Lesson 4: Main Stock Market Players

There are many different people and groups involved in the stock market, and they each have distinct roles. You have companies that sell stocks, investors who buy stocks, the exchanges where stocks are bought and sold, brokers who facilitate trades, and the regulators that make and enforce rules.

Stock exchanges

As we discussed in an earlier lesson, the stock exchanges are where the buying and selling of stocks actually happens. But the stock exchange’s job is a little more complicated than just ringing a bell when selling starts or ends for the day.

A stock exchange has a few primary tasks:

- Listing stocks

- Processing payments

- Keeping track of prices

Although many stock exchanges have physical locations, with trading floors, others are online only. (In the U.S., the New York Stock Exchange has a physical trading floor, while the Nasdaq is all electronic.)

Brokers

As an individual, you can’t walk up to the NYSE or Nasdaq, knock on the door, and hand over your money. Instead, you need to rely on a certain key player to make your stock purchase: a broker.

Brokers buy and sell stocks on behalf of their clients. A broker can be a person whom you work with on an ongoing basis and call up when you need to make a trade. Or a broker can be a company, with a website where you can log in to make your own trades on your own terms with minimal fuss.

Brokers make their money by charging their clients fees on transactions.

Here’s how that works:

You (the investor) go to a brokerage firm and ask to buy stock in a company

↓

Brokerage firm goes to the stock exchange and buys that stock with your money

↓

Brokerage firm holds on to your stock

↓

When you want to sell, you tell the brokerage firm

↓

The brokerage firm goes to the stock exchange and sells your stock

↓

The brokerage firm pays you the proceeds from the sale

Regulators

The stock market isn’t a giant free-for-all. There are different regulators who try to keep bad actors at bay and make sure that what companies are doing is legal so that you, the investor, don’t get swindled.

In the United States, the main federal stock market regulator is the Securities and Exchange Commission (SEC). There are other regulatory groups for brokerage firms and the exchanges, and states have their own as well.

The most important thing you need to know is that they’re all there to make sure that investors, companies, brokers, and others are all playing by the rules.

Mutual funds

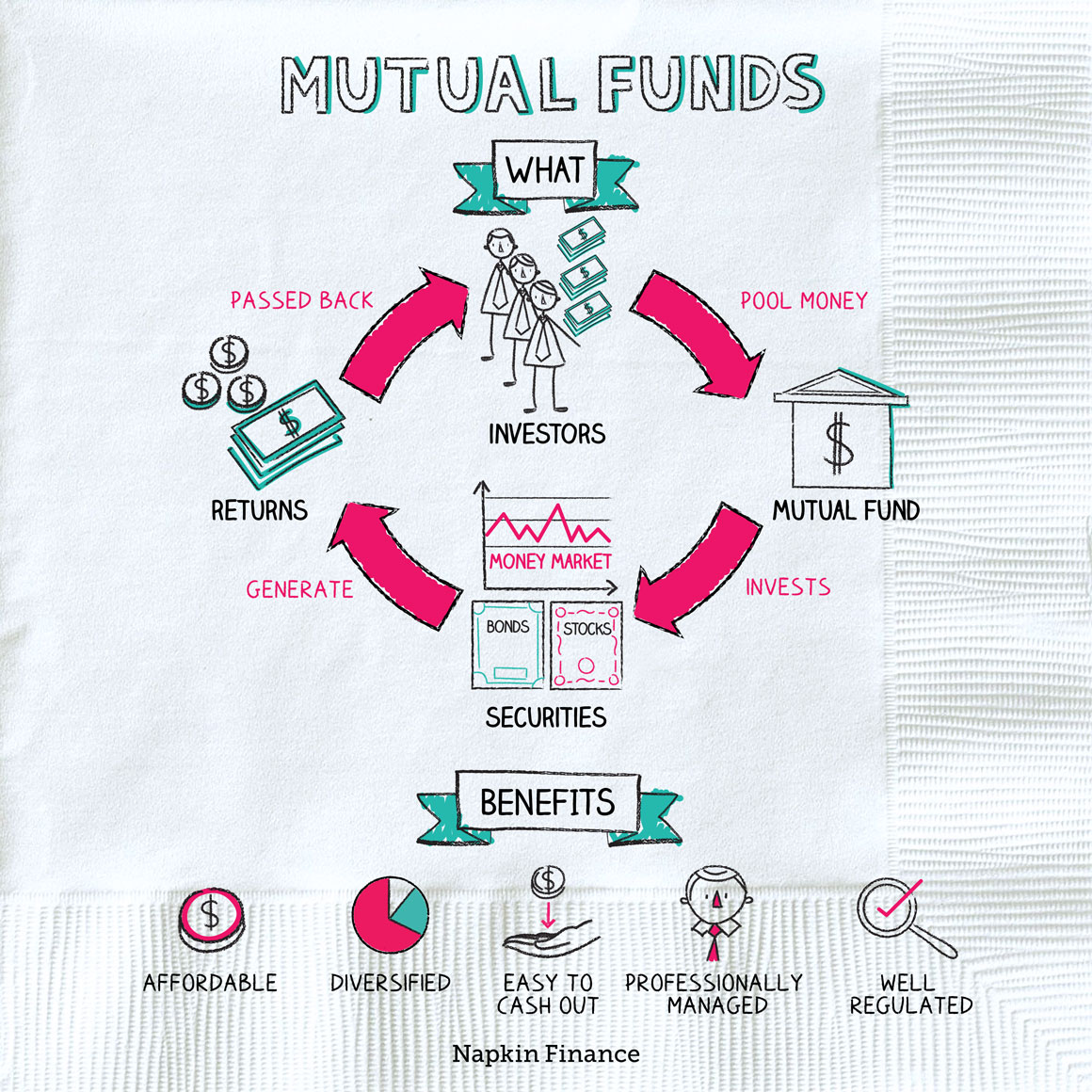

It’s also important to note here that many people don’t buy stocks in individual companies directly. Instead, they invest in one or more mutual funds. A mutual fund pools the money of many investors to purchase various stocks or other securities (what it creates is called a portfolio).

There are different types of mutual funds, but the goal of each is to help diversify your investment so that your money is spread across many different companies. This can help better protect your investment from market fluctuations.

ETFs

A popular investment option, similar to a mutual fund, is an exchange-traded fund, or ETF. It’s a collection of many stocks (and/or bonds and other financial instruments) pooled in a single fund that can be bought and sold on a stock exchange. There are around 1,000 ETFs available in the United States, and most are built to mimic the movement of a particular index. Like mutual funds, ETFs offer diversification to help minimize investment risk.

Unlike mutual funds, they can be traded any time of day, and the management costs tend to be lower. However, brokers often charge commissions when ETFs are bought and sold, which can add up.