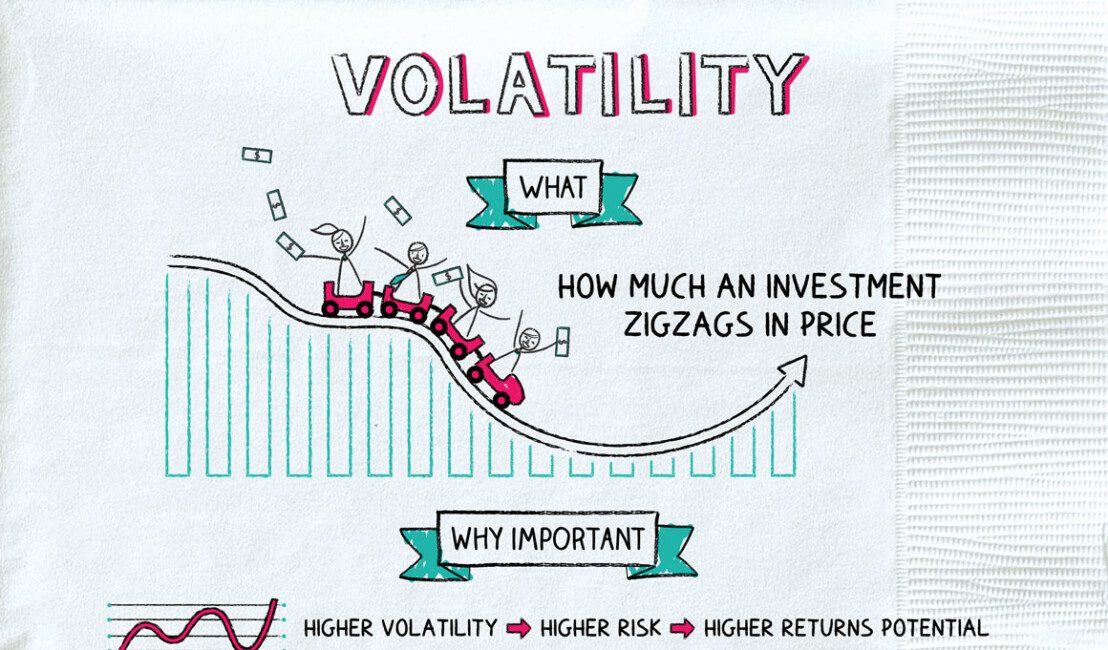

Volatility: Buckle Up

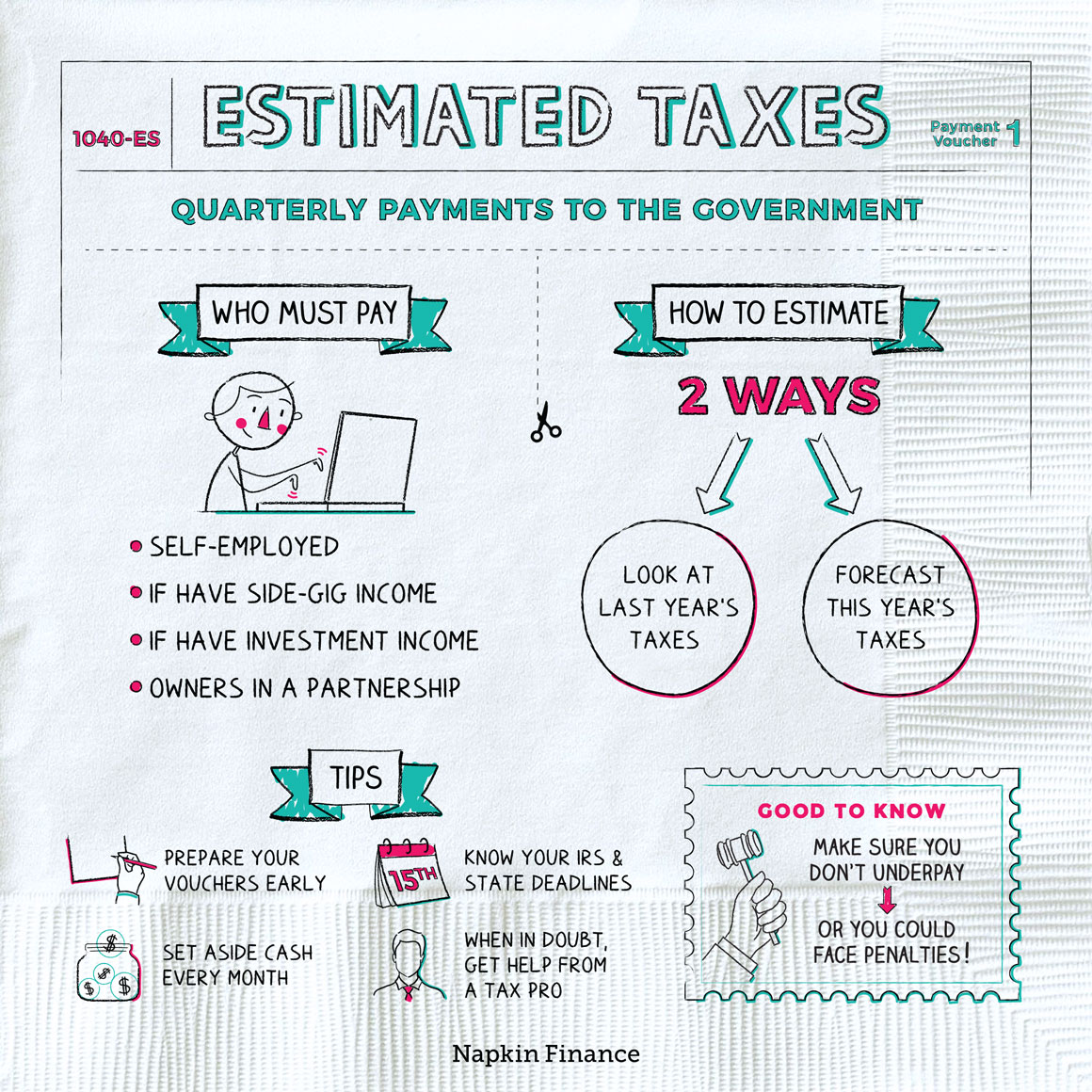

If you’re a freelancer, Uber driver, online yoga instructor or are otherwise self-employed, you probably have to pay estimated taxes. Due once a quarter, estimated taxes include state and federal income taxes plus Medicare and Social Security.

In a typical year, you’ll owe federal estimated taxes on April 15, June 15, September 15, and January 15. But since 2020 is anything but typical (looking at you, coronavirus), the government pushed back the Q1 and Q2 deadlines to July 15. That means you still have a few weeks to get your payments together—but it also means you’ll need to cut a super-sized check in July.

Don’t forget about state taxes, though. The deadlines where you live may vary from the federal schedule, but the quarterly requirement remains the same. If you’re not sure when to pay or where to submit your payment, call your state department of revenue.

There are two ways to figure out your estimated taxes: