IRA vs. 401(k)

Nest Eggs

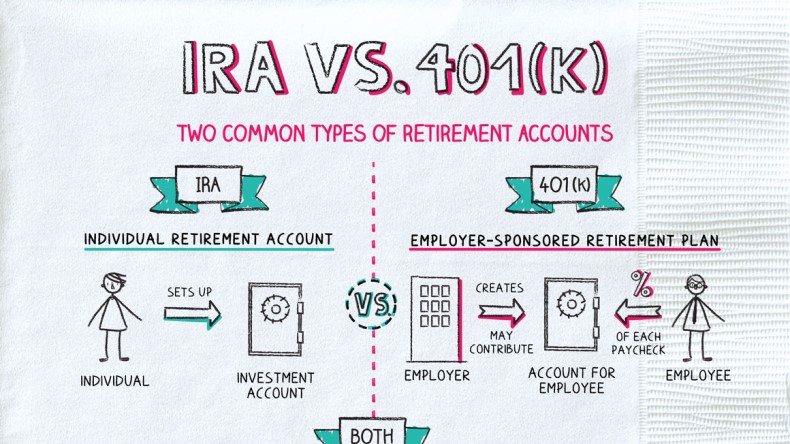

IRAs and 401(k)s are two popular types of retirement savings accounts. Most people who work in the private sector have at least one of these accounts (government employees often have different options), and many people own several retirement accounts.

Although they both serve the same purpose, the accounts have some important distinctions:

| IRAs | 401(k)s | |

| How do you open an account? | Open an account with a financial institution and deposit some money. | Your employer must sponsor an account, and you sign up through HR. |

| How do you contribute? | Transfer money to your account. | Set up automatic payroll deductions. |

| How much can you contribute? | $6,500 per year (though this amount changes year to year). | $22,500 per year (though this amount changes year to year). |

| When can you use the money? | Not until age 59½ (other than a few exceptions, such as for financial hardship). | Not until age 59½ (other than a few exceptions, such as for financial hardship). |

| Perks | Lots of choices for investment options.

Easy to consolidate accounts or move them to a new financial institution. |

Free money!

Many employers match your contributions up to a certain amount. |

Both types of accounts can provide great perks, including:

- Potential growth—both IRAs and 401(k)s typically offer a range of investment options you can choose from, so your money grows over time.

- Tax advantages—contributions to either type of account are typically tax deductible and so reduce your current year’s tax bill. And both types of accounts let you avoid paying taxes on your money’s growth while it’s in the account.

- Chance to build your wealth—by contributing regularly and letting your money grow, you can use either account type to meet your retirement goals.

One downside? Because the accounts are truly supposed to be used only for retirement, you can face a big tax and penalty bill if you ever need to withdraw money early. So it’s important not to treat them like savings accounts.

