IPO

Opening Bell

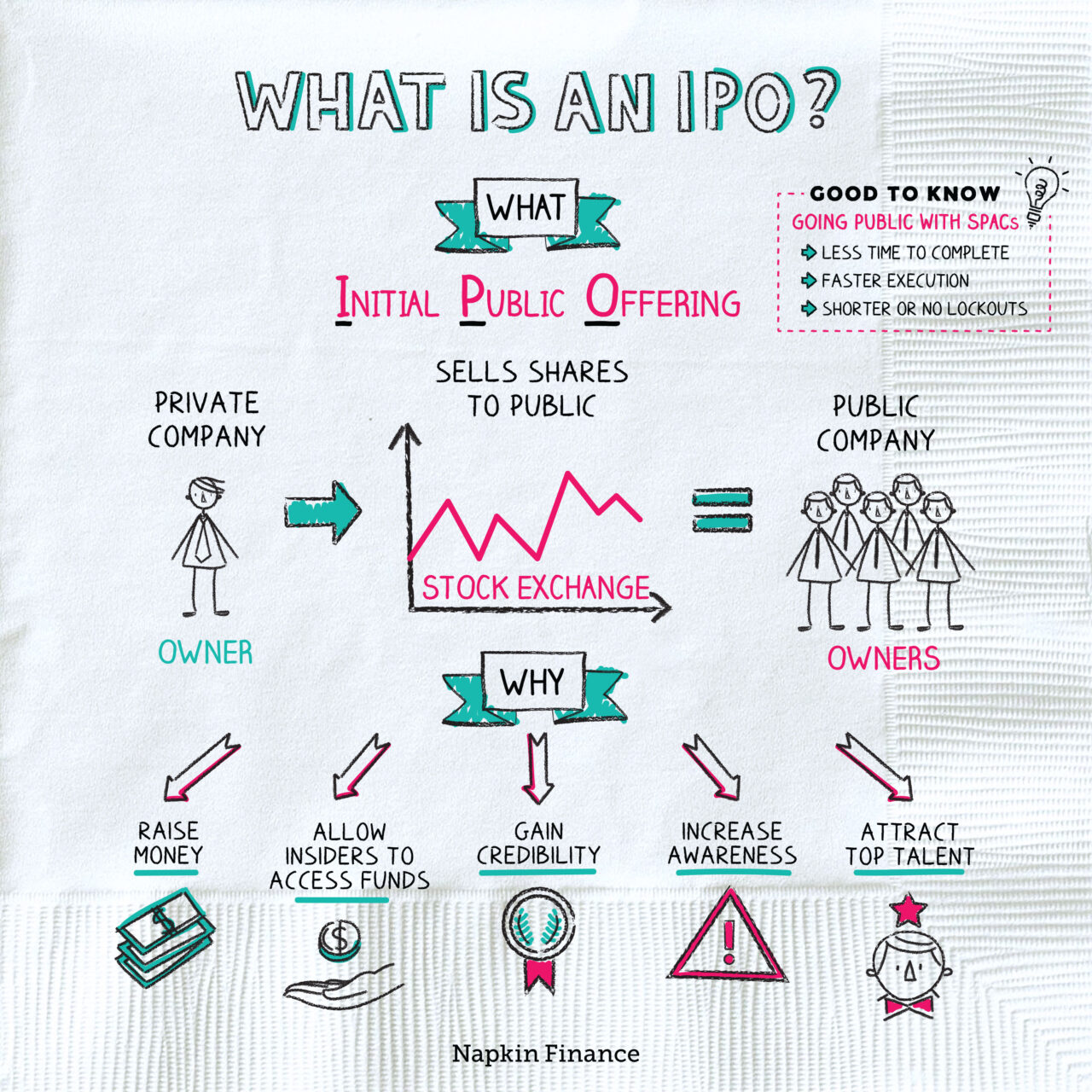

An IPO, or initial public offering, is when a company’s shares start trading on a stock exchange and when average people can start investing in the company. It’s also called “going public.”

Step 1: A company starts out as a private company, meaning it doesn’t have shares that trade. Insiders, such as the founders or employees, typically own most of the company.

Step 2: The company decides to go public. It hires an investment bank to help it figure out the details—such as how many shares to sell and at what price.

Step 3: The company files an S-1 statement with regulators. This form is like a heads-up that the company plans to go public, and it includes details on how much money will be raised plus information about the company’s finances.

Step 4: The investment bank buys the shares that the company is going to offer.

Step 5: IPO day: The shares start trading on an exchange, and the investment bank sells its shares to the public.

The main reason companies go public is to raise money, which they need to expand their business. Some additional reasons may include to:

- Allow insiders to access funds—Early employees could hold valuable ownership positions in the company but have no way of selling their stake. After an IPO, they can finally sell their shares, use the cash to diversify their investments, make luxury purchases, contribute to charitable causes and many other pursuits.

- Gain credibility—Having shares traded on a major exchange might boost a company’s reputation.

- Raise awareness—Having a big, news-making IPO can get potential investors excited about the company.

- Attract talent—With publicly traded shares, it can be easier to offer stock compensation plans to employees, which can make the company a more attractive place to work.

Not all companies (even big, well-known ones) decide to go public. Some may even go through the IPO process but later decide to become private again. While the benefits of an IPO might seem appealing, companies that go public also face risks, including:

- Pressure can distract from long-term focus

- Making their finances and other sensitive corporate information public

- Complying with extra regulations (and filing a great many mandatory reports)

- The high cost of both preparing for an IPO and keeping up with accounting and regulatory requirements

- Loss of control to shareholders and a board of directors

A company can sell more shares in the future even after having an IPO. Those sales are called “secondary offerings,” and they usually happen with less hype than IPOs.

Businesses that don’t want to use a traditional IPO might choose a special purpose acquisition company (SPAC). A SPAC is created by investors to hold an IPO, raising money to buy or merge with another company.

SPACs offer some benefits over the traditional IPO, such as:

- Less time to complete: The SPAC process takes just a few months versus six to 12 months for an IPO.

- Quick deal making: SPACs must buy or merge with another company within two years of raising funds, or they have to give the money back (plus interest).

- Shorter lockout periods: Occasionally, a SPAC has a shorter lockout period than an IPO, meaning insiders can sell their shares sooner.

An initial public offering, or IPO, is when a company first makes its shares available for sale to the public on a stock exchange. Companies typically decide to “go public” to raise funds but might also want to attract talent, let early investors cash out, or raise their profile with the public. Going public, however, also has some drawbacks, including loss of control, greater regulations, and making corporate information public.

- When a company IPOs on the New York Stock Exchange, its executives often get to ring the bell on the trading floor.

- Terrible IPOs can make great stocks and vice versa. Facebook shares fell when they first started trading but have since gained more than 700% in value.

- SPACs are sometimes called “blank check companies” since the investors don’t usually know which company the SPAC will try to buy.

- It’s possible for a company to go public without an IPO. Coinbase and Squarespace were among the companies that did so with a so-called direct listing in 2021. The downside is that a direct listing doesn’t allow the company to raise new money (it only lets existing investors cash out). The upside is that because direct listings are less hyped than IPOs they tend to be less volatile than IPO stocks.

- An IPO is when a company’s shares start trading in the stock market. This is also called “going public.”

- The first chance for anyone to buy into a company typically happens when a company holds an IPO.

- Companies go public to raise funds but may also use it as a chance to raise awareness or let existing investors cash out.

- Some companies choose to stay private because they don’t want to deal with the cost, regulations, increased scrutiny, and loss of control that goes with being a public company.