Lesson 1: What is Cryptocurrency?

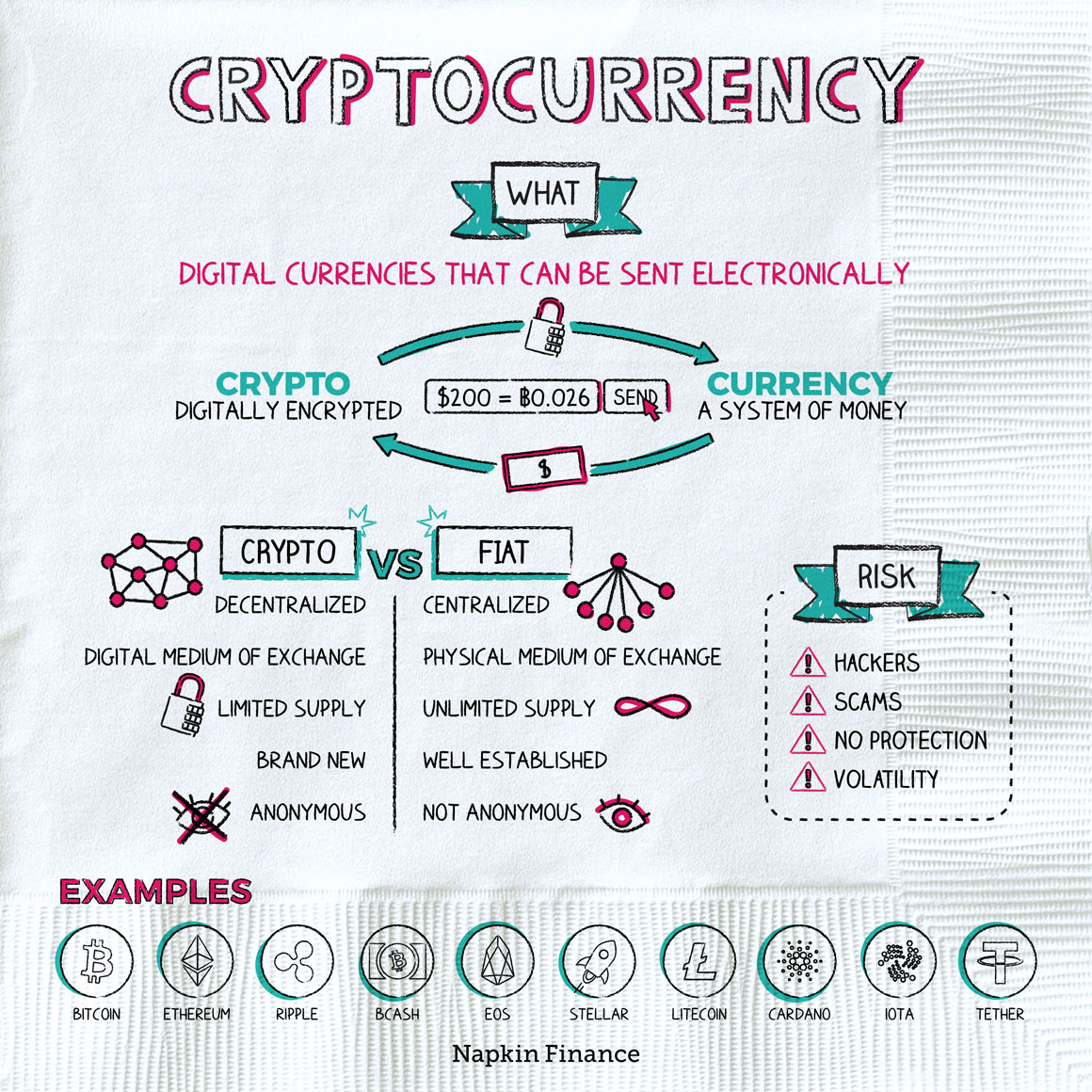

Cryptocurrency is a relatively new form of money that exists only in the digital world. It is exchanged peer to peer online and isn’t controlled by any government or bank.

How does cryptocurrency work?

You can send cryptocurrency electronically the same way you can send dollars through PayPal and Venmo. However, instead of a company operating as a middleman and potentially setting limits or rules on how you can send money, cryptocurrency transactions are overseen by a large network of peers.

That results in a few major differences compared with traditional payment systems:

- No limits—you can send any amount

- No chargebacks—once a transfer is started, it cannot be stopped or reversed

- No government interference—a repressive government couldn’t, say, cut off the financial transactions of a political opponent

While parts of this sound really great, users also lose out on some protections, such as the ability to stop a payment if you added an extra zero to that $10 bar tab or sent it to the wrong person.

