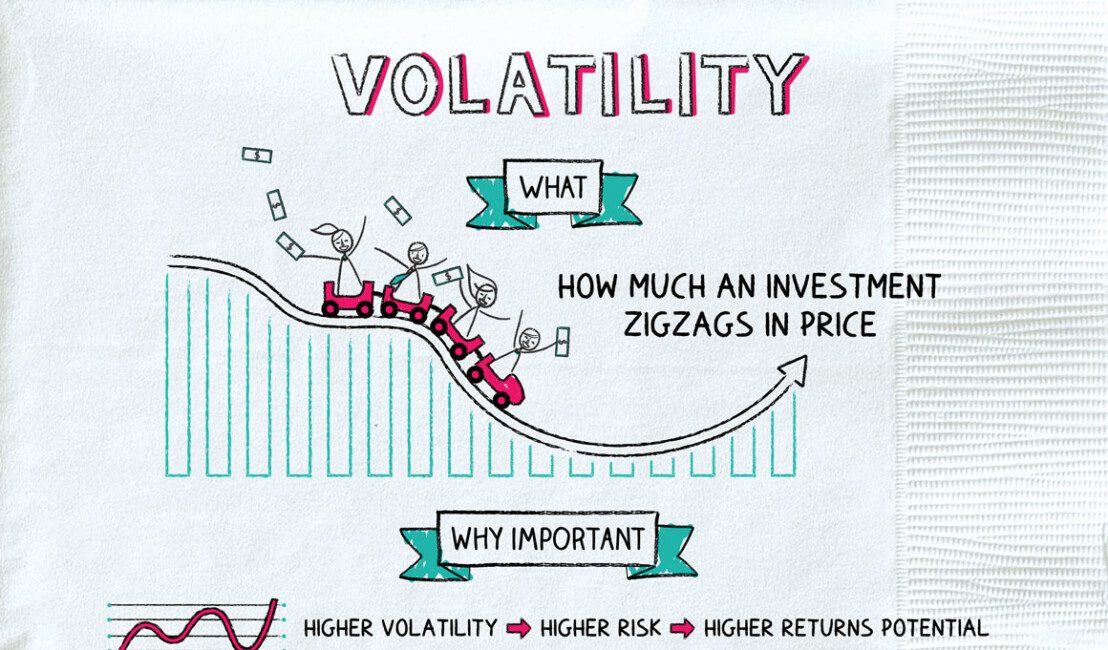

Volatility: Buckle Up

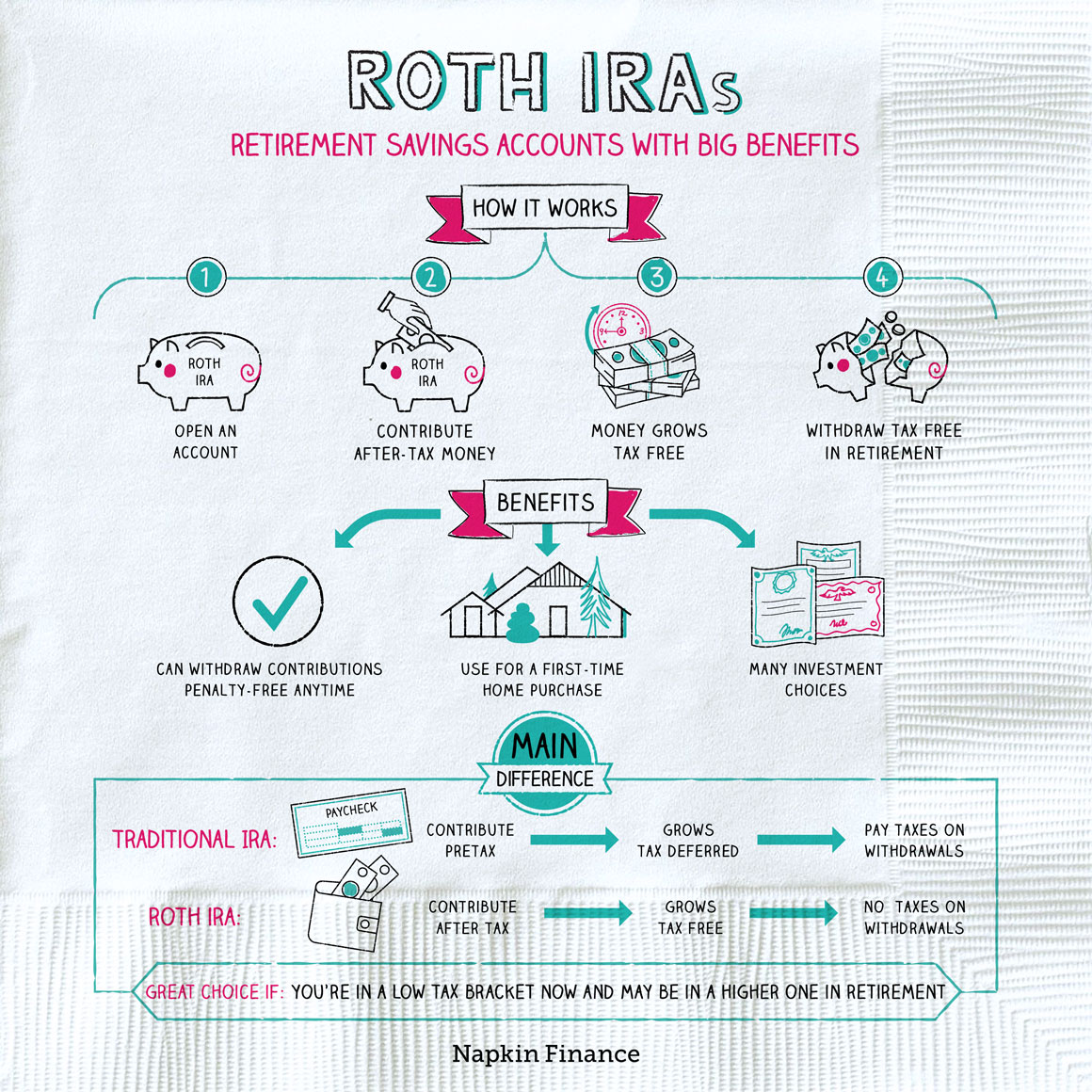

If the financial upheaval of 2020 has you thinking about planning for the future, you may want to consider setting up a Roth IRA. Short for Individual Retirement Accounts, IRAs allow you to invest up to $6,000 a year ($7,000 if you’re 50 or older) to build your retirement savings.

There are two types of IRAs: traditional and Roth. They serve the same purpose, and the contribution limit is the same. The difference is in how they’re taxed. When you pay into a traditional IRA, you won’t be taxed until you withdraw the money in retirement. With a Roth IRA, you pay taxes now so you can withdraw your earnings tax-free down the road.

A good rule of thumb is to think about whether you’ll likely be in a higher or lower tax bracket when you retire, compared with what you’re in now. If you anticipate earning significantly more money as you get older, you may want to opt for the Roth IRA, to get those taxes out of the way now while you’re in a lower bracket. But if you expect your income to decrease and think you’ll be in a lower bracket later on, then a traditional IRA may be the way to go.

In either case, you’ll also have the chance to invest your savings—whether in mutual funds or something else—so it can grow over time. No matter which one you choose, the sooner you start saving, the more comfortable your Golden Years will be.