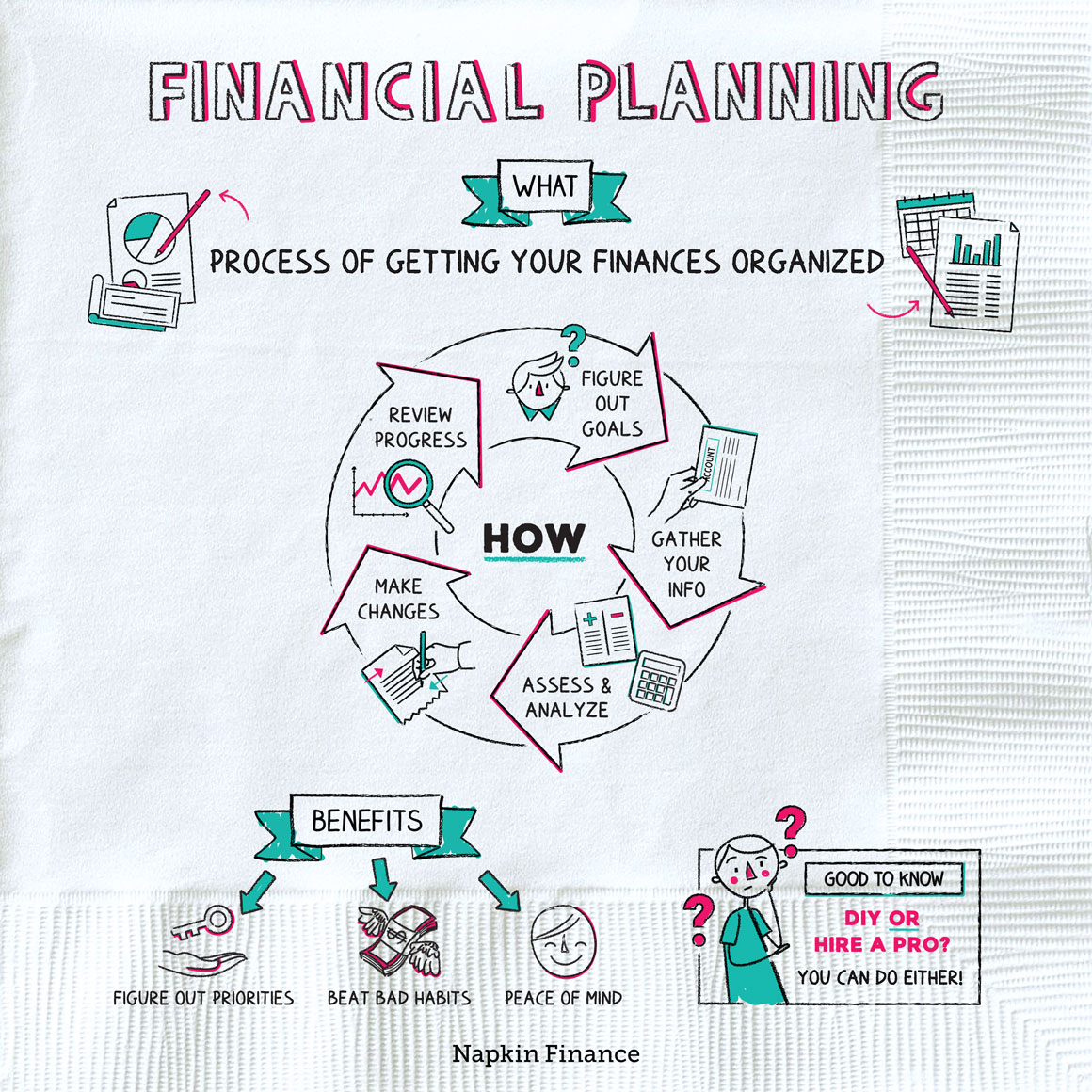

What’s financial planning?

Financial planning means bringing the Marie Kondo vibe to your finances. It can entail looking at all your junk—including your different accounts, your sources of income, your bills, and your spending—putting it into order and whipping it into shape.

Financial planning isn’t the same for everyone. It can mean tackling everything in one swoop. Or, it could mean dealing with just one or two specific pesky aspects of your money—like coming up with a plan for your student loans, or overhauling your investment strategy.

And while some people may choose to hire a professional planner for guidance, others may prefer to handle it all themselves.

But the life-changing magic of tidying your finances has many benefits, including:

- Beating bad financial habits (hello, middle-of-the-night online shopping)

- Helping you figure out your priorities for your money (save for retirement, or save for a house?)

- Peace of mind (because as KonMari fans know, “tidying orders and relaxes the mind”)

Do you need it?

Honestly? Probably yes.

