CDs

On Principal

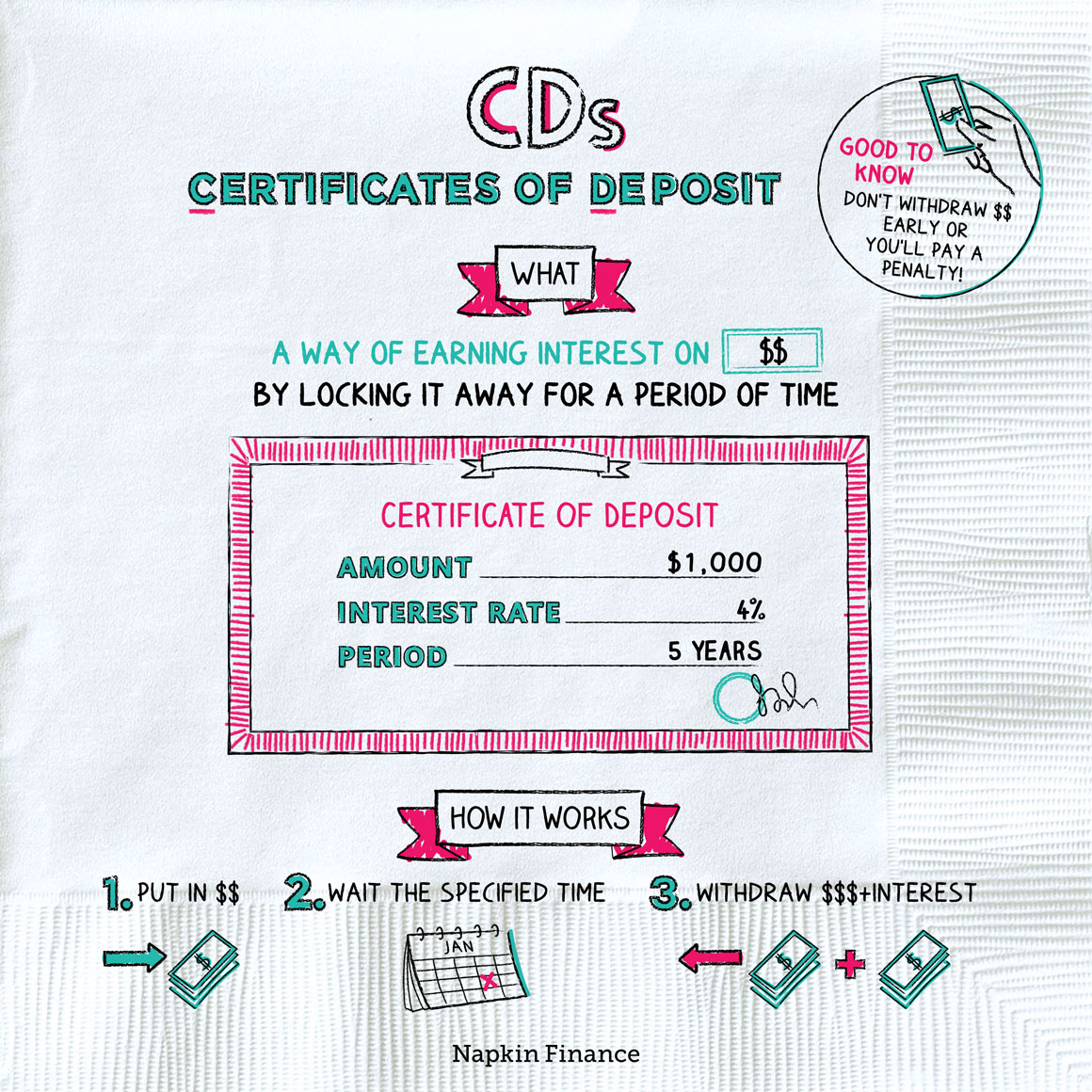

Certificates of Deposit, or CDs, are low-risk investments that pay interest. You can think of them as alternatives to savings accounts, with the main difference being that CDs lock up your money for a set period of time.

