Volatility

Rocky Road

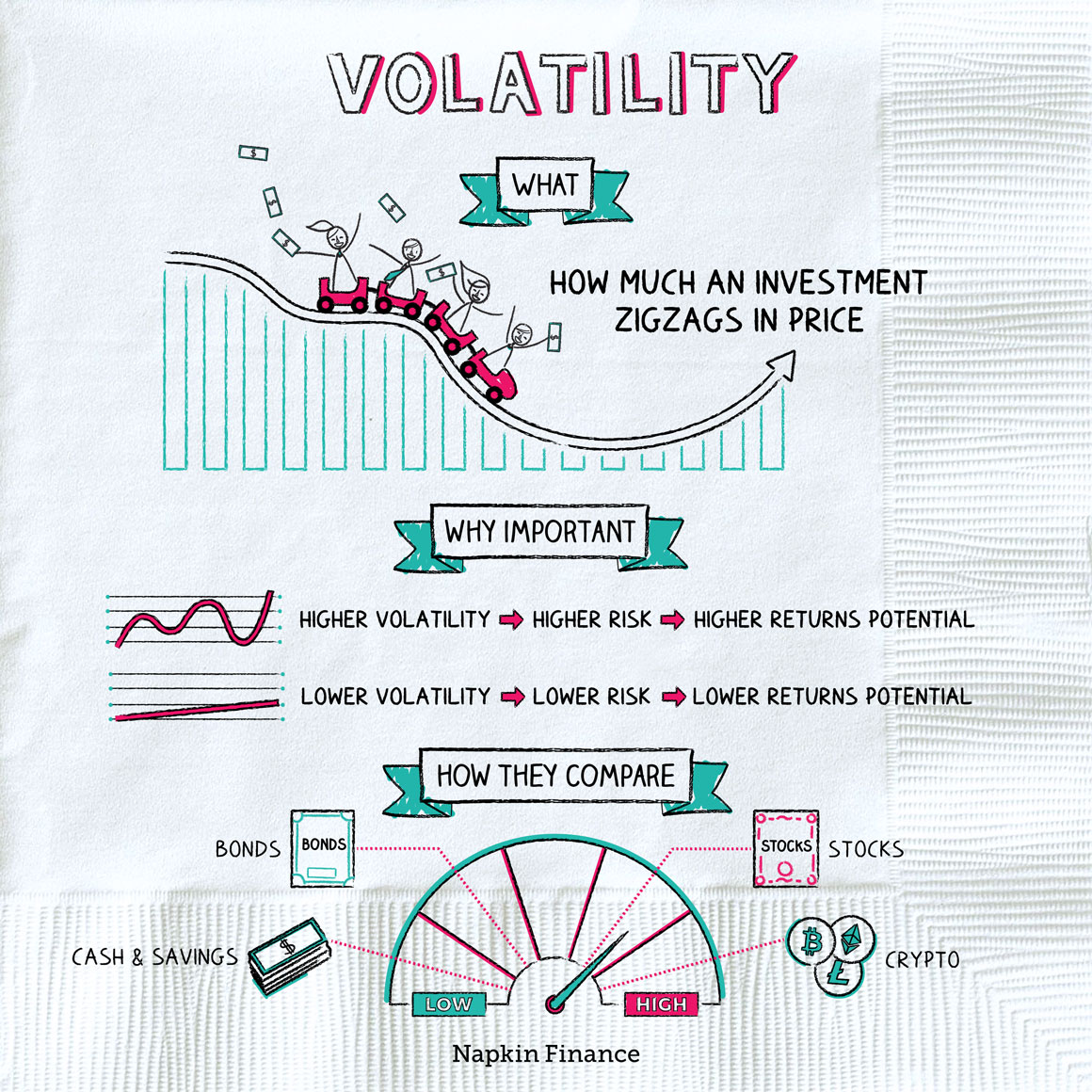

Volatility describes how much an investment bounces around in price.

