Lesson 2: Your Credit Score

How is My Credit Score Determined?

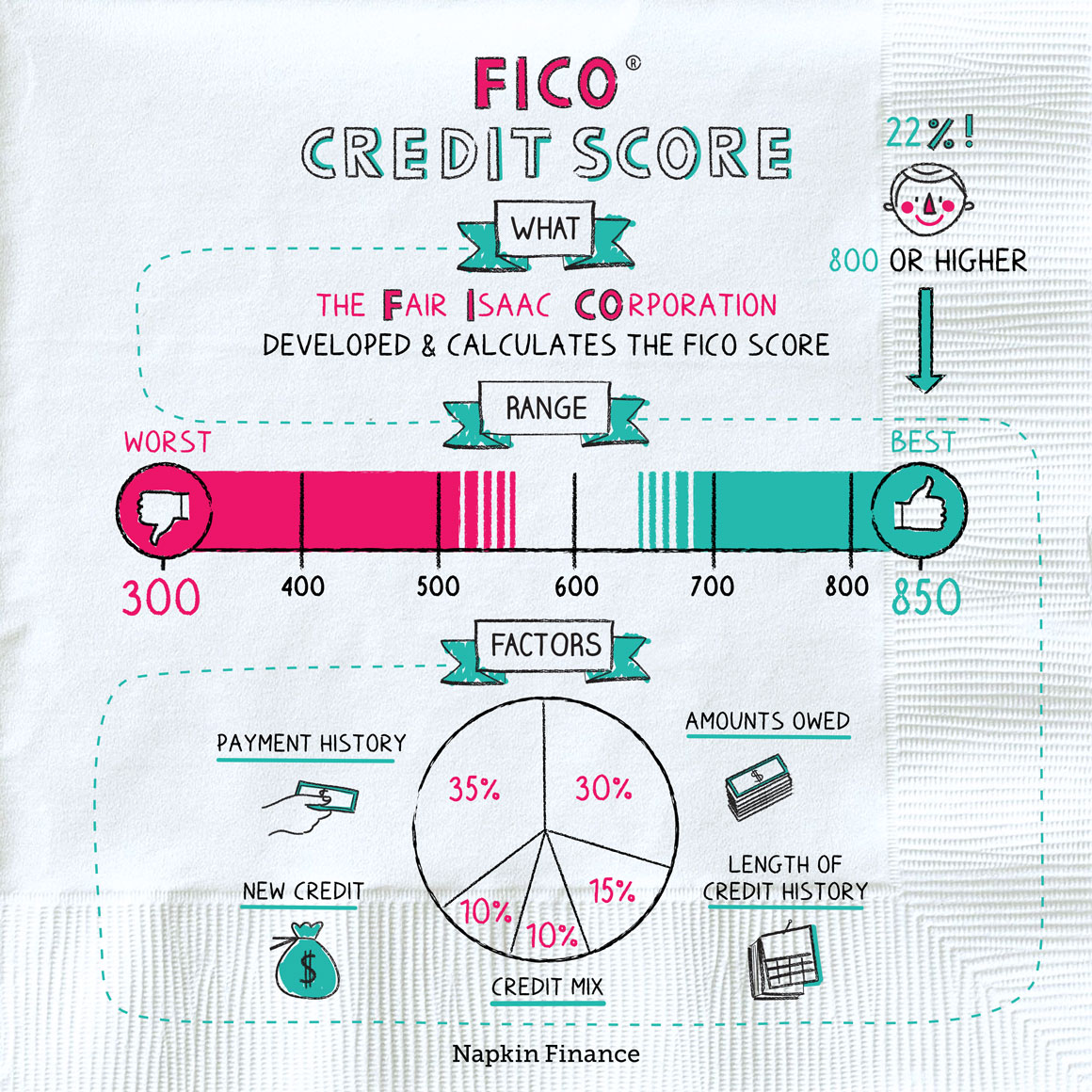

Your credit score is a mix of many factors that represent how good or bad a borrower you are.

The two biggest considerations are:

- How much debt you have compared with the total amount of credit available to you (your Credit Utilization Ratio, or CUR)

- How consistently you pay on time

These factors determine more than 65% of your credit score.

Here are other factors that affect your score:

- Another 15% is attributed to the length of your credit history; the longer you have had a credit history, the better.

- An additional 10% of your score comes from your credit mix, or how many different kinds of debt you have

- The final 10% comes from how often you’re opening new credit lines

What is FICO?

FICO originally stood for Fair, Isaac & Company, but this company is now known as the Fair Isaac Corporation. Since 1956, FICO has been the number cruncher providing the analytics behind your credit score.

![]()

Why is my credit score reported differently at each bureau if they all use FICO?

There are dozens of FICO reporting methods. Some are tailored to the type of debt you’re looking at (loans versus credit cards); there are older and newer versions of the same basic algorithms; and each credit bureau has its own version. That’s why you might see a different credit score depending on where you look.

What is a Good Credit Score?

| FICO score | Score | Risks |

| 800+ | Exceptional | Low: about 1% of consumers |

| 740-799 | Very Good | Low: about 2% of consumers |

| 670-739 | Good | Medium: about 8% of consumers |

| 580-669 | Fair | Medium-High: about 28% of consumers |

| 579 and lower | Poor | High: about 61% of consumers |

What is my credit card company, bank, or landlord seeing?

It depends on the preferences of each lender and which bureau they have a relationship with. According to Forbes, credit card companies generally see FICO’s latest publicly available version, while mortgage lenders tend to be a version behind. Vehicle financing operations subscribe to a special FICO Auto Scores algorithm. Equifax, Experian, and TransUnion each have a proprietary version of FICO that weighs the criteria just a little differently, which is why your credit report usually shows these three numbers as being similar but not always identical.