Incorporating

Limited Liability

A corporation is one type of formal business structure that entrepreneurs can choose to use when starting or growing a company. A corporation is a stand-alone entity separate from its owners.

Corporations require a lot more paperwork and recordkeeping than some other business types, but incorporating lets owners limit their personal liability. This means that creditors can go after the company’s money and property but for the most part can’t touch an owner’s house, car, savings, or other assets.

There are two main types of corporations:

| C-Corporation | S-Corporation | |

| Who can form one? | Anyone | Must meet certain qualifications |

| Who pays taxes? | Both the corporation and shareholders | Shareholders |

| Shareholder limit | Unlimited | No more than 100 |

Unlike a partnership or sole proprietorship, running a C-corp or S-corp requires a few more players.

- Board of directors

- Makes major decisions for the business, chooses (and can fire) the executives, and makes sure the company doesn’t break the law.

- Has a legal obligation to protect the interests of owners (i.e., shareholders).

- Shareholders

- The company’s owners.

- They invest money in exchange for ownership, meet at least annually, and choose the board of directors.

- Officers (aka executives)

- Run the business day to day.

- Usually include at least a CEO, CFO, and secretary.

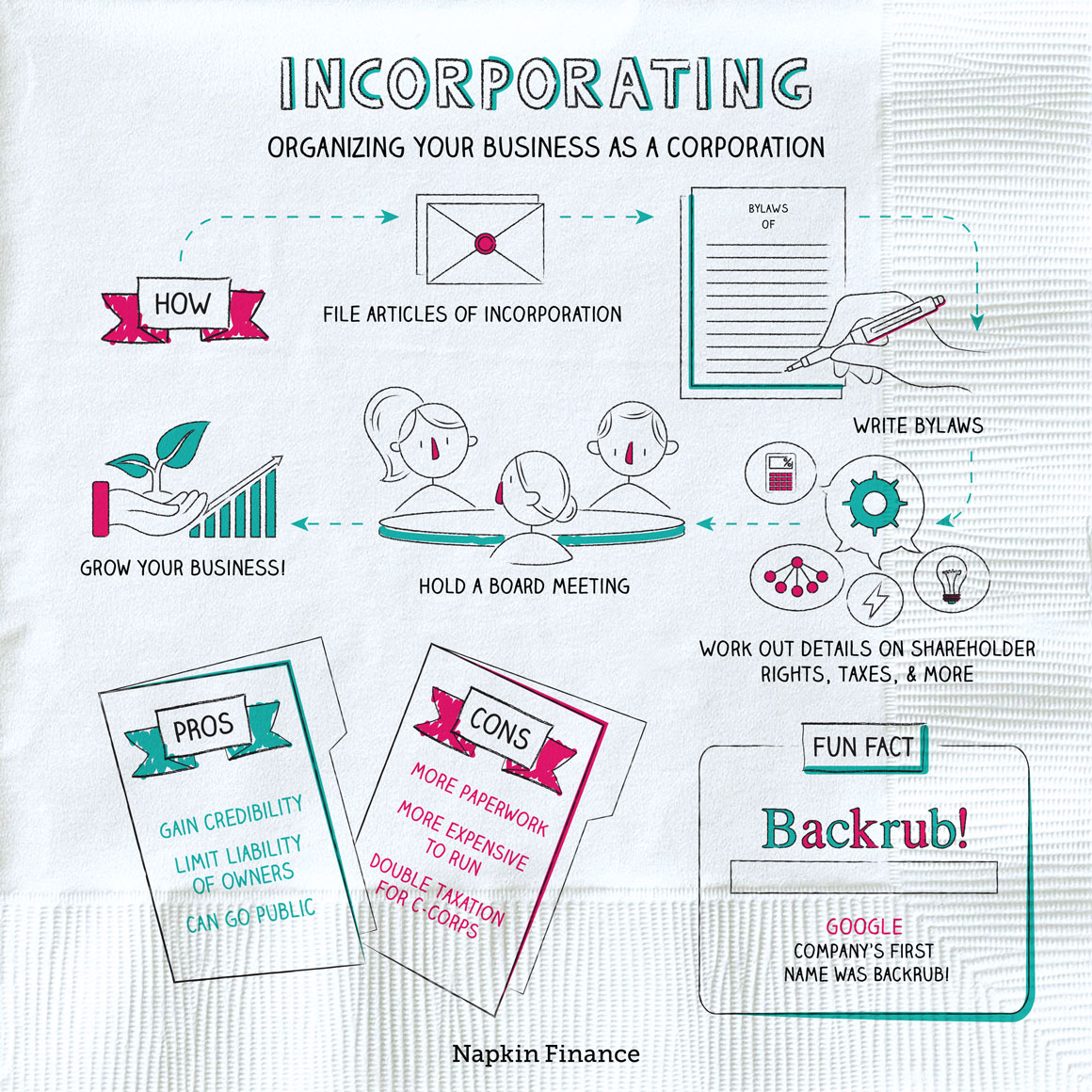

| Pros | Cons |

| Inc. after a business name may give you more credibility | More work to set up and run |

| Can live forever (or until the business is closed, merged, or goes bankrupt) | More expensive to set up and run |

| Limited personal liability | A ton of compliance requirements |

| Potential to go public | Double taxation (for C-corps) |

Incorporating can make sense for almost any business type or size. It’s often the right structure for companies with intellectual property (such as tech or design) and those that want to go public one day.

Experts say it can make sense to take the plunge before signing contracts or hiring employees. That’s because a contract signed before incorporation makes the owners personally liable for that specific contract. And, if you’re unincorporated, you’re also personally liable for the mistakes employees make.

For small entrepreneurs or startups, the large amount of paperwork and high financial costs of incorporating may not be feasible at the start. Some business owners choose to start as a limited liability company (LLC), which doesn’t have as many requirements, and then incorporate when the time is right.