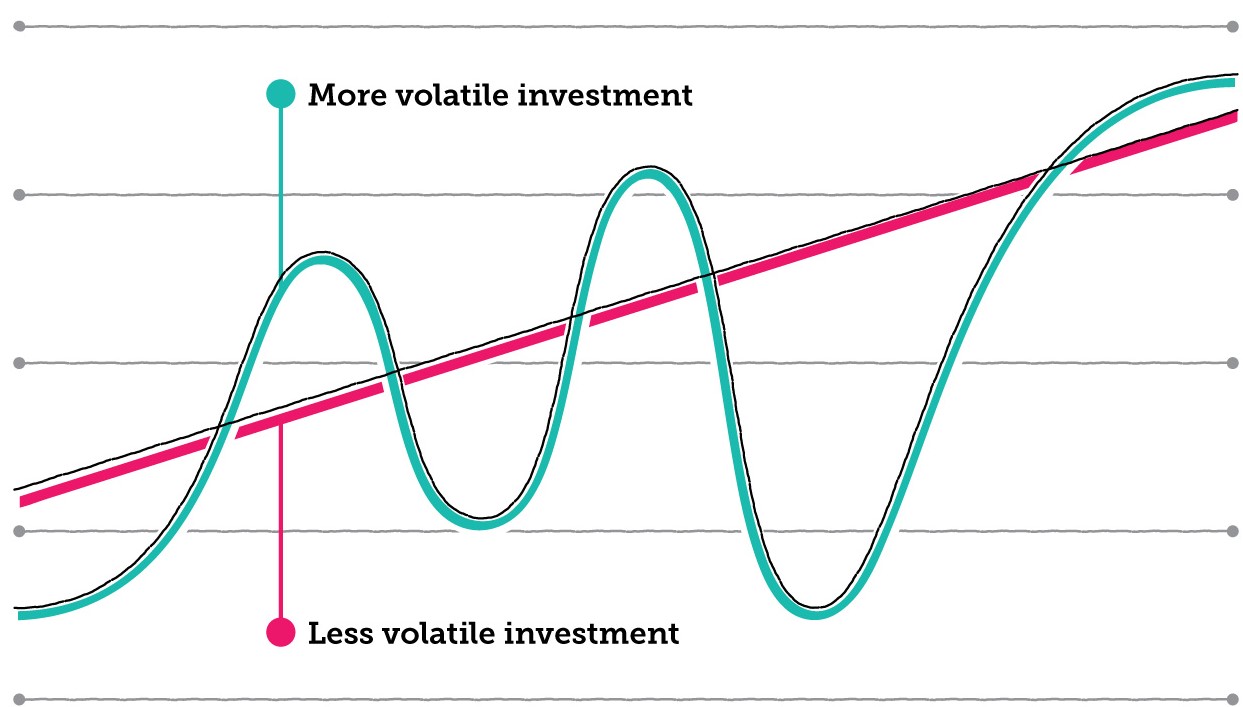

More volatile investments zigzag in price more dramatically, while less volatile investments show smoother price changes.

It’s important to understand the volatility of any investment you’re considering making as part of making sure that the investment is a good fit for you.

For example, if you’re investing money that you’ve saved up for a down payment on a home—and you’re planning to purchase a home in the next year—you probably want to invest that money in something with very low volatility. That way you can be sure the money will be there when you need it.

On the other hand, perhaps you’re looking to make a bet on an investment that could win big. In that case, you probably want to invest in something with high volatility—though you’ll also have to accept the risk of losing what you invest.

Volatility is an important measure of an investment’s risk. In most cases:

- The higher the volatility, the riskier the investment.

- The lower the volatility, the less risky the investment.

In investing, risk and reward usually go hand in hand. If you want the chance at an investment that could double in a month, you may also have to accept the possibility that it could drop to zero in a month. And if you want to be sure of avoiding losses, you have to give up the chance of big gains.

Volatility is a good shortcut for thinking about risk, but many experts argue it misses out on some important types of risk. Here are a few of the ways it can fall short:

- Doesn’t capture inflation risk

- Money in your bank account doesn’t bounce around in value at all, so it has zero volatility. But that doesn’t mean it’s without risk—it loses value to inflation over time.

- Ignores whether an investment goes up or down in value

- Technically, an investment that smoothly loses money could have low or no volatility. But it would still be a terrible investment.

- Misses the full picture

- One warning sign in fraudster Bernie Madoff’s client accounts was that the accounts showed incredibly smooth, positive performance year after year. Sometimes, overly low volatility is a clue that something fishy is going on.

- Ignores whether an investment is cheap or expensive

- Suppose that one day a stock is trading for $50 per share, but then the market has a hiccup, and it falls to $35. At $35 per share, the stock is actually cheaper than it was at $50 (because you can buy the same ownership stake for less money).

- Buying investments cheaply is safer than buying them when they’re expensive. But measured by volatility alone, the stock would look riskier at $35 than at $50.

Although there are complicated quantitative ways of describing volatility (the main one being the metric “standard deviation”), some rules of thumb and common sense can be just as useful as any fancy math.

By and large, you can sort the major categories of investments into different buckets of volatility (which, again, is similar to different buckets of risk).

Cryptocurrency → Very high

↓

Stocks → High to moderate

↓

Bonds → Moderate to low

↓

Cash, savings accounts, CDs → Rock bottom

Within each of those categories, here are a few ways you can separate the more volatile and less volatile investments:

| Consider… | Because… |

| How well-established is the investment? |

|

| What does the investment’s price chart look like? |

|

| What could go wrong with the investment? |

|

| What do the experts say? |

|

Volatility describes the size and frequency of an investment’s price swings. It’s important to understand the volatility of your investments because volatility is one of the most important measures of risk. It’s not necessarily better to only invest in low- or high-volatility investments. Instead, what’s most important is to make sure that the whole mix of your portfolio has the right level of volatility for you.

- You can invest in volatility itself with one of the many exchange-traded funds (ETFs) that track the VIX—an index that measures the stock market’s volatility. (But you may not want to—they tend to lose money over the long run.)

- The stock market (and other risky investments) tend to become more volatile during bear markets (when stocks fall) or anytime investors are worried about risk.

- Volatility describes how bumpy or smooth an investment’s price changes are.

- Higher volatility means an investment shows crazier price swings, while lower volatility means the investment tends to be smoother in price.

- The more volatile an investment, the riskier it generally is—because you have less certainty as to what the investment’s price will be in a week, a month, or a year.

- Although volatility is arguably the most important measure of risk, it misses out on some types of risk, such as the risk that your money loses value to inflation over time.