A brief history of cryptocurrency

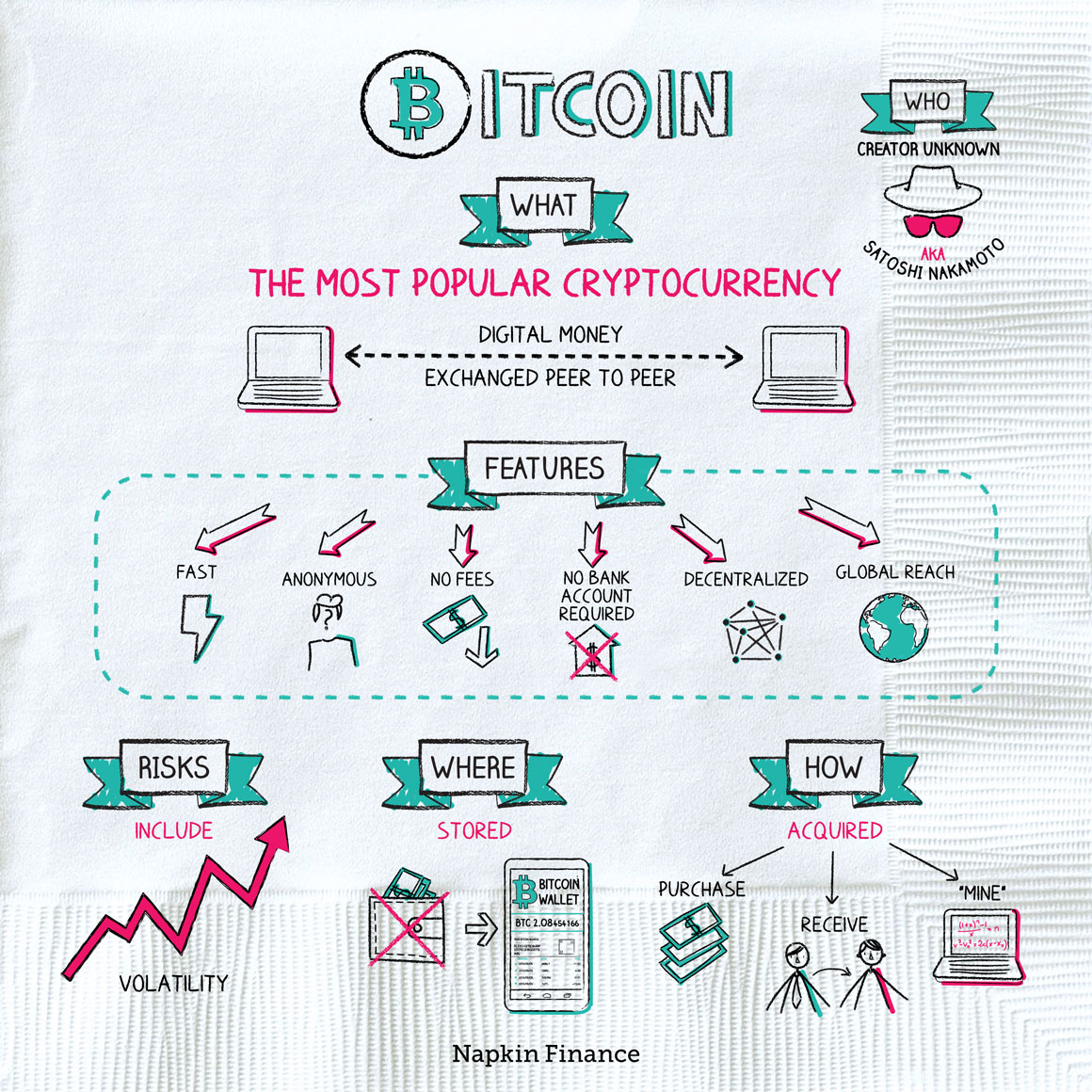

2008: The world economy was a mess, and faith in the traditional financial system was low. An author calling himself Satoshi Nakamoto, but whose real name is unknown, released a paper explaining how a digital peer-to-peer currency could work.

2009: Satoshi mines the first block of Bitcoin—equivalent to the first bills of a new currency being printed.

2011: Competing cryptocurrencies launch, including Litecoin and Namecoin.

2011-2013: Some mainstream businesses begin accepting Bitcoin as a form of payment.

2016: Ethereum launches. The market for Initial Coin Offerings (ICOs), or new cryptocurrency offerings, takes off.

2017: Cryptocurrency prices skyrocket, with Bitcoin gaining 1,318% for the year and Ripple gaining 36,018%.

2019: The total crypto market tops $100 billion, with more than 2,000 individual coins in existence.

Bits and blocks

Bitcoin may be the best known cryptocurrency, but it’s not the only one.

Bitcoin uses blockchain technology. Many other cryptocurrencies also rely on blockchain technology, while others use different methods of verifying transactions.

The blockchain: one big spreadsheet

Anyone with a computer can be part of the Bitcoin network (or that of similar cryptocurrencies) in which individuals verify and send transactions. This network has access to a single ledger that shows every transaction and cannot be modified.

The entire Bitcoin network is encrypted, which protects the information of those who participate in it. Computers run special software to solve cryptographic puzzles—similar to someone using a decoder to read a secret note—to verify transactions and make sure that people actually have the funds they claim to have. Solving these puzzles also creates new Bitcoin.

Traditional currency vs. crypto

Here are some of the differences between traditional money and cryptocurrency:

| Traditional currency | Cryptocurrency |

| A bank typically holds your money | You hold your money directly |

| Centralized—a government lays down the rules | Decentralized—a network of computers verifies transactions |

| Government regulations or bank policies may limit your ability to transfer money | No limits on transactions |

| May incur fees to transfer money | Transfer money for free |

| You rely on regulators and the bank itself to make sure your money isn’t lost or stolen | Blockchain records are public and unchangeable, but you rely on yourself not to lose your crypto wallet |

With cryptocurrency, there are no bailouts for big banks, but there are also no bailouts for the little guy. That means you as an individual take on more risk, but you can also have more control over your personal data and how you choose to send your money.