Lesson 2: What is the Stock Market?

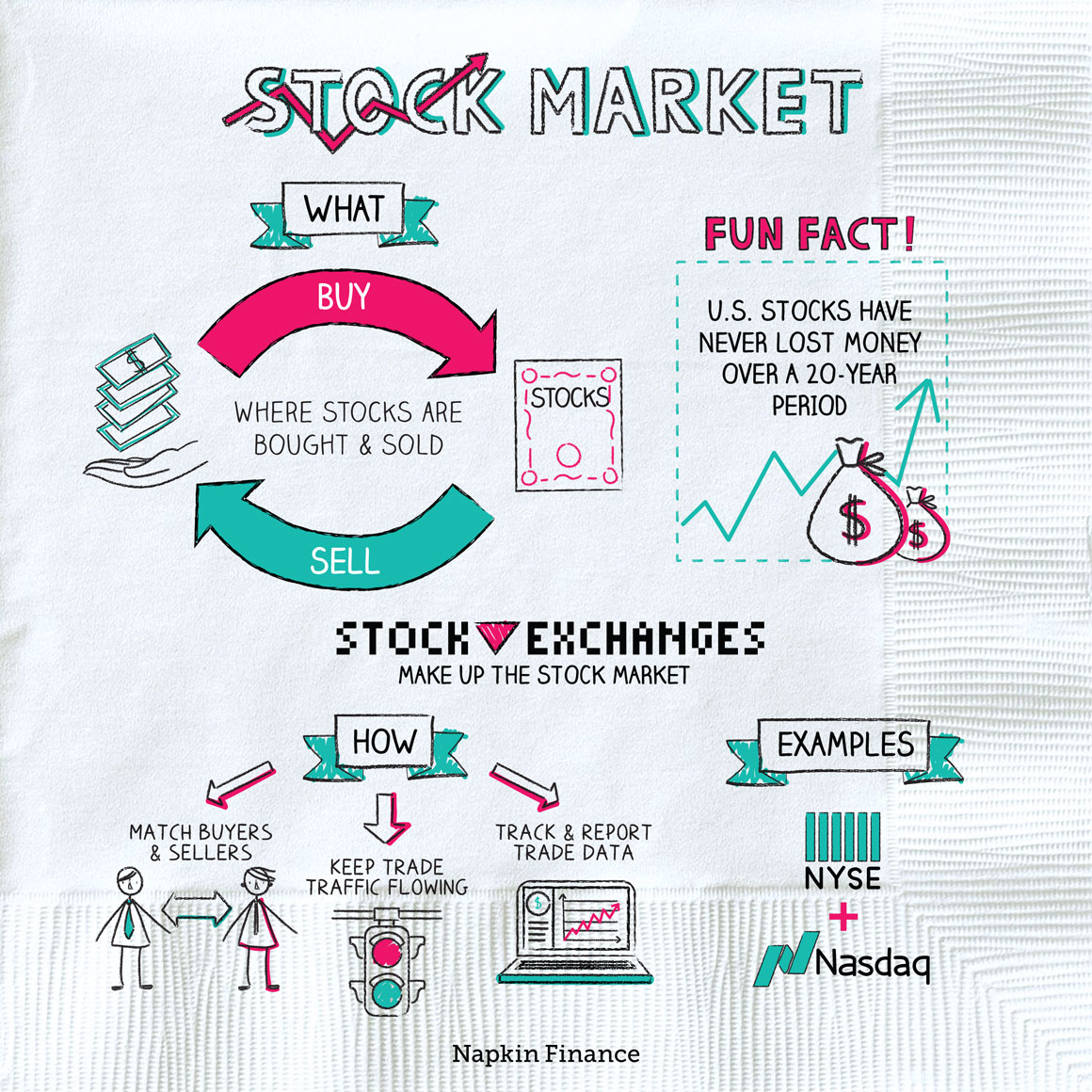

The stock market is the resale market for those corporate ownership stakes. Issuing stocks lets a company take on new investors. But those investors may not want to hold on to those ownership stakes forever. The stock market exists so that investors can sell those stakes, or buy more, or buy new stakes in entirely different companies.

But instead of buying and selling those ownership stakes at preset prices—the way you buy things at a store—the stock market works like an auction. Sellers come to the market with an idea of the prices they’d like to receive, while buyers come to the market with an idea of what they’d be willing to pay. Shares change hands and then change hands again—with millions of shares trading constantly throughout the trading day.

Major stock exchanges

Stocks are bought and sold on stock exchanges. If the stock market is one big auction, then exchanges are like the individual auction houses that facilitate specific transactions. Companies get to choose which exchange (or exchanges) their shares trade on. The U.S. has two major stock exchanges:

- The New York Stock Exchange (NYSE), which is where most large, established companies trade

- The Nasdaq, which features more technology firms and smaller companies

But the U.S. isn’t the only game for stock trading. Important international stock exchanges include:

- The London Stock Exchange

- The Euronext Exchange

- The Tokyo Stock Exchange

- The Shanghai Stock Exchange

- The Bombay Stock Exchange

Fun fact:

In Somalia, pirates run a stock exchange where people can invest to receive a cut of future hijacking ransoms. No cash? No problem! The pirates also accept goods, like rocket-propelled grenades.

Stock indexes

When you hear someone refer to how the “stock market” is doing, they’re often actually talking about an index. An index tracks the performance of a select group of stocks but can give a pulse on what the broader market is doing.

There are three major indexes in the U.S.

| Dow Jones Industrial Average | S&P 500 | Nasdaq Composite | |

| Number of companies it tracks | 30 | 500 | 3,000+ |

| Focus | Very large, well-known companies | Large companies across all industries | Technology |

| Includes companies like | Apple, Boeing, Johnson & Johnson, Visa, Walmart, Disney | Apple, JPMorgan Chase & Co., Facebook, Comcast Corp., Coca-Cola Company, Pfizer, Inc. | Alphabet (Google), Netflix, Starbucks, Amazon, Apple, Facebook |

Even though they just track certain groups of stocks, the indexes are often viewed as good measures of the performance of the entire stock market.

Why stock prices move

Stock prices can seem kind of crazy. They’re always changing, and what you buy shares for today could be completely different from what you could sell them for tomorrow.

At any moment in time, the price of a stock is driven by that interplay between buyers and sellers (like at an auction). Over time, the price of a stock changes as those dynamics between buyers and sellers change. If news comes out that should be positive for a company’s profits, buyers will suddenly be willing to pay more for a company’s stock, and its price should rise. The reverse happens when negative news comes out.

So the stock market is like a continual, real-time reaction to the news cycle—and what new developments in the world mean for corporate profits. Investors describe the severity of the stock market’s price swings as “volatility.” When volatility is lower, the market’s movements are smaller and smoother. And when the market becomes a wild ride, investors say that volatility is high.

Dark pools

Most buying and selling of shares happens on the NYSE or Nasdaq, and those transactions occur in public. However, around 13% of all trading happens in what are known as dark pools. These are private exchanges where everything is kept secret. No one knows who is buying or selling shares, so an electronic system matches interested buyers and sellers.

Dark pools are most often used by companies or organizations rather than individuals. They tend to use this method because they want to buy or sell large numbers of shares either without someone finding out or without affecting the stock market at the time the sale is happening.