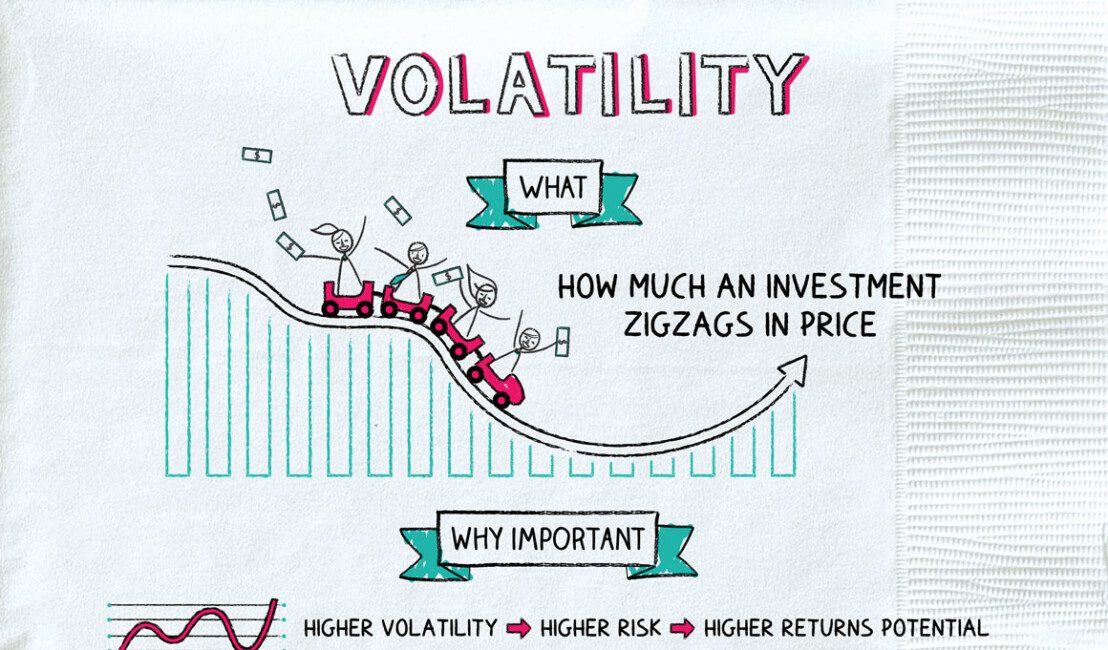

Volatility: Buckle Up

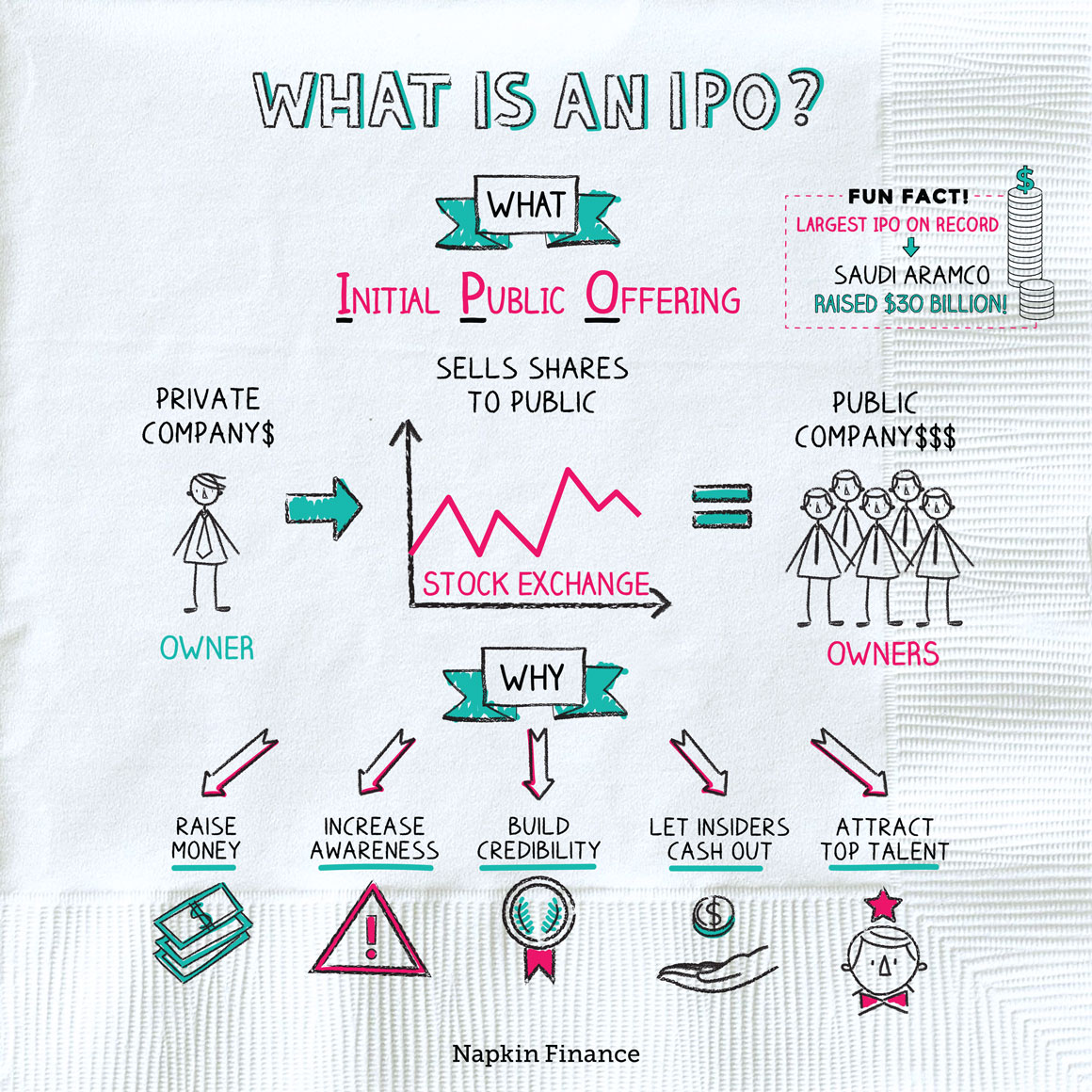

An initial public offering, or IPO, is how a private company becomes a public company. IPOs can translate into big paydays for insiders and investors (or occasionally, big disappointments).