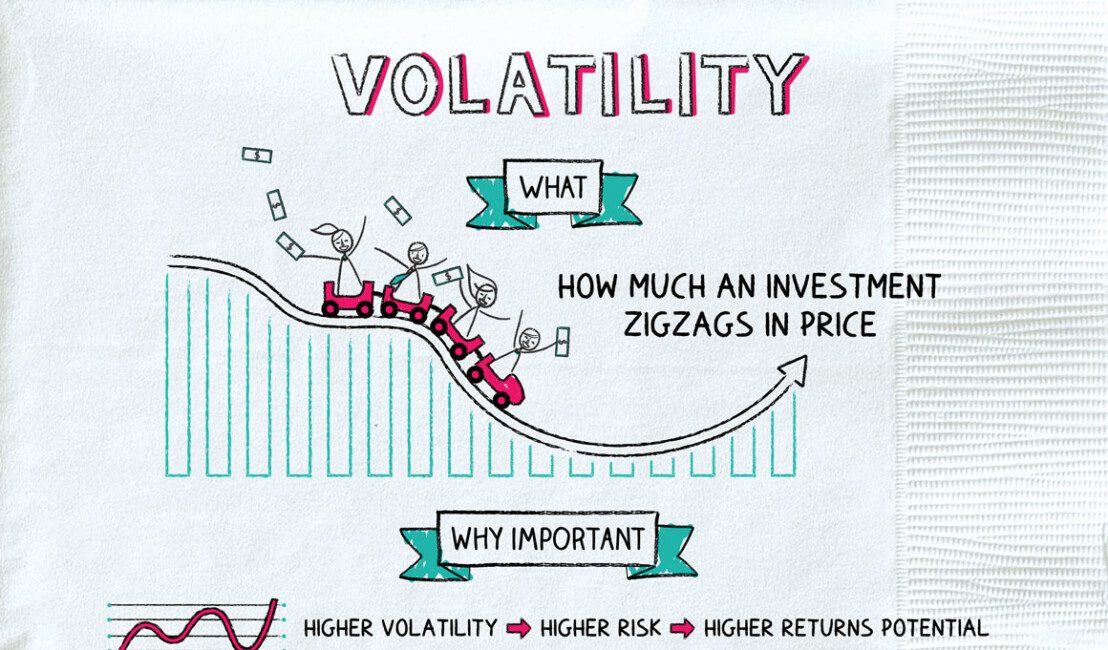

Volatility: Buckle Up

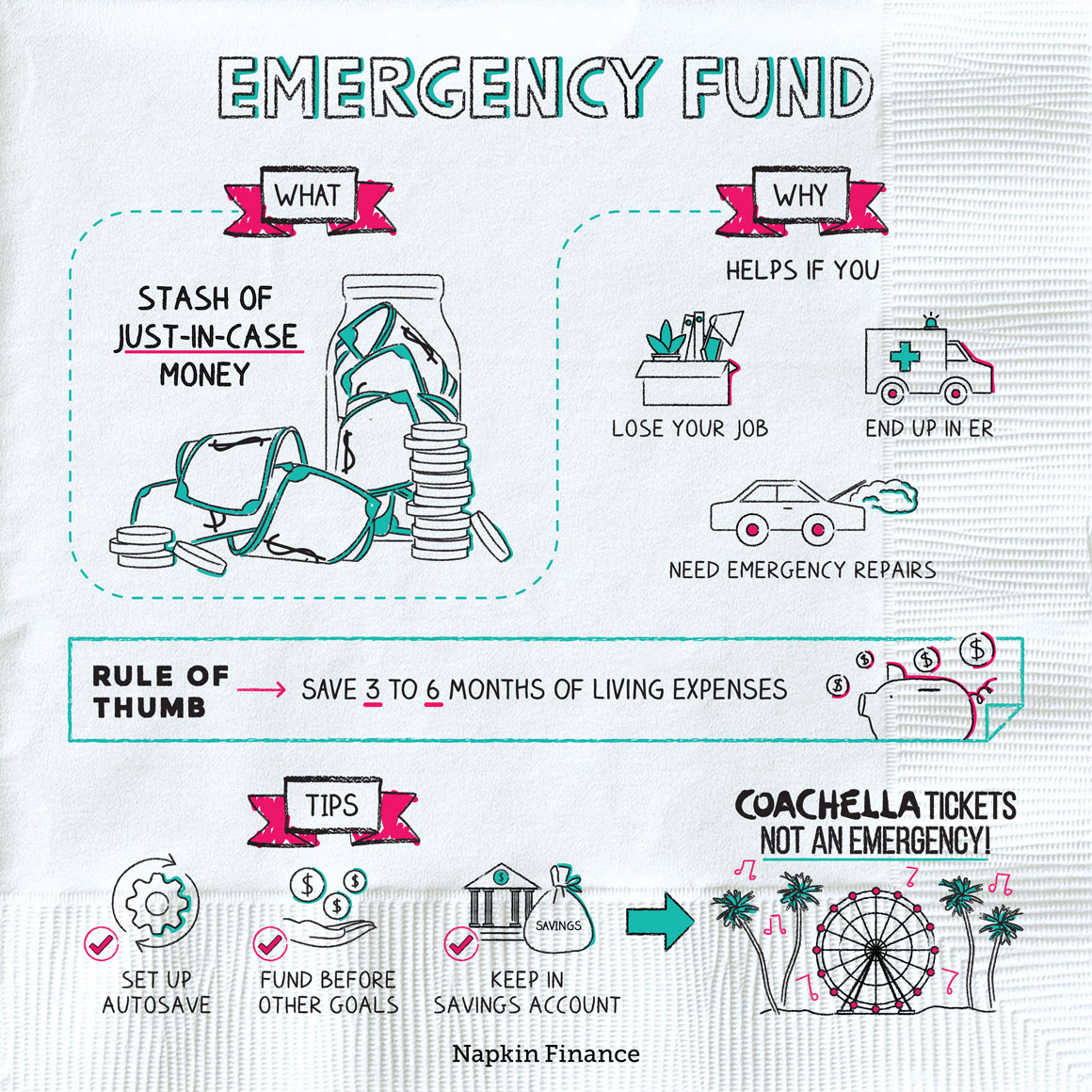

It’s a fact of life that bad things—especially of the financial variety—sometimes happen to good people. That’s why you need an emergency fund.

Emergency funds are buffers between you and life. When the plumbing bursts in your newly purchased home or a sudden illness leaves you with steep medical bills, you need money fast. If you have an emergency fund, you can dip into it rather than your long-term savings or retirement funds—or worse, using credit.

Your emergency fund should cover truly unexpected, urgent expenses. Here are some costs that don’t make the cut:

The rule of thumb is to have three to six months of expenses in an emergency savings account. Struggling to sock away that much cash? Look to financial windfalls like your tax refund or annual bonus to get the ball rolling.