Lesson 1: What are Stocks?

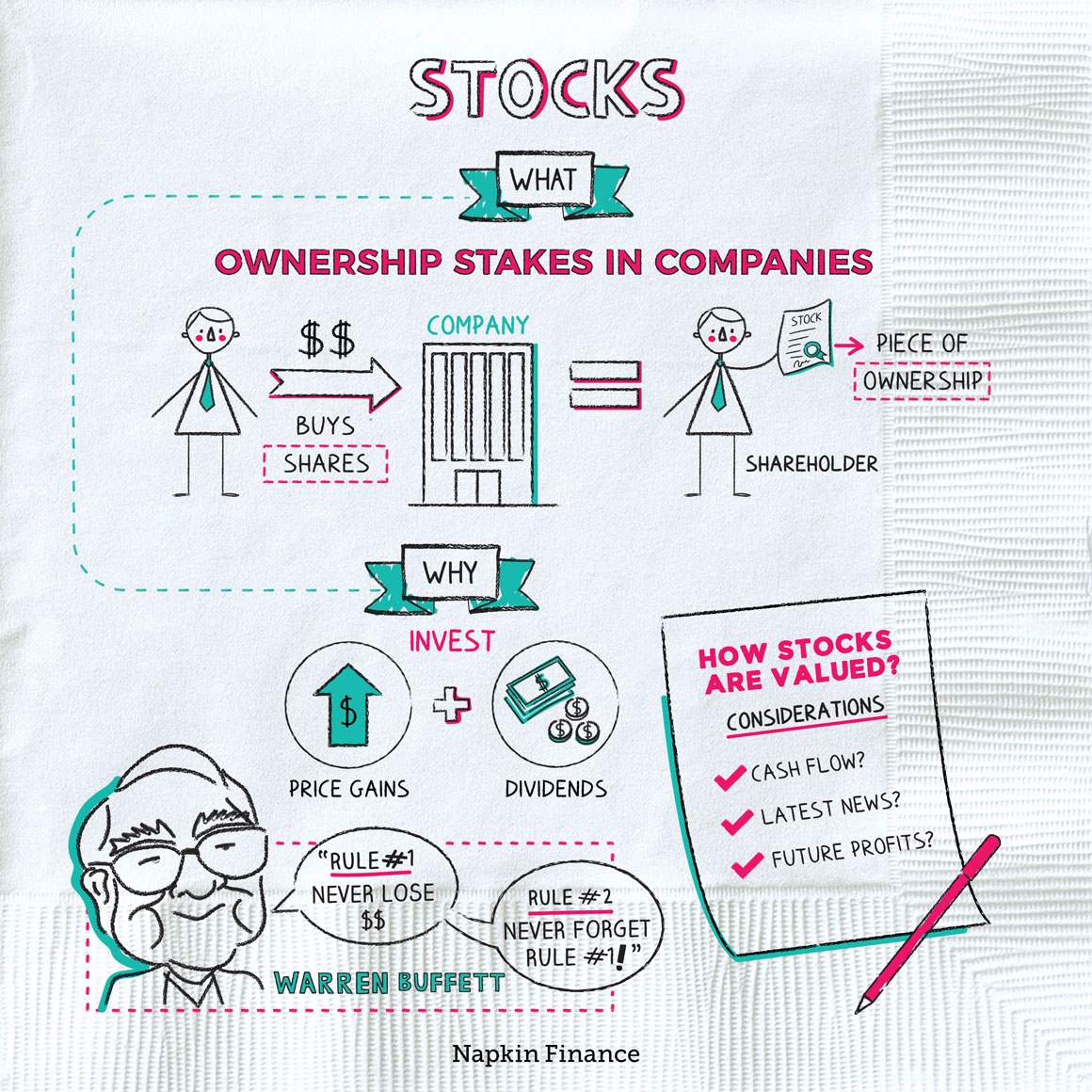

Stocks are small pieces of ownership in a company. Stocks can also be called shares, equities, or securities. When you buy a stock, you become a stockholder, or shareholder, and you then own a small fraction of the overall corporation.

Public vs. private companies

There are two types of companies: public companies and private companies. The main difference is:

- A public company sells stock on a stock exchange, which means anyone can own it

- A private company can issue stock, but not on a stock exchange, which means only a few select people own the company

Here are a couple of other differences:

| Public companies | Private companies | |

| Owned by | Shareholders (i.e., the public) | Founders, key employees, family members, etc. |

| Financial information and activities | Publicly available; reported to shareholders and the federal government | Can mostly be kept private |

When people or the news talk about stocks or the stock market, they’re almost always talking about public companies.

Why companies issue stocks

Company management sells stocks in order to raise money. This money might be used to:

- Research or create new products

- Improve existing products or services

- Enter a new market (e.g., a cereal company wants to start making snack bars)

- Build new facilities

- Pay off debt

- Hire more staff

- Set up locations in a new region

When a company first issues stock, it’s essentially taking on new owners—who in exchange provide it with some cash.

Why investors buy stocks

For a company to sell stocks and raise money, it needs investors or people to buy its stocks. Usually, investors buy shares of a company with the intention of making money. This can happen in two ways:

- Earning money from selling stocks after their values rise

- Collecting dividends—which are a portion of a company’s cash profits that it may pay out to shareholders

Because owning stock makes you a partial owner of a company, it also gives you a say in how the company runs its business (that’s why shareholders get to periodically vote on corporate decisions). So, some investors also purchase large numbers of shares to try to influence a company’s decision-making.

What do you really own?

A share is a piece of ownership in a company. But if you own Nike stock, that doesn’t mean you can walk into a Nike store and take a pair of shoes without paying for them. And it doesn’t give you a direct line to the CEO or let you tell McDonald’s when to bring back the McRib.

When you buy stock, what you’re really buying is a claim on a company’s profits. If a company is doing well, you might make money from dividends or selling your stock at a price higher than what you bought it for.

While that sounds pretty rosy, if there are no profits, you don’t have much to claim. That’s why stock investors are (to put it mildly) obsessed with corporate profits and generally aim to buy companies with solid profit outlooks.