.

Exactly how much higher paying may depend on what career field you decide to go into and what level of education you pursue—whether going to trade school, earning an undergraduate degree, or going for an advanced or specialized degree (like what doctors, lawyers, or college professors need).

Whatever route you choose, completing some kind of postsecondary education can open more doors for you and boost what you earn over the rest of your life.

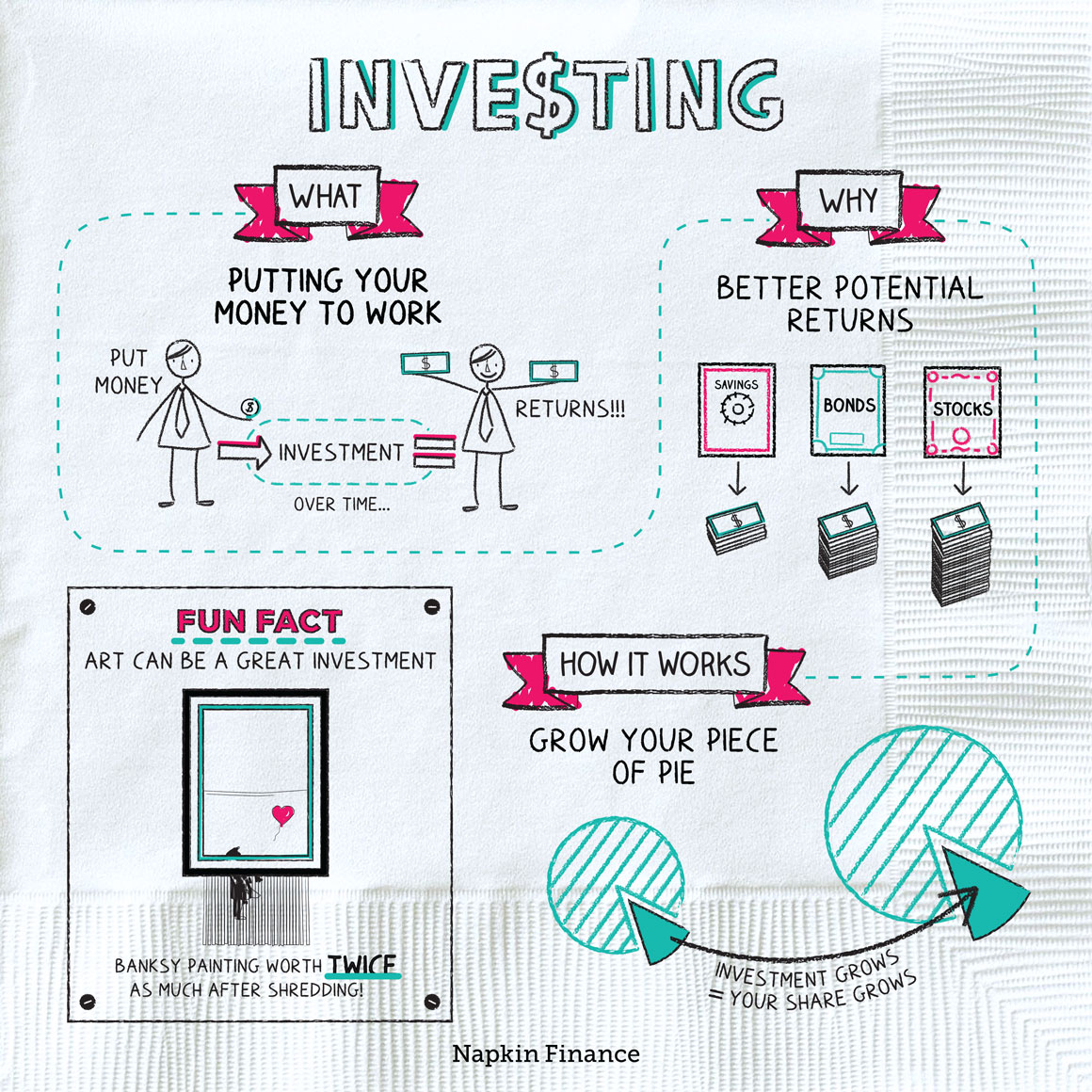

Helping it grow

But working (or cashing checks from the bank of mom and dad) isn’t the only way to get money.

It’s also possible to earn money without lifting a finger: through the magic of investing. Here’s a quick rundown of what that can look like:

| What | What it looks like |

|---|---|

| Earn interest |

|

| Buy bonds |

|

| Invest in stocks |

|

| Invest in real estate |

|

To make money investing, you have to have at least some money to invest. But it can be a powerful way of turning a small stash into major cash. Billionaire Warren Buffett made his first stock investment when he was just 11.

“Guess you lose some and win some, long as the outcome is income.“

—Drake

Talk it through

- What are some of the ways your friends or family members earn money?

- Do you know anyone who invests, and, if so, what do they invest in?