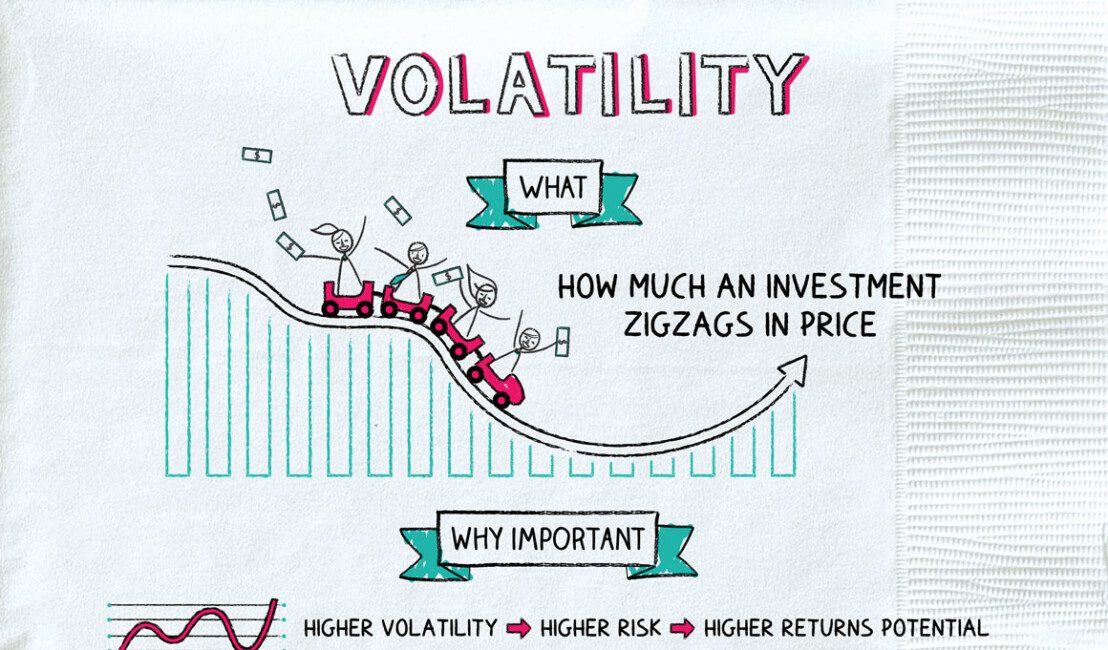

Volatility: Buckle Up

With interest rates dropping in recent weeks, you may be wondering whether the COVID-19 crisis has created a ripe opportunity to buy a house at a great rate.

Unfortunately, the picture isn’t quite that clear. If you’re ready to buy and have solid credit and a low debt-to-income ratio, you may be able to take advantage of low interest rates on a mortgage (though rates are so volatile right now, there’s no guarantee of that).

But lenders are tightening their criteria, with some suspending or raising the qualifying criteria for programs such as VA and FHA loans, which specifically cater to borrowers with average-to-low credit scores. Economic uncertainty doesn’t help either. Some estimates say unemployment could hit 20% by June, and no one knows how long the pandemic-driven recession will last. If there’s a chance you could be laid off in the coming months, you may want to hold off on applying for a mortgage.

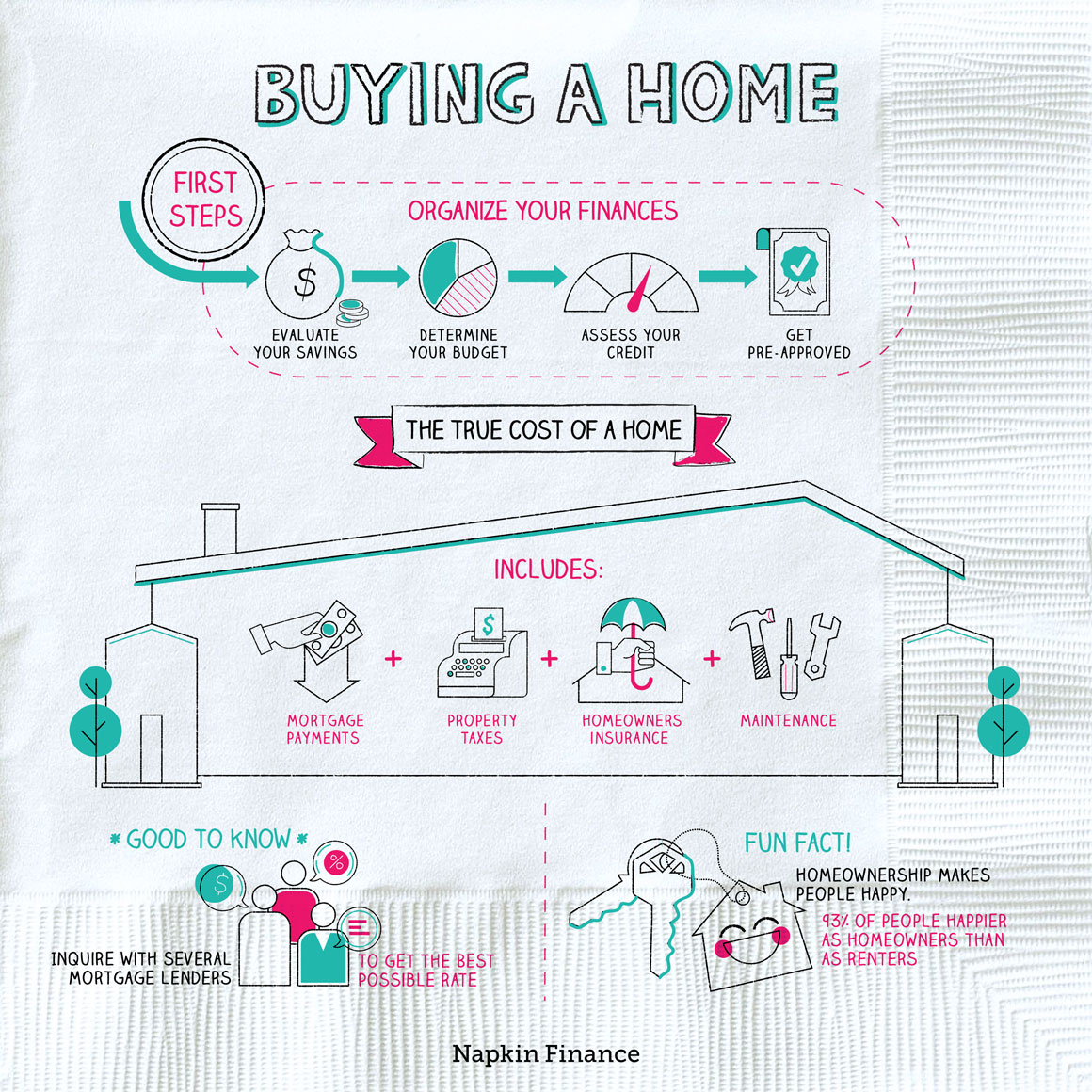

But whether you’re ready to buy or just daydreaming about homeownership, it’s never too early to learn about the homebuying process. Our Buying a House Napkin walks you through the fundamentals, including:

Check out the napkin and full article here.