Budget

Nickels and Dimes

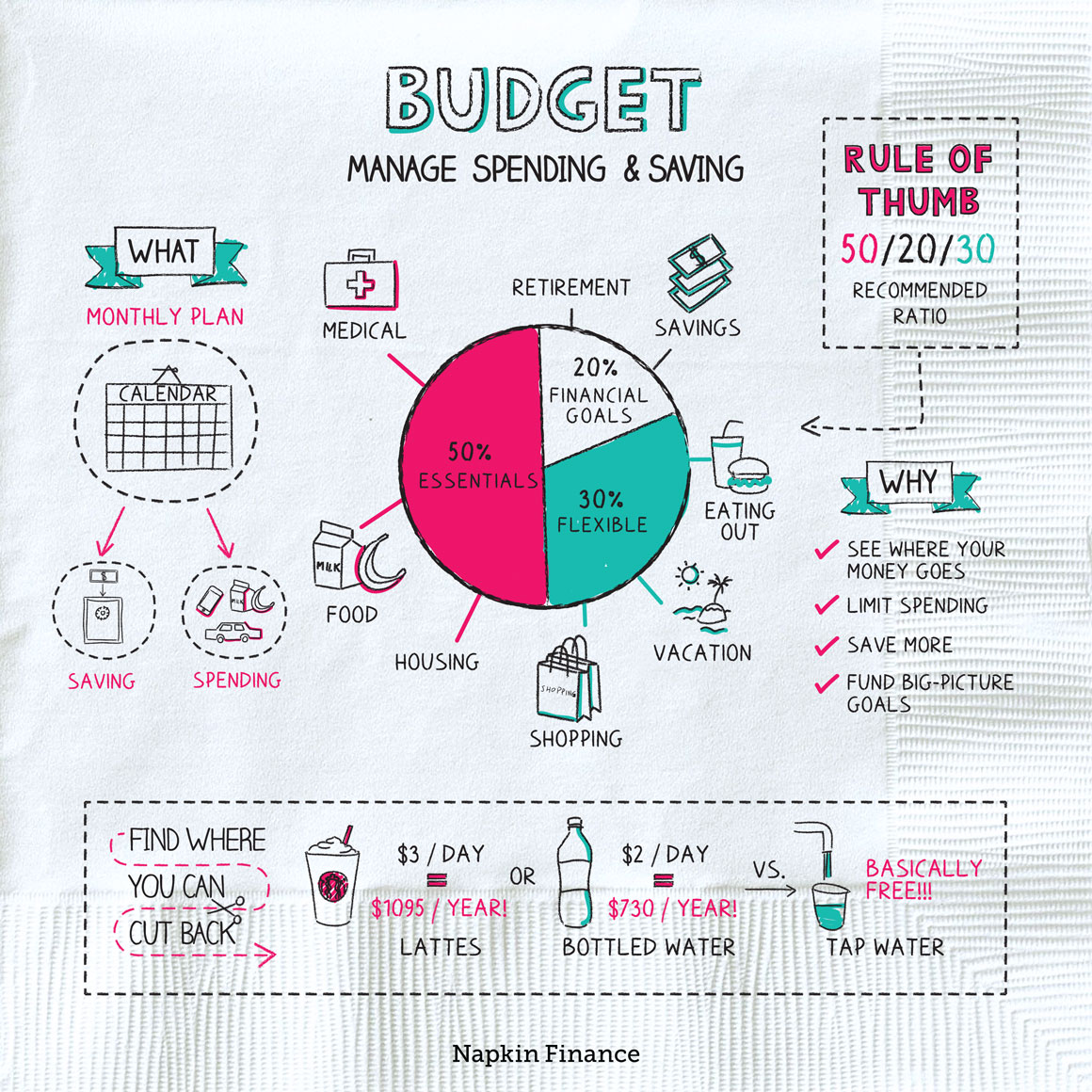

A budget is a plan you can use to better manage your spending and saving. When you follow a budget, you set limits on where your money goes. Following a budget can be a powerful way to improve your financial fortunes because it helps ensure you’re not spending more than you earn.

The benefits of budgeting include:

- Getting a clearer picture of where you actually spend your money (hello, takeout).

- Making sure you have enough money to meet your needs while limiting how much you spend on your wants.

- Saving more money.

- Freeing up more money to pay down debt and fund other big-picture goals.

“Beware of little expenses. A small leak will sink a great ship.“

—Benjamin Franklin

Here’s the basic process for getting started with budgeting:

Step 1: Figure out what you earn each month after tax.

Step 2: Track your expenses for a month or two and see how much you spend in a typical month and what you’re spending it on. Many budgeting apps can do this for you automatically.

Step 3: Decide what categories you’ll use for your budget and come up with a monthly limit for each one, like $200 per month for eating out.

Step 4: Stick to your limits. A good app can also help you with this step—such as by alerting you when you’ve reached your limits for the month.

Step 5: Once you’ve gotten into the habit of watching your spending, try to find more places to cut back.

One big decision you need to make when budgeting is how much to dedicate to each major spending category.

One rule of thumb is called a 50–20–30 budget. With this approach, you divide your income into:

- 50% for essentials—including rent, utilities, groceries, and healthcare.

- 20% for financial goals—such as paying down debt, saving up a down payment, or funding your retirement.

- 30% for flexible spending—including entertainment, vacations, eating out, and nonessential purchases.

Get Started with Budgeting — Try the 50/20/30 budget

One benefit of a budget is that it can help you make faster progress toward your long-term financial goals, such as buying a house, paying off debt, going on vacation, or even just saving up for a bougie brunch with friends. How can you do that?

Pick a goal

(make it realistic)

↓

Figure out how much money you need for it

↓

Set a time frame for reaching your goal

(again, make it reasonable; you won’t fully fund your retirement in two years)

↓

Choose a weekly, monthly, or annual savings target

that puts you on track to reach your goal

↓

Carve out space in your budget to save money for your goal

↓

Keep saving!

↓

Check in on your progress

and adjust as needed

Discipline is the name of the game when it comes to sticking to a budget. And that can be tough when a new pair of shoes is staring you in the face. Here are some tips to make it a little easier:

- Keep it reasonable. Are you really going to skip your favorite coffee shop for an entire 30 days? Can you actually eat only lentils for a month?

- Use an app (or even just a paper on the frige!) to track your spending and savings and remind you when bills are due.

- Automate your deposits to savings, retirement, or funds for other goals—so that you don’t have a chance to spend that money in the first place.

- Instead of forbidding yourself from spending on wants, try to take a cooling off period before you make a purchase—like waiting a week before you click “buy” on those shoes. That can help you avoid the pull of instant gratification.

- Find compromises, like learning to make your favorite restaurant foods at home.

- Come up with tiny rewards for staying the course, like a night of guilt-free TV binging.

A budget can help you better understand and control where your money goes each month. It can help you save for long-term goals, avoid ending up in debt, and simply bring more discipline and organization to how you manage your finances.

- The word budget comes from the French word bougette, meaning “leather bag.”

- In a year, the average American family spends $710 on their pets, $558 on alcohol, and only $110 on reading materials. #priorities

- A budget is a plan that lets you decide how much you spend and on what.

- Using a budget can be a powerful way to make sure you’re living within your means.

- You can come up with a custom-made budget or try a 50–20–30 budget.

- Apps can help you track your spending and stick to the limits you set.