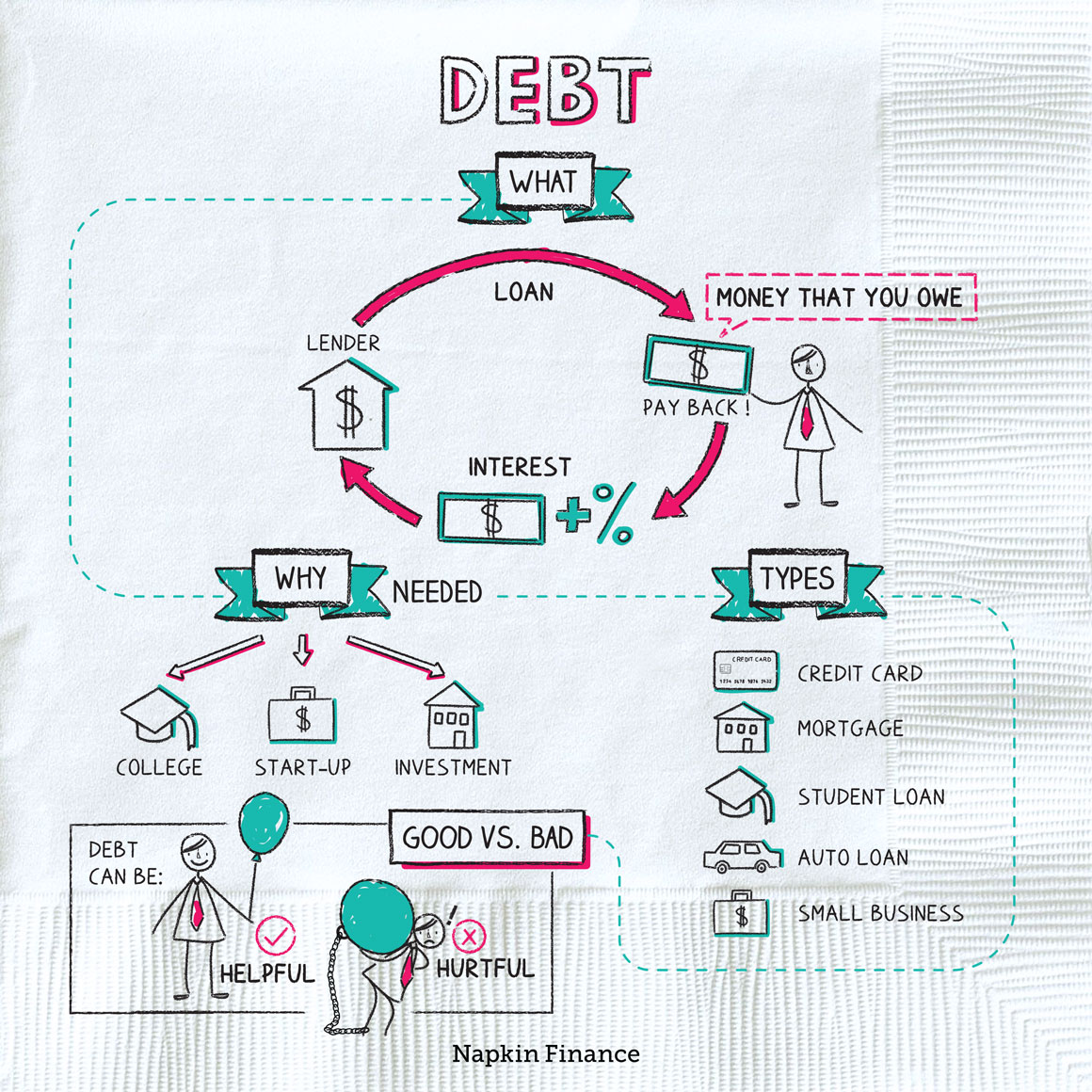

If you’re still paying off your holiday splurges, you’re not alone. Americans took on an average of

$1,325 in debt during the just-finished holiday season—up 8% from last year—with 57% of those taking on debt even though they didn’t plan to.

For the 15% of consumers who are only making the minimum payment, that balance could take as much as a decade to pay off. But it’s still a drop in the bucket compared to the almost $900 billion total tab Americans carry on credit cards and other forms of revolving debt.

Learn More

Live by the spending, die by the spending

- We may be a nation in debt, but we are a nation responsibly in debt. The average FICO score among Americans hit an all-time high in 2019 of 704—mainly thanks to rising scores among millennials—according to a study by Experian.

- Among states, the credit bureau found that Minnesotans had the highest credit scores in 2019 (for the eighth year running), while Louisiana had the lowest.

- Although retail companies have yet to report their fourth-quarter results (which can be an important economic indicator), Target issued a press release yesterday noting that its retail sales were lackluster—up only 1.4% over 2018, compared with 5.7% the year before. Wal-Mart and Amazon shares fell yesterday in sympathy.

- In particular, Target noted that its sales of toys and electronics were disappointing. But a notable bright spot were beauty products (thank you #selfcare), where sales were up 7%.