Partnerships

Passing Through

If you’re starting a business with someone else (or multiple people), the partnership is the most basic legal structure. They’re easy to start and maintain as long as you lay the right groundwork at the beginning.

Unlike some other types of businesses, partners share profits and losses. They also jointly manage and make decisions for the business.

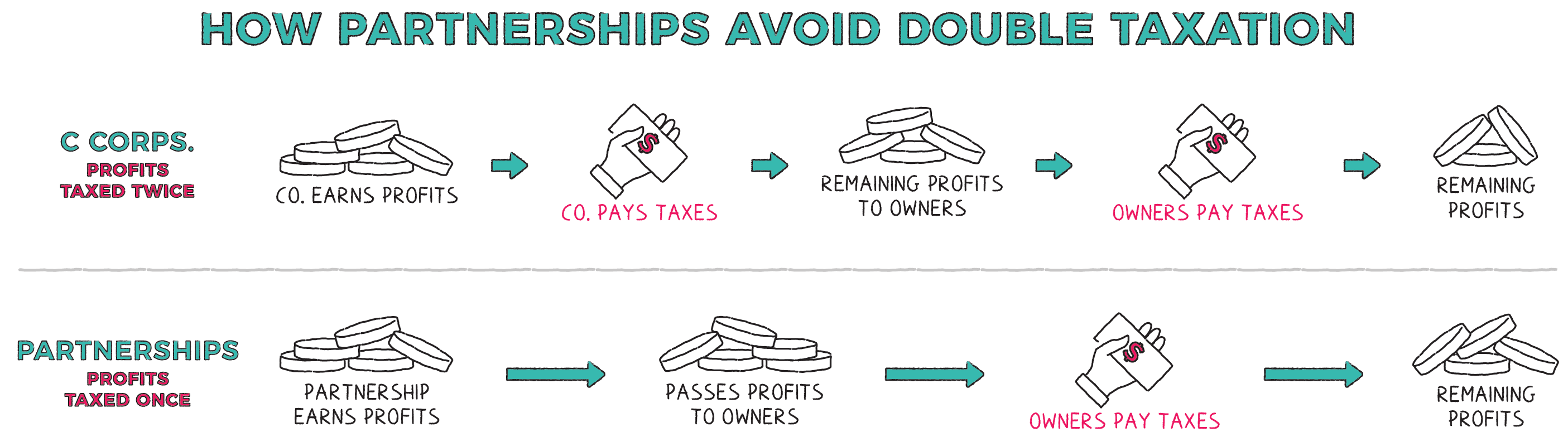

Partnerships are “pass-through” entities. This means that profits are held not by the business but rather by the individual partners. Here’s how it works:

Partnership earns money from its business

↓

Partners are paid by the business from any profits

↓

Partnership files tax return but pays no taxes

↓

Partners pay personal income taxes

on the income received from the business

By contrast, C-corporations (the most common type of corporate structure) face so-called “double taxation” because the corporation pays taxes on its profits, and then individual owners also pay income taxes on any profits they receive.

Partnerships get to skip paying taxes at the business level and are only taxed at the individual income tax level. (Partnerships aren’t the only structure that get this pass-through treatment—some corporate structures do too.)

So, while the business still has to file a tax return each year, the business itself pays no income taxes.

