Securities

Market Maker

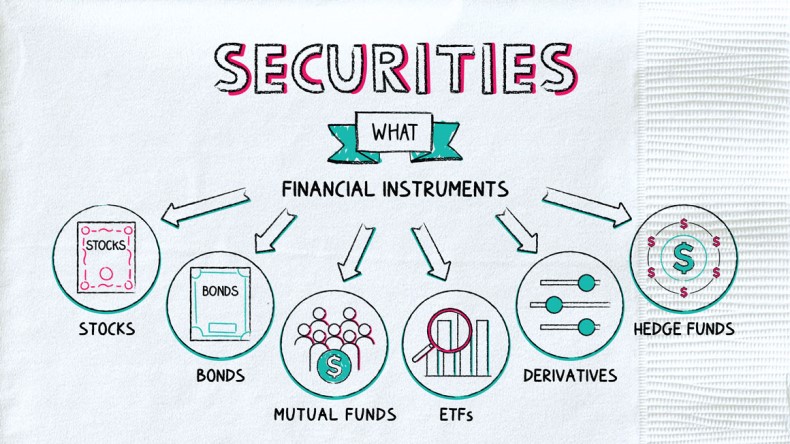

“Securities” is the term used to describe stocks, bonds, mutual funds, and other types of financial investments.

Securities have monetary value, and you can buy, sell, or exchange them. But they’re not physical (or “tangible”) things, like houses or cars. Instead, they have value because the owner of the securities is entitled to some kind of financial claim.

Securities can include:

- Stocks

- Bonds

- ETFs

- Mutual funds

- Money market funds

- Hedge funds

- Private equity

- Derivatives such as futures and options

But ultimately, essentially all securities boil down to one of two types of claims: equity or debt.

| Equity | Debt | |

| What it is | An ownership stake | A loan |

| Examples | Stocks, private equity, mutual funds and ETFs that own stocks | Bonds, CDs, Treasury bills |

| How earns a return | Investor (i.e., the owner) hopes to sell their stake for more than they paid; may also receive dividends over time | Investor (i.e., the lender) receives interest and principal payments |

| Risk | Usually higher | Usually lower |

You can further divide securities into two categories:

- Marketable: Investments that you can easily buy, sell, or redeem, such as stocks, bonds, and shares of ETFs.

- Marketable securities are liquid, meaning it’s typically easy and fast to sell the security for its market price.

- Nonmarketable: Investments that are difficult to sell or that you’re prohibited from selling, like equity in a private company or privately issued debt.

- These securities can be more difficult or costly to sell.

Investing in securities comes with risk, but you can also reap big rewards.

| Pros | Cons |

| Let your money work for you | Possible to lose your entire investment |

| Benefit from a growing economy | Economies run in cycles, and there’s always a dip out there |

| Can help protect your money against inflation | Can be complicated and require extensive research |

- If you want to buy securities, it’s easiest to do it through a broker or an investment firm (hot tip: don’t try walking your money over to Wall Street and asking for some stocks).

- Some securities have preferential tax treatment, so in addition to your gains, you might also be able to reduce your tax liability.

- While they can’t guarantee a return on your investment, the federal government (and in some cases state regulators too) keeps watch over buying and selling securities to help make sure you’re not swindled.

Securities are stocks, bonds, and other types of investments that have value and that you can buy and sell. Unlike real estate, cars, or jewelry, securities aren’t physical (or “tangible”) items. You can classify most securities as either equity or debt and as either marketable or nonmarketable.

- If you’re considering investing in securities, don’t do it in September. Historically, it’s the month when the stock market has performed the worst—both in the U.S. and around the world. (Economists have a lot of theories about why, but no one really knows.)

- You might be more familiar with stocks, but the bond market is actually larger—at more than $100 trillion worldwide.

- Securities are stocks, bonds, mutual funds, ETFs, and other types of investments with value that you can buy and sell.

- Unlike physical items of value, such as real estate, securities are intangible.

- You can categorize securities as either debt or equity and can further classify them as marketable or nonmarketable based on how easy they are to sell.

- Investing in securities is one way to grow your money, but there’s risk involved, and you could lose what you put up.