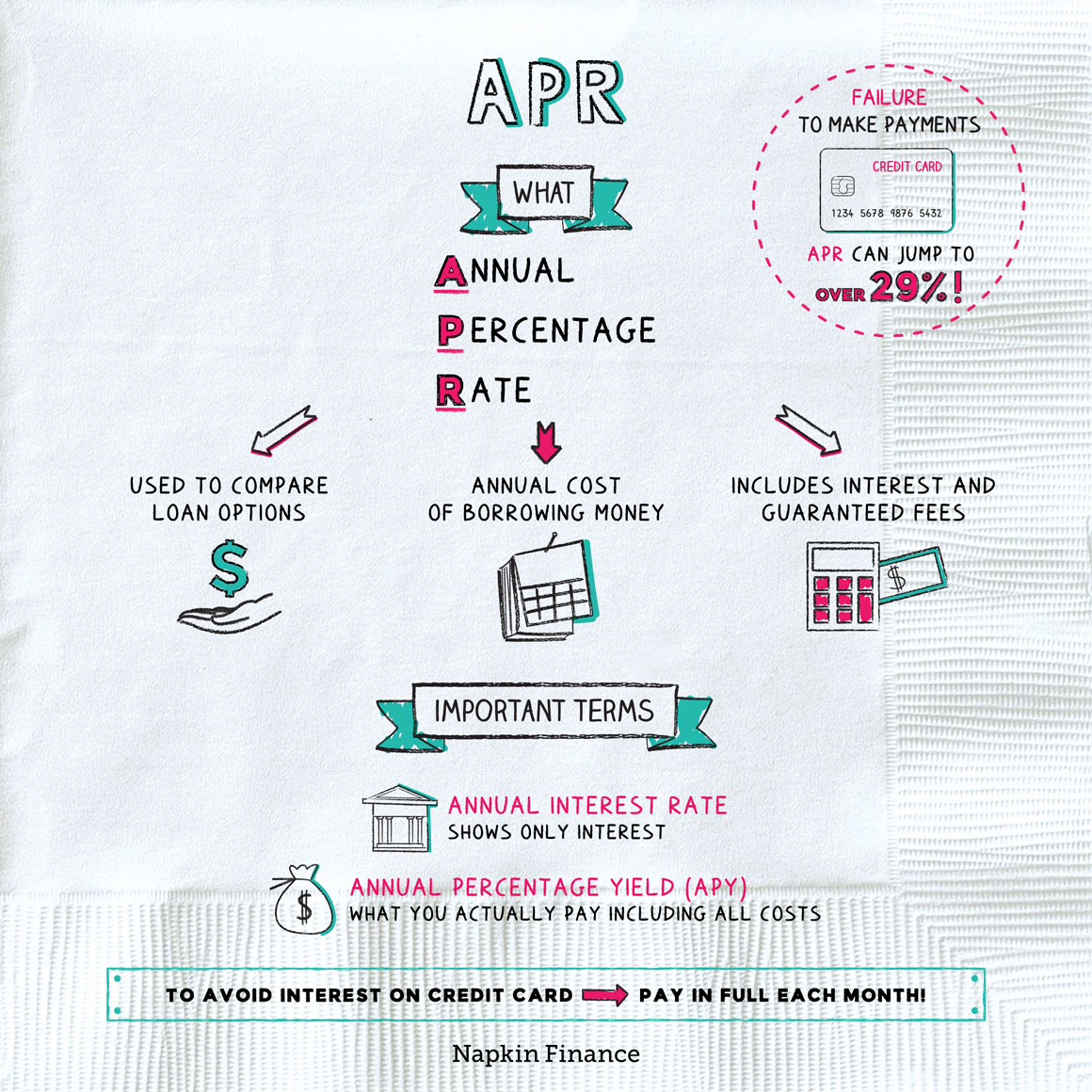

APR

Another Day, Another Dollar

An annual percentage rate (APR) represents the annual cost of borrowing money, including fees.

Because the APR includes fees, it’s typically higher than a loan’s stated annual interest rate.

However, it only includes fees that you are guaranteed to pay (such as closing costs on a mortgage), not fees that could only be triggered in some situations, such as late fees.

You’ve probably seen APRs used in advertising for financial products. What fees are included in an advertised APR may depend on the specifics of the loan offer.

For example, while the APR of a home mortgage should include fees for loan origination and closing, credit card APRs typically don’t include annual fees or other costs. That’s because the credit card company doesn’t know in advance which cardholders will incur which fees. Some customers may pay late, while others may qualify for a waived annual fee and always pay on time.

Here are a few examples of the types of fees that are included or excluded from APR calculations:

| Guaranteed fees (included in APR) |

Possible fees (not included in APR) |

|

| Mortgages & loans | ● Mortgage closing costs ● Loan origination fees ● Processing fees ● Administration fees ● Mortgage “points” ● Underwriting costs |

● Inspection or appraisal costs ● Agent commissions ● Credit check fees ● Homeowners or title insurance premiums |

| Credit cards | ● None | ● Annual fees ● Late or missed payment fees ● Bounced check or insufficient funds fees ● Balance transfer fees |

If you know the amount of your loan and the annual interest rate, calculating your APR based on the fees you’ll pay can be easy. Simply calculate the total interest charges on the loan amount, add fees, and divide by the loan amount.

For example, consider a small, short-term loan to be paid off after one year:

Loan amount: $10,000

Annual interest rate: 8%

Loan interest charges: $800

Total other fees: $200

Total interest charges = ($10,000 + $200) * 8% = $816

APR = ($816 total Interest) + ($200 fees) / $10,000 = 10.16%

However, if a loan has no fees, the APR is the same as the annual interest rate:

Loan amount: $10,000

Annual interest rate: 8%

Loan interest charges: $800

Total other fees: $0

Total interest charges = ($10,000 + $0) * 8% = $800

APR = ($800 total interest) + ($0 fees) / $10,000 = 8%

- Annual interest rate—This figure represents only the annual interest expense without taking any fees or other costs into consideration.

- Annual percentage yield (APY)—The annual amount you actually pay, including compounding and other charges, expressed as a percentage of the loan amount. This is the most comprehensive measure of the cost of a loan, but because it includes non-guaranteed fees, it often can’t be calculated until after a loan is repaid.

If you think APRs are confusing, you’re not alone—and they’re only the tip of the iceberg when it comes to making sense of interest rates. Different financial institutions may quote different types of rates or use different compounding periods. And some interest rates are even calculated and quoted in terms of a 360-day year.

The bottom line: Make sure you’re comparing apples to apples anytime you’re shopping for the best rate—whether you’re looking to borrow or invest.

An APR reflects what you’ll pay for the privilege of borrowing money and is a quick way for consumers to compare financial products at a glance. However, an APR may not reflect all the potential costs you face on a loan, so always make sure you read the fine print.

- APR includes the annual interest rate you pay on a loan plus any fees that you are guaranteed to pay, such as mortgage closing costs.

- An APR can be a more comprehensive reflection of the cost of a loan than the annual interest rate.

- APR does not include the effects of interest compounding or fees that may be triggered only in some situations, such as late-payment fees.

- The actual cost of a loan may be higher than the stated APR if you don’t pay your balance in full each month or incur additional fees.

- If you play your cards right (pun intended), you may not actually end up paying any interest at all. If you have a credit card, even one with a high APR, you can avoid paying even $1 of interest by paying your full balance each month.

- If you fail to make on-time payments, the APR on your credit card can jump to 29.99% or more.