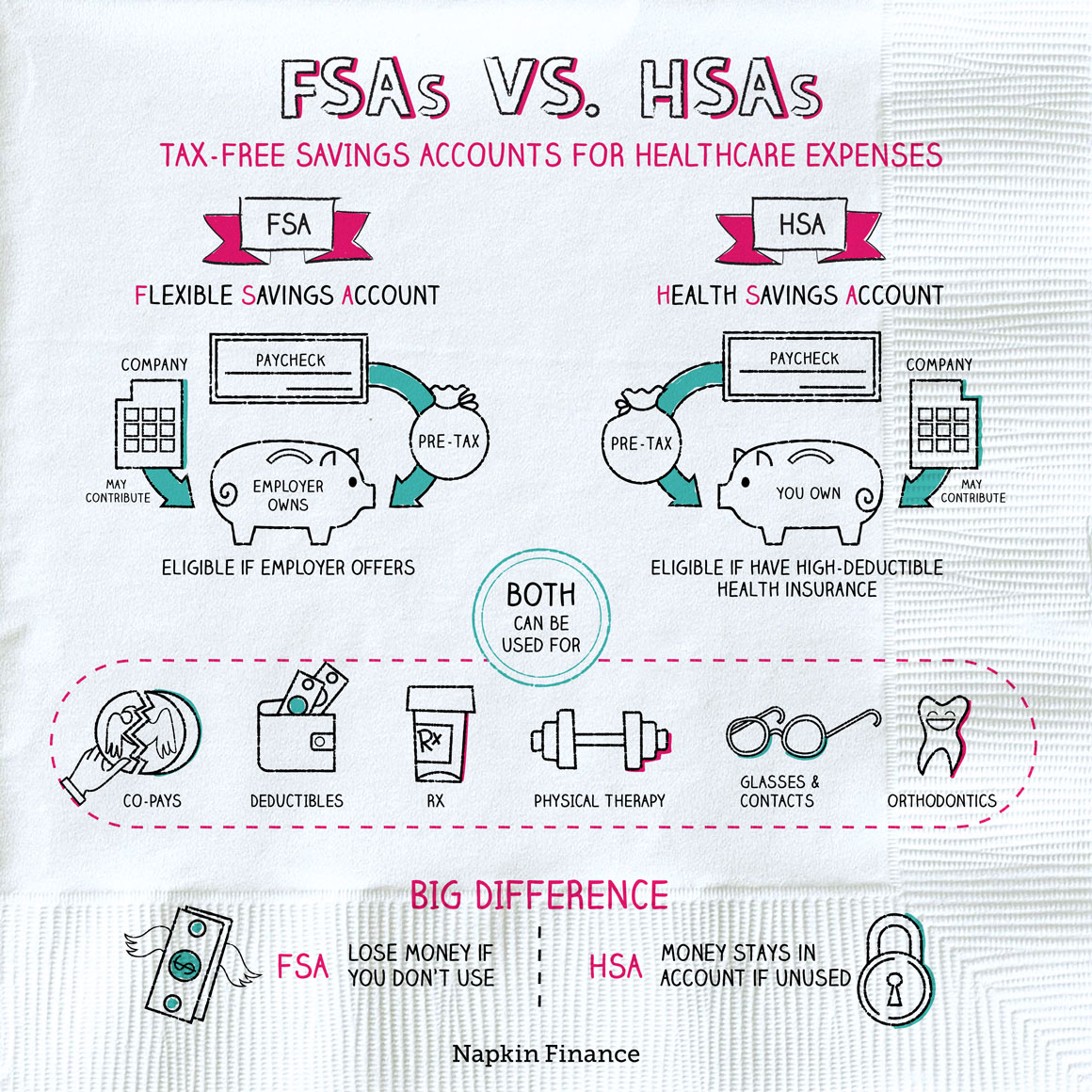

What are FSAs and HSAs?

FSAs and HSAs are special types of savings accounts that can let you pay for healthcare expenses with pretax dollars.

They effectively let you pay less (or put another way, save more), on a whole range of healthcare products and services—from copays to acupuncture to sunblock.

If you’re eligible, saving in an FSA or HSA can be a great deal. But for FSAs in particular, you typically only get one shot to adjust your contributions each year—and that’s during open enrollment.

For many people, open enrollment ends this year on December 15th. (So if you didn’t already have plans for your lunch break today, you’re welcome.)

Learn More

Other end-of-year financial moves

- Open enrollment may be your only chance to adjust your FSA contributions—but you may also face a deadline for spending your 2019 FSA account balance. That’s important not to miss since unused FSA money doesn’t roll over from year to year, so check when your plan’s deadline is (and book a year-end trip to the dentist or optometrist, if need be).

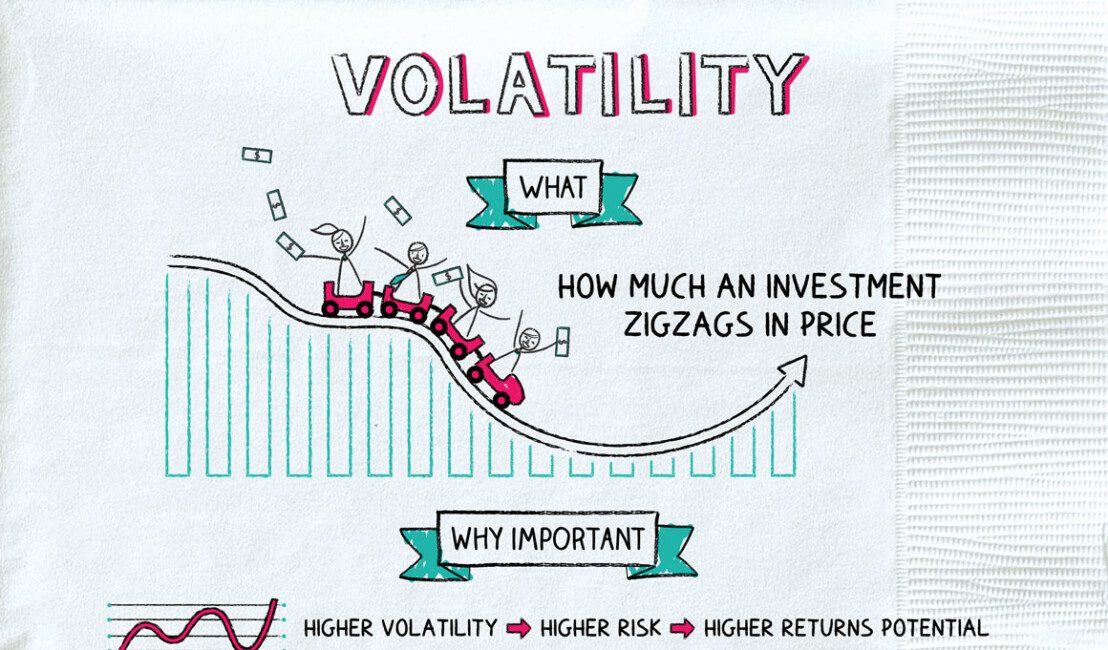

- Stocks have had a roaring year, with the S&P returning almost 30%. That means it could be a good time to check in on whether your portfolio’s asset allocation has drifted off course, and rebalance if need be.

- If you’re 70½ or older, make sure you take any RMDs you need to from your retirement accounts before the apple drops.

- And if you have any wealthy relatives, gently remind them that the annual gift exclusion for 2019 is $15,000.