Lesson 4: Taxes

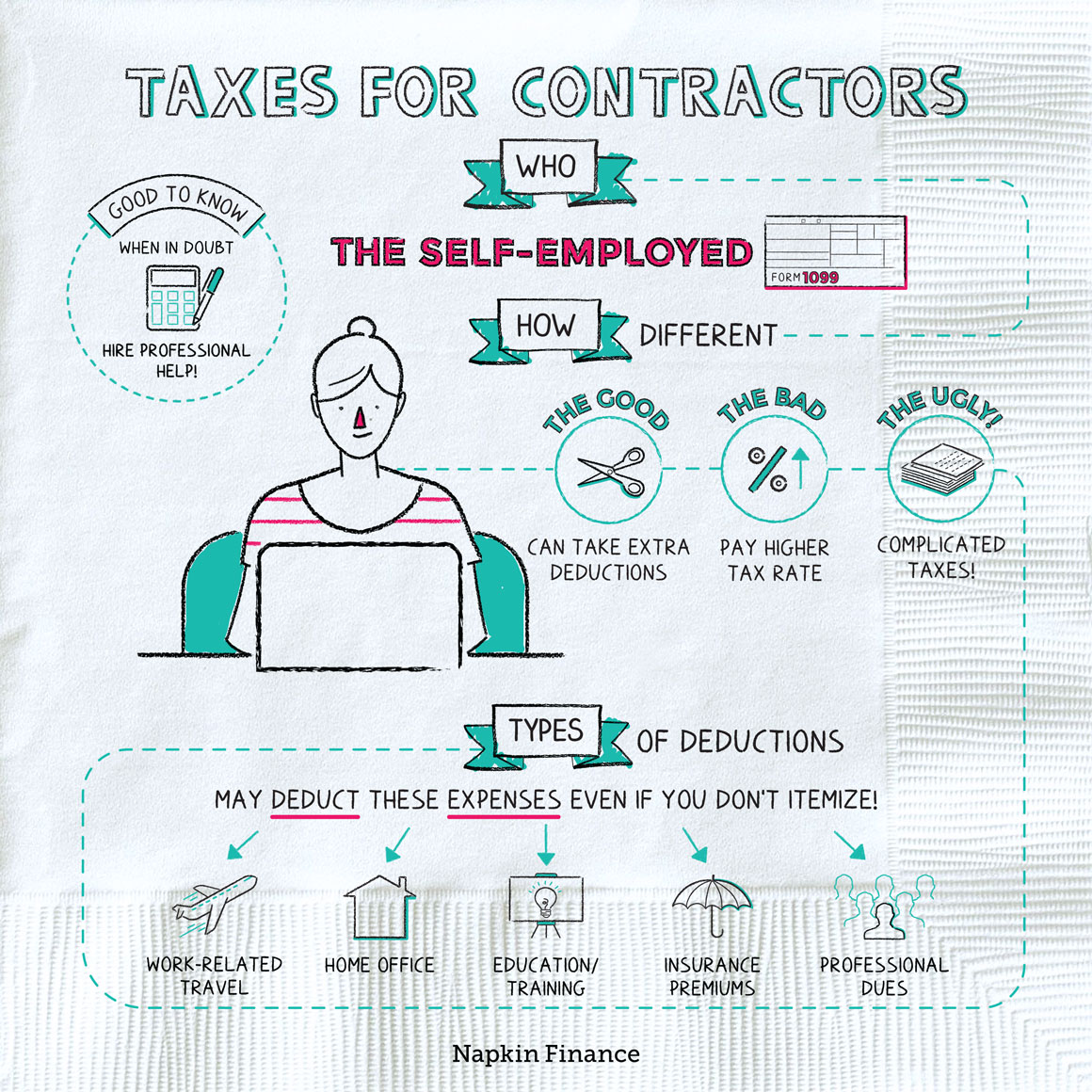

When you’re self-employed, you face a very different tax situation than employees do. Here are the main differences:

- The good: As a contractor, you can deduct a host of expenses that employees can’t.

- The bad: Thanks to the self-employment tax, even after those deductions you’ll probably end up paying tax at a higher rate than you would as an employee.

- The ugly: You may need to consider hiring professional help, because chances are your taxes will be complicated.

Deductions

Self-employment taxes may sting at first, but deductions can ease the pain. Some of the extra deductions you may be able to take can include:

- Office rent

- Home office expenses

- Business meals and entertainment

- Mileage

- Networking expenses

As a self-employed person, you can deduct many of these business expenses even if you take the standard deduction and don’t itemize.

Fun fact

- Under the 2017 Tax Cut and Jobs Act, many self-employed people—including freelancers, sole proprietors, S corporations, and LLCs—became eligible for an additional 20% tax deduction.

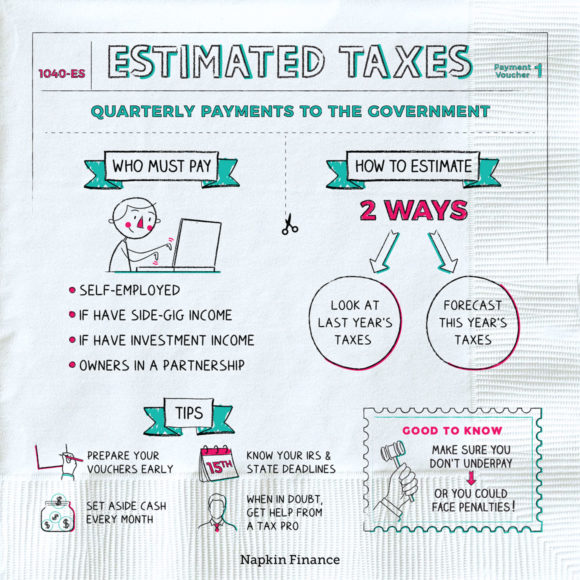

Estimated taxes

When you’re a W-2 employee, your employer withholds taxes from each paycheck you receive so that you pay your taxes as you go.

When you’re a 1099 contractor, there’s no employer to do this for you. Instead, you have to set aside your federal and state tax contributions and submit them every quarter as estimated taxes.

When to pay

The estimated tax filing deadlines for the IRS are usually:

- Quarter 1: April 15

- Quarter 2: June 15

- Quarter 3: September 15

- Quarter 4: January 15

Your state’s deadlines may be different from IRS’s, so contact the state department of revenue if you’re unclear on when to pay.

How much to pay

You have two options for figuring out your quarterly taxes:

- Estimate based on what you owed last year. If you expect to earn about the same income this year, divide your previous tax bill by four to figure out how much to send each quarter.

- Estimate by what you expect to earn this year. This can be a more accurate method and may help you avoid over- or underpaying, since it’s based on current earnings.

If you opt for the second method, here’s how to calculate your payments:

Track your income in a spreadsheet

so that you know how much you’re earning each quarter

↓

Calculate your deductions,

and subtract them from your taxable income

↓

Calculate your income and self-employment tax rates

↓

Submit your quarterly payments to the IRS and your state treasury

If you’re not sure how much you owe or struggle to figure out your obligations, consider hiring professional help. An accountant or tax advisor can help you make sense of business taxes and advise you on the best way to structure your self-employed future as well.