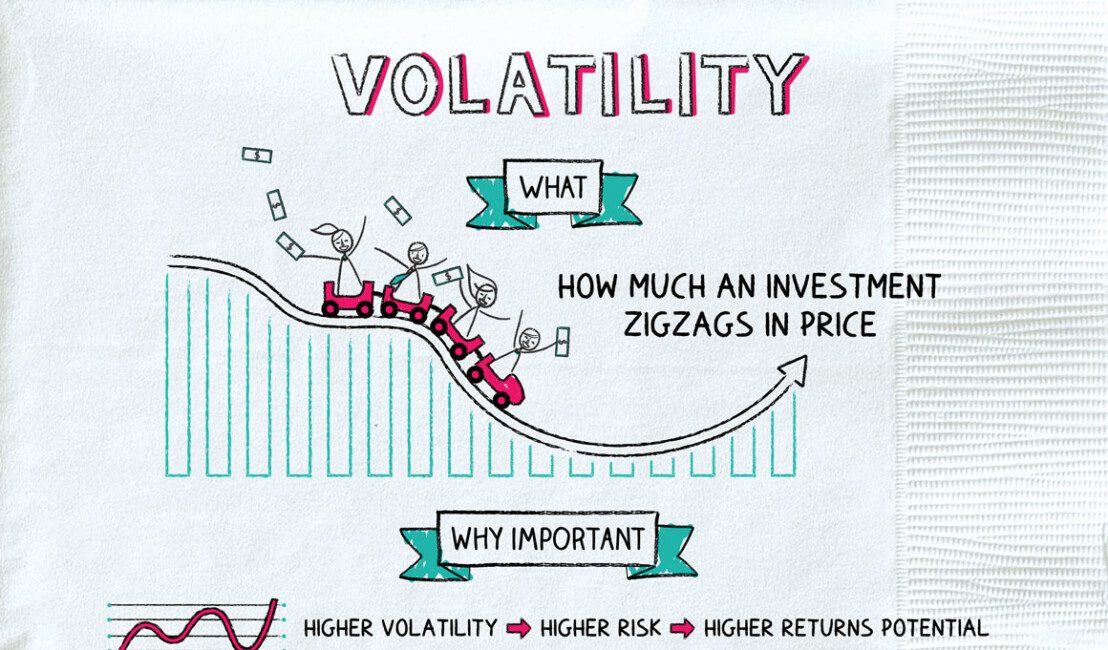

Volatility: Buckle Up

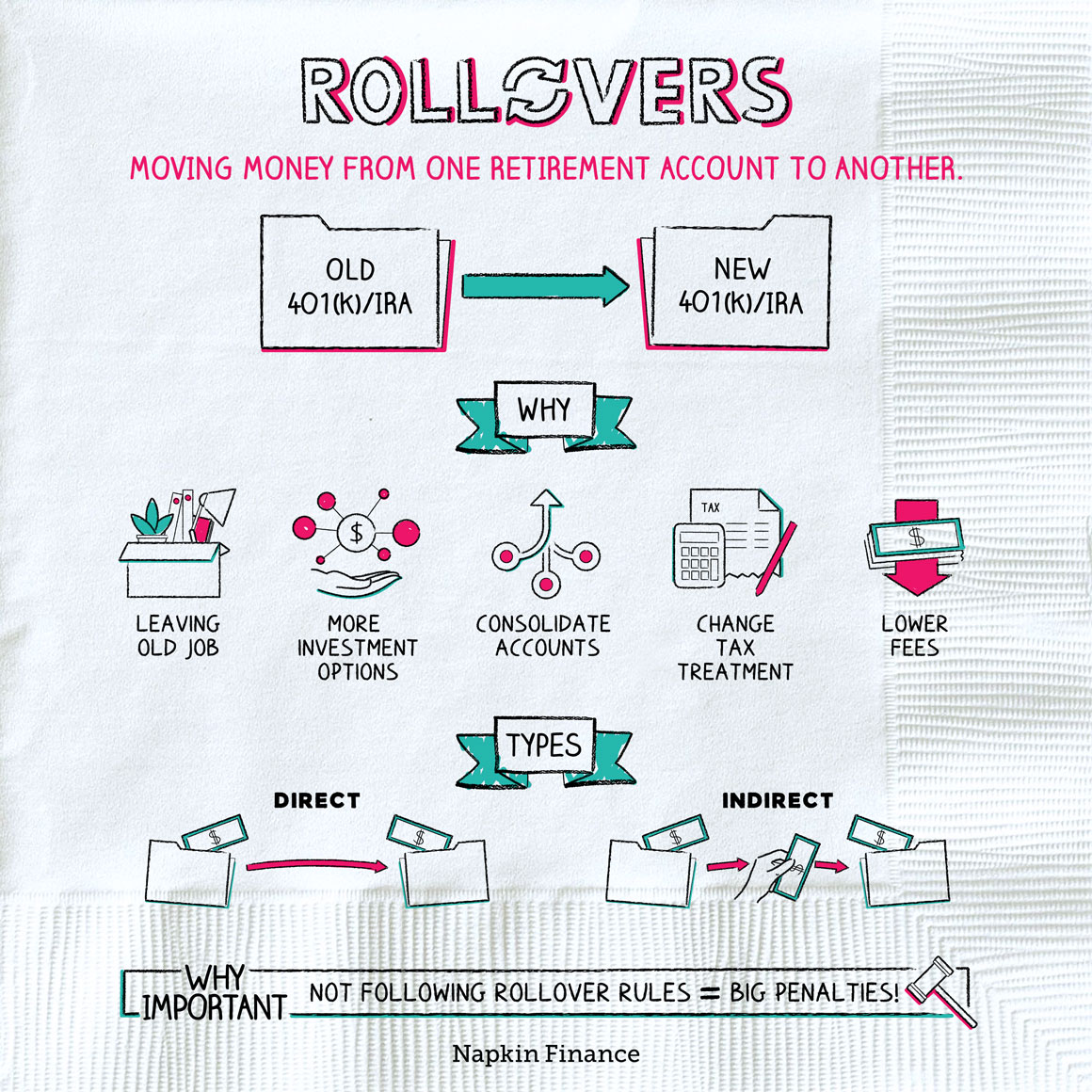

A rollover is when you move money from one retirement account into another—like if you decide to transfer your 401(k) from your old job into an Individual Retirement Account (IRA) you’ve set up.

Retirement accounts are supposed to be used for retirement—and they get special tax benefits to try to encourage people to save for retirement. But that means you can’t just shift money in and out of your retirement accounts whenever you want. Instead, transferring a retirement account gets its own special process: a rollover.