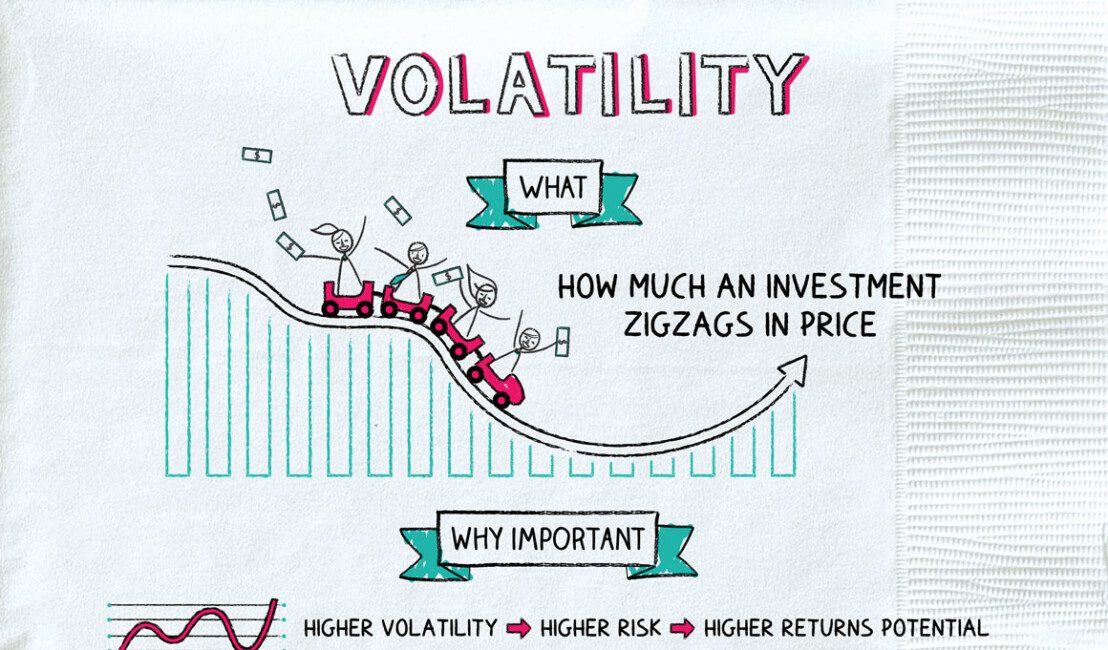

Volatility: Buckle Up

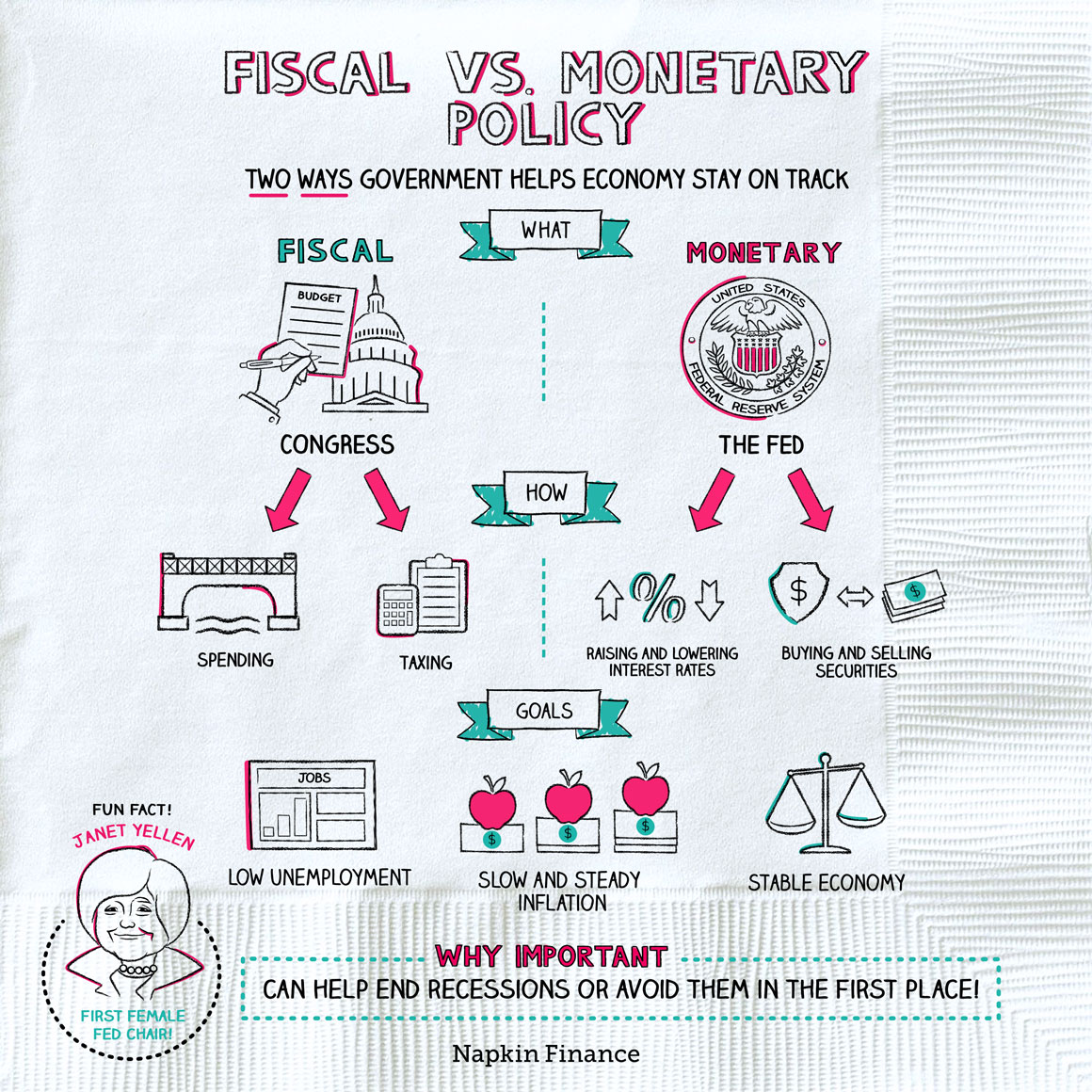

The federal government has two tools for dealing with a financial crisis — fiscal policy and monetary policy. It’s using both to combat the negative effects of the COVID-19 pandemic.

Fiscal policy refers to government spending and taxation, so measures like the recently passed stimulus package and a possible jobs program fall under this category. Monetary policy, on the other hand, falls to the Federal Reserve, and deals with interest rates and market moves such as buying and selling securities.

It’s also engaging in quantitative easing, or buying mortgage securities and Treasuries, to try to keep consumer interest rates low and affordable over the long-term. The goal is to keep the economy as stable as possible, despite the ongoing upheaval.

Stimulus checks are coming, but not for everyone. Millions of Americans are desperately awaiting $1,200 relief checks, but new guidelines require Social Security recipients and low-income citizens to file a tax return to be eligible for the funds. Many of these people do not file tax returns because they earn so little. College students and high school upperclassmen are also dismayed to realize they won’t be receiving checks either, despite the fact that they may have lost their part-time jobs.

Markets dropped over grim predictions. After President Trump announced that the U.S. could see 100,000-240,000 deaths in the next two weeks, markets tumbled, marking a grim start to the second quarter. Forbes reported that it is the S&P 500’s second worst start to a quarter in its history.

But don’t panic and cut retirement contributions. Market volatility may have you wondering whether you should be contributing less to your retirement accounts during the coronavirus crisis, but experts say to keep saving. Although the current market is frightening, you still want to be saving and investing for the future—especially if your employer is not among those considering cutting their 401(k) matching programs right now.