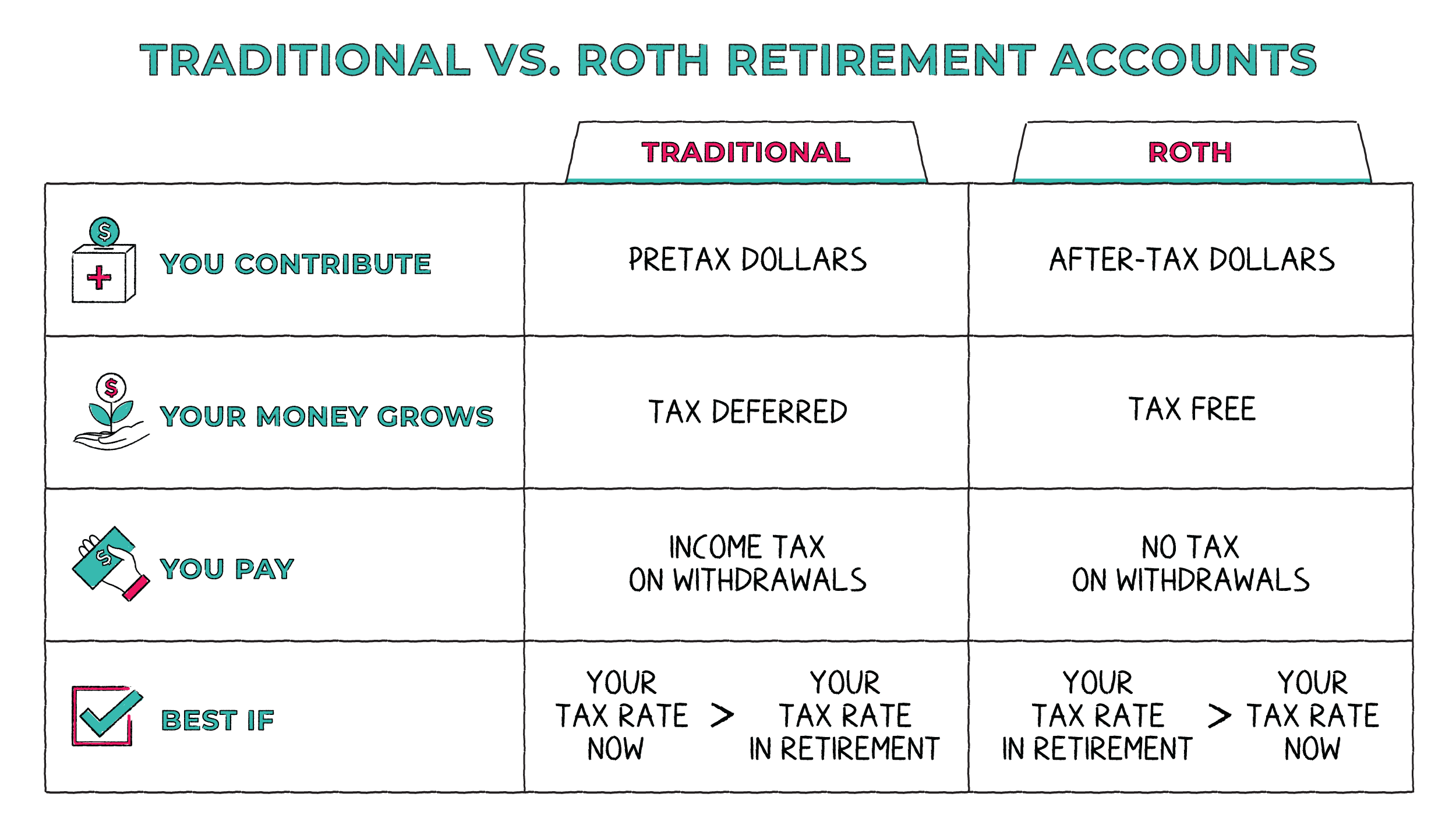

Both 401(k)s and IRAs come in two flavors: traditional and Roth. The main difference is when you pay taxes.

Because of this, Roth accounts are often a good fit for someone who has relatively low income today but expects to have higher income in retirement (like those early on in their careers).

If you’re choosing between accounts or just want to know what you’re in for, here are some things to keep in mind:

- Not every employer offers a 401(k), and not all employees are automatically eligible. Check with HR for details.

- Both types of accounts let you make additional “catch-up” contributions once you turn 50. (Though 401(k)s have higher limits for both regular contributions and catch-up contributions.)

- You’re generally required to start taking withdrawals from your retirement accounts in the year you turn 70½ (there’s an exception for Roth IRAs).

- You can have both a 401(k) and an IRA if you want to contribute as much as possible to your retirement.

- Contributions to IRAs aren’t always tax deductible. That perk gets phased out above certain income levels (and where those levels are set depends on whether you’re also eligible for a 401(k) through work). Make sure you know what your tax treatment will be before you contribute.

IRAs and 401(k)s are two types of retirement savings accounts. You can set up an IRA on your own, but a 401(k) needs to come through your employer. Other differences include how much you can contribute and investment options. Both types of accounts have tax advantages and the potential to grow and build your wealth for retirement.

- What’s the FIRE community? No, it’s not a Burning Man camp—it’s “Financial Independence, Retire Early,” a movement of millennials obsessed with aggressively saving money so that they can retire early.

- The average balance in a 401(k) is just over $100,000, but it is possible to become a “401(k) millionaire”—i.e., someone with a balance in the seven digits.

- IRAs and 401(k)s are the two main types of retirement savings accounts.

- The main difference is that 401(k)s must be sponsored by an employer, while you can set up an IRA on your own.

- Both account types can be either traditional or Roth, which affects when you pay taxes on your contributions.

- Either, or both, can be a great option for retirement savings.