Whether it’s worth your coin to hire a professional planner or advisor is a question only you can answer. But bringing order to your finances—and making sure that your day-to-day financial decisions reflect your actual priorities—is really only a good thing.

situs togel

toto slot

rtp slot

situs toto

bo togel

situs toto

situs toto

situs togel

situs togel

bo togel

pam4d

bento4d

toto togel

situs togel

situs togel

bento4d

situs togel

bento4d

situs togel

bo togel

situs toto

pam4d

daftar pam4d

daftar pam4d

login bento4d

cerutu4d

cerutu4d

cerutu4d

situs toto

bento4d

situs toto

situs toto

situs togel

situs toto

situs toto

situs togel

situs togel

toto togel

situs toto

situs togel

situs togel resmi

toto slot

situs toto

situs togel

situs toto

situs togel

situs toto

situs toto

situs togel

situs toto slot

cerutu4d

situs toto

cerutu4d

situs toto

gimbal4d

daftar gimbal4d

gimbal4d

toto slot

situs toto

situs toto

toto slot

situs toto

situs toto

toto togel

toto slot

situs togel

live casino

toto slot

toto togel

bandar togel

situs toto

situs togel

situs togel

situs toto

situs togel

bakautoto

situs bandar togel

bakautoto situs resmi toto togel

bakautoto situs toto togel terpercaya 2024

monperatoto

monperatoto

monperatoto

monperatoto

monperatoto

monperatoto

situs togel

situs toto

situs toto

situs toto

situs toto

bo toto pulsa

bo toto

bo toto pulsa

bo togel

bo togel

bo togel

bo togel

cerutu4d

bo togel

bo toto

situs togel

situs togel

situs toto

daftar togel

situs toto

situs togel

situs togel

bakautoto

situs togel

bakautoto

situs togel

situs toto

bandar togel

situs togel

bo togel

situs togel

bo toto

bandar toto macau

togel pulsa

bo togel

Daftar Situs Toto

situs toto

situs toto

situs toto

toto togel

situs toto

situs toto

situs togel

situs togel

situs toto

situs toto

situs togel

situs toto

situs lotre

situs togel

bakautoto

bandar togel

bo togel

bakautoto

bakautoto

bakautoto

bakautoto

situs toto slot/a>

totoslot

scatter hitam

situs togel

situs toto

bo togel

togel pulsa

bento4d

bento4d

situs toto

situs toto

jacktoto

bandar togel

bo togel

situs toto

situs toto

situs togel

agen toto

bo togel

situs toto

situs toto

situs togel

situs toto

bo togel

bandar togel

situs togel

jacktoto

monperatoto

monperatoto

monperatoto

monperatoto

monperatoto

data macau

slot gacor hari ini

situs toto

situs toto

situs toto

situs togel

situs togel

togel online

situs togel

bandar toto macau

bandar togel

togel pulsa

situs togel

toto togel

situs toto

bo togel

toto togel

bo togel

bo togel

situs togel

situs toto

agen toto

situs toto

agen toto

jacktoto

bo togel

bo toto

situs togel

situs togel

situs togel

situs toto

situs togel

bo togel

situs togel

bo togel

rimbabola

agen toto togel

situs togel

situs toto

bo togel

situs togel

situs togel

toto togel

situs toto

situs toto

toto macau

bo toto

situs togel terpercaya

agen toto

situs toto

bo toto

situs toto

bandar toto macau

situs toto

situs toto macau

togel dana

situs togel

togel pulsa

jacktoto

link togel

jacktoto

situs toto

situs toto

monperatoto

monperatoto

monperatoto

monperatoto

monperatoto

data macau

monperatoto

slot gacor hari ini

situs toto

situs toto

toto togel

situs toto

situs toto

togel online

situs togel

rimbabola

situs toto

situs togel

slot gacor

bo toto

situs togel

togel pulsa

rimbatoto

rimbatoto

rimbatoto

situs toto

situs toto

bento4d

situs toto

bo toto

situs toto

bo toto

jacktoto

situs togel

rimbatoto

situs deposit pulsa

togel online

situs toto macau

cerutu4d

cerutu4d

rimbabola

situs toto macau

situs toto macau

situs togel

situs toto

situs togel terpercaya

situs toto

rtp

bo toto

situs togel resmi

situs togel

situs toto

bo toto

situs togel

situs togel

bandar togel

situs togel

jacktoto

situs toto

situs togel

situs togel

situs slot gacor

situs toto

situs togel

situs togel

situs togel

bo togel

situs togel

situs toto

situs toto

situs toto

situs togel

situs toto

situs togel

bo togel

bakautoto

bo togel

bakautoto

bet togel

situs toto