Lesson 7: Expect the Unexpected

No matter what your line of work, you need to prepare for the unexpected. Markets falter, you get sick, clients go off the rails—it’s a fact of life (and business). But there are ways to insulate yourself from the fallout, including by:

- Maintaining some business savings

- Buying business insurance

- Keeping a trusted lawyer on file

- Making sure you’re carrying enough personal insurance

Next, we’ll take a closer look at each one of these options.

Business savings

A business savings account serves several important functions:

- Separates your personal and business finances

- Helps you build savings to prepare for downturns or invest in new opportunities

- Can help if you ever need to qualify for a business loan

Working invoice-to-invoice creates stress for you and instability for your business. By contributing monthly to a savings account, you create a buffer against sudden big expenses or drops in income.

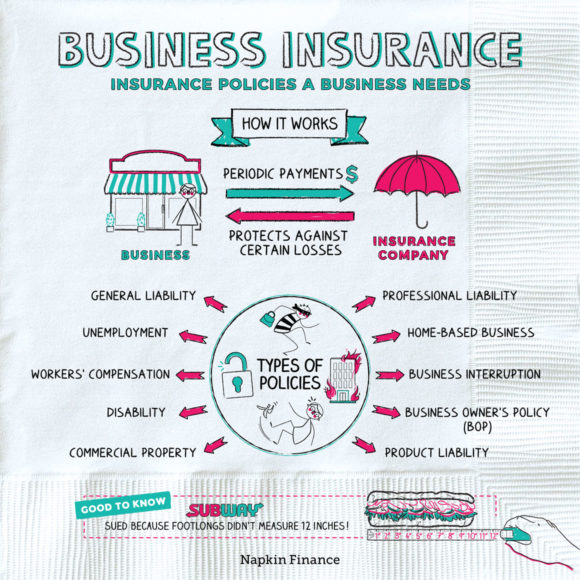

Business insurance

Depending on the nature of your business, it may make sense to buy a dedicated business insurance policy—such as one that would cover a business interruption, workers’ compensation, or product liability.

The policies you need may depend on your line of work and whether you have a brick-and-mortar store, among other factors. But it’s a good idea to think through all your assets and liabilities to figure out what you might need to cover.

Legal expenses

Here’s where your business savings can prove crucial. Although you hope to never need a lawyer, situations arise when you really need legal counsel to protect yourself and your enterprise—however small it might be.

A few examples:

- Consultations to review your contracts

- Help with clients who haven’t paid their invoices

- Defending yourself if a client sues you

That last example is a worst-case scenario, of course, and your liability insurance may provide some protection. But if the claim becomes complex or aggressive, you’ll likely want a lawyer to represent you.

Personal insurance

Unfortunately, there’s no such thing as one all-encompassing self-employment insurance policy. You’ll need to take a choose-your-own-adventure approach to protecting your health, your business, and your personal assets.

There are a number of insurance policy types you may want to consider, including:

| Insurance type | What it covers |

| Health insurance | Covers health-related needs, from routine to emergency care |

| Life insurance | Provides a payout to your dependents if you pass away |

| General liability insurance | Covers legal expenses and some damages if a client sues your business |

| Other types of personal insurance | Includes short- and long-term disability if you’re ill or injured and cannot work |