Lesson 6: Social Security and Medicare

So far, we’ve covered the aspects of saving and investing for retirement that you have to handle yourself. But the government doesn’t want you to be broke in retirement either. So, thankfully, there are two major government benefit programs that can help give you a cushion of financial stability in retirement: Social Security and Medicare.

Although both programs provide benefits to retirees, that’s pretty much where their similarities end. So let’s take a closer look at each one.

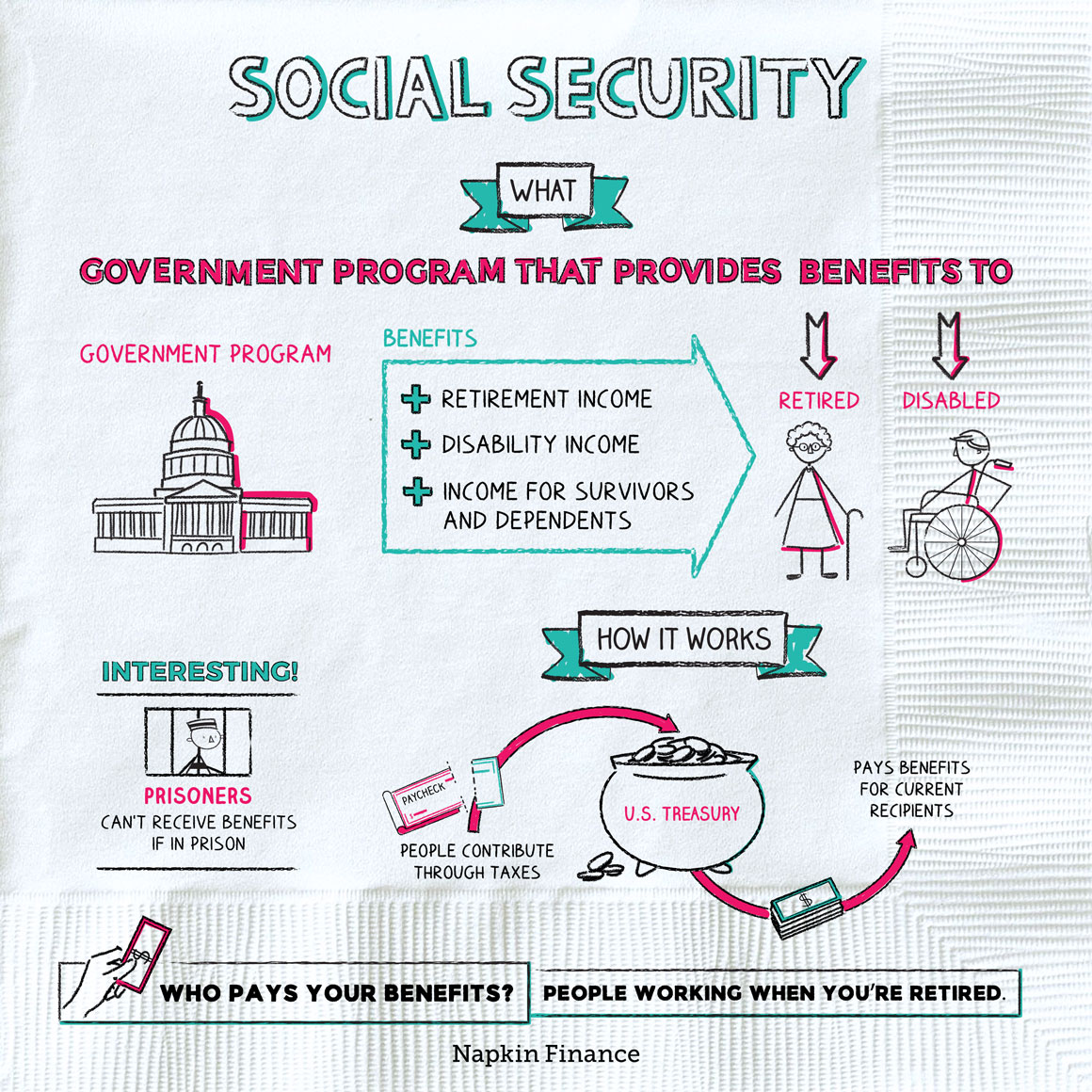

Social Security

Social Security pays monthly income to people who qualify for its benefits. It’s not exactly free money because you will have been paying into the system (see the “FICA” withholding section of your paystub) throughout your working years. But it’s still a check that will show up in your mailbox every month from whenever you start benefits until you die. Although it’s mainly known as a program for retirement income, it also pays benefits in some cases to disabled workers, spouses, and survivors.

To qualify for Social Security’s retirement income benefits, you generally need to:

- Have worked—and paid into the Social Security system—for at least 10 years of your life

- Be at least 62 years old

Here are the other main points you need to know about the program:

- You have one big choice to make.

- That choice is when to start receiving benefits. Although you’re typically eligible to start receiving Social Security at age 62, your monthly benefit increases for every month you delay starting benefits—up until age 70.

- Experts typically recommend that you wait if you can.

- You can check in on your projected benefits even if retirement is decades away.

- You can do that by setting up a login on the Social Security Administration’s website.

- Experts recommend that you do this and check your earnings history from time to time—both to make sure their records are accurate and as a safeguard against ID theft.

- Those projected benefits you see aren’t 100% guaranteed.

- Social Security is politically controversial, and it’s possible the program could be changed before you retire. Think of the benefits as a nice-to-have, not a must-have.

Medicare

Medicare is a government-sponsored health insurance program for retirees. (As with Social Security, it also provides insurance in some cases to the disabled.)

To be eligible for Medicare, you generally need to:

- Have worked—and paid into the system—for at least 10 years of your life

- Be at least 65 years old

Unfortunately, even if you’re a pro at navigating your employer’s health insurance plan, making sense of Medicare’s different features and programs can be overwhelming. Here are some of the basics you should know:

- It’s not actually “one” program.

- Medicare is made up of four different parts—parts A, B, C, and D—each of which covers a different range of health services and expenses.

- Navigating which benefits you’re eligible for and which extra benefits you want to sign up for means you potentially have to navigate each of those four programs separately.

- You’ll still have a lot of out-of-pocket expenses.

- The “free” portion of Medicare only covers a small range of health expenses.

- Chances are you’ll still be looking at monthly premiums (depending on what benefits and extra coverage you opt for), plus deductibles, copays, and more.

- You may still be buying from a private insurance company.

- To help fill the holes in the government’s basic program, many people end up buying additional coverage from a private insurance company through either a Medicare Advantage plan or a Medigap plan.