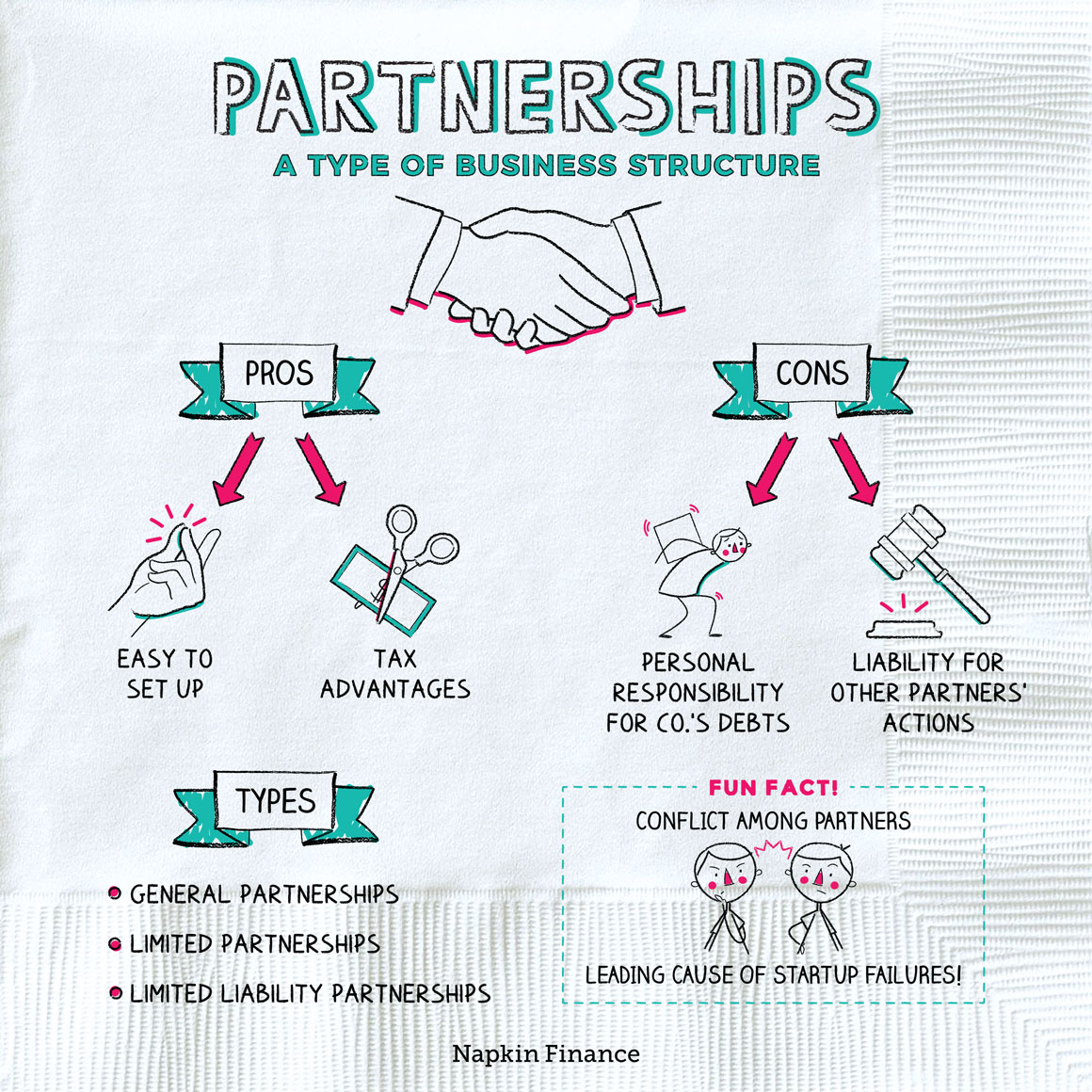

There are three main types of partnerships:

| General partnership | Limited partnership | Limited liability partnership | |

| Who makes business decisions? | All partners | The general partner | All partners |

| Who’s responsible for debts? | All partners | The general partner has unlimited liability; limited partners are liable for debt up to the amount of their investments | All partners |

| Can be held personally liable for other partners’ actions? | Yes | Limited partners can’t be personally liable (unless they begin actively managing the business) | No |

A partnership isn’t for everyone. Here are the trade-offs:

| Pros | Cons |

| Business pays no taxes | Could be liable for another partner’s screwups |

| Get to share costs and risks with partners | Have to share profits with partners |

| Share the burden of running a business | Have to make decisions together |

| Build something you love with a group of people you trust | Potential for personality clashes |

| Relatively easy to set up | Not available for all business types (such as corporations and publicly traded companies) |

Setting up a partnership requires a few simple steps. Depending on the size and complexity of the partnership, a lawyer or an accountant may be able to help with the process.

Step 1: Choose a partner or partners whom you trust and work well with.

Step 2: Pick a business name.

Step 3: Draft, read, and sign a partnership agreement that details each partner’s duties, how you’ll make business decisions, and how you’ll handle compensation, profits, and losses.

Step 4: Register with all states (and potentially counties) where you’ll do business. Keep in mind that each state has its own regulations on which types of partnerships can be formed.

Step 5: Request an Employer Identification Number (EIN) from the IRS. (Even if you don’t plan to hire employees, you’ll want this for tax filing and to give clients as needed.)

Step 6: Obtain any other licenses and permits you may need for your business.

Once you’ve hit the ground, keeping a partnership running smoothly means maintaining careful financial records, communicating frequently and clearly with all partners, and filing all tax paperwork on time.

If you want to share the ups and downs of running a business, a partnership might be right for you. Set yourself up for success by choosing the right partners, putting a business agreement in writing, and staying honest with regulators and taxing authorities.

- An estimated 65% of startups fail because of conflict between the founding partners.

- Partnerships are popular among professional service providers, such as real estate agents, lawyers, and accountants. (It’s also the go-to structure for hedge funds.)

- Partnerships are pass-through entities, meaning the responsibility for paying income tax falls to the individual partners.

- Partners typically make business decisions together and may even be held personally responsible for the business’s debts—although the exact distribution of duties and obligations depends on the partnership type.

- Most partnerships are simple to establish and maintain.

- Successful partnerships require good communication, close collaboration, and a shared vision.