When you buy a CD, you make a deposit with a bank, wait until the CD matures, and then get your initial investment back plus interest.

Here’s a rundown of the basic features of CDs:

- Who issues?

-

- Banks and other financial institutions.

- How much interest?

-

- Low interest, with rates similar to or slightly better than savings accounts.

- How much do you invest?

-

- Some require a minimum deposit, such as $500, while others don’t.

- How long?

-

- Tie up your money for a set length of time.

- Typical terms range from six months to five years.

- Good to know

-

- Usually insured by the Federal Deposit Insurance Corporation (FDIC) for up to $250,000, so your money’s safe.

- You pay a penalty if you withdraw your money early.

CDs can be a great option for money that you need to keep safe and that you only want to invest for a short period of time.

They don’t typically make great long-term investments because they pay such low rates of return (that’s why investing in a mix of stocks and bonds is generally a better option for your retirement fund). But if you’re looking to earn a small return on your down payment fund—and you plan to buy a home in one year—then a CD could be the right choice.

Here’s how investing in a CD works:

Step 1: Think about how long you want to invest your money. Common terms range from six months to five years.

Step 2: Compare rates among banks for that term. Choose a bank and a specific CD.

Step 3: Open an account with that financial institution and buy the CD.

Step 4: Leave your money in the CD for its full term.

Step 5: When your CD matures, you can withdraw the money and do something else with it, or you can roll it over into a new CD

Like other financial products, CDs can come with a number of bells and whistles. Here are some of the main varieties:

| Type | Features |

| Traditional CDs |

|

| Liquid CDs |

|

| Bump-up CDs |

|

| Callable CDs |

|

| Jumbo CDs |

|

CDs are typically lumped into a category of investments called “cash-equivalents”—along with other options that are essentially as safe as cash but offer 1slightly higher returns. Although there are some important distinctions in the nuts and bolts of how different cash equivalents work, they all count as low-risk, low-return options. Here are the main ones:

- Savings accounts

- Like CDs, offered through banks and are typically FDIC insured.

- Restrict how often you can withdraw money but don’t require you to commit to a set lockup period as a CD does.

- Money market accounts

- Similar to savings accounts, these are higher-yielding accounts offered by banks that restrict how often you can withdraw money. Like savings accounts, they’re typically FDIC insured.

- The key difference is that unlike savings accounts, money market accounts often come with ATM access and check writing.

- Money market funds

- Mutual funds—i.e., investment funds—that hold low-risk investments, such as U.S. government debt or CDs.

- Not FDIC insured, though municipal money market funds can come with tax perks.

- You can invest in these through a brokerage, not through a bank, and can withdraw your money anytime.

CDs are one main option to consider for money that you want to keep safe over a relatively short period of time, such as six months to a few years. They typically offer higher interest rates than savings accounts—but the trade-off is that they require you to lock up your money for the CD’s full term (or else you pay a penalty). CDs count as low-risk, low-return investments.

- Although CDs are typically thought of as banking products, you can also invest in them in retirement accounts, such as 401(k)s and Individual Retirement Accounts (IRAs).

- Even if a bank doesn’t place a maximum limit on CD investments, you generally don’t want to ever hold more than $250,000 in CDs with one bank. That’s because FDIC insurance maxes out at that amount (per person, per institution). As long as you spread your money around with multiple banks, however, the sky’s the limit on how much you can invest in total.

- CDs are low-risk investment options that you can hold at a bank.

- They generally offer similar or slightly better interest rates than savings accounts—with the trade-off that you can’t withdraw your money during the CD’s term (or else you’ll pay a penalty).

- CDs can be a good choice for money that you want to keep safe over a relatively short period but that you know you won’t need to touch during the CD’s term.

- Although plain-vanilla CDs are the most popular type, they can come in a few varieties that offer different features.

- CDs are considered a type of cash equivalent and may be considered as an alternative to savings accounts, money market accounts, and money market funds.