Step 1: File an application for a charter in the state where the business will be incorporated. This doesn’t have to be the state where you’ll do business.

Step 2: Write articles of incorporation and send to the secretary of state’s office. (These list details, such as the company’s name, purpose, and location).

Step 3: Write bylaws that explain how the company will be run (such as who’s on the board and when meetings will be held).

Step 4: Ask for an Employer Identification Number (EIN) from the IRS. S-corps also have to file a specific form with the IRS stating that the corporation is choosing to pass all profits and losses to shareholders.

Step 5: Run the business. The corporation must follow the laws of the state where it’s incorporated, keep careful financial records, file all required reports, hold yearly meetings (and keep minutes!), and ensure that personal and corporate funds remain separate.

Possibly the biggest downside of incorporating as a C-corp is having to pay taxes on profits twice. Here’s how that works:

Corporation does business

↓

Corporation earns profits

↓

Corporation pays taxes on its profits

↓

Corporation passes remaining profits to shareholders

↓

Shareholders pay taxes on their earnings

Incorporating can help business owners limit their personal liability and can make particular sense for companies that plan to eventually go public. But incorporating can also mean more paperwork to file, more regulatory requirements to meet, and spending a lot more money on lawyers and accountants than some other types of business structures.

- Most Fortune 500 companies are incorporated in the tiny state of Delaware because of the quality of the courts and the state’s efforts to keep corporation laws and regulations modern.

- Walmart is the biggest corporation in the United States. Its founder, Sam Walton, once did a hula dance on Wall Street because he lost a bet to the company CFO.

- Google was originally named “BackRub” by its creators. (They changed the name by the time it incorporated in 1998.)

- A corporation limits the personal liability of its shareholders.

- Corporations are expensive to set up and require careful recordkeeping, report filings, and annual meetings.

- Corporations have a more formal oversight structure than other businesses, with officers, a board of directors, and shareholders.

- Whether a corporation is a C-corp or S-corp determines whether its profits are taxed twice or only once.