Convertible Note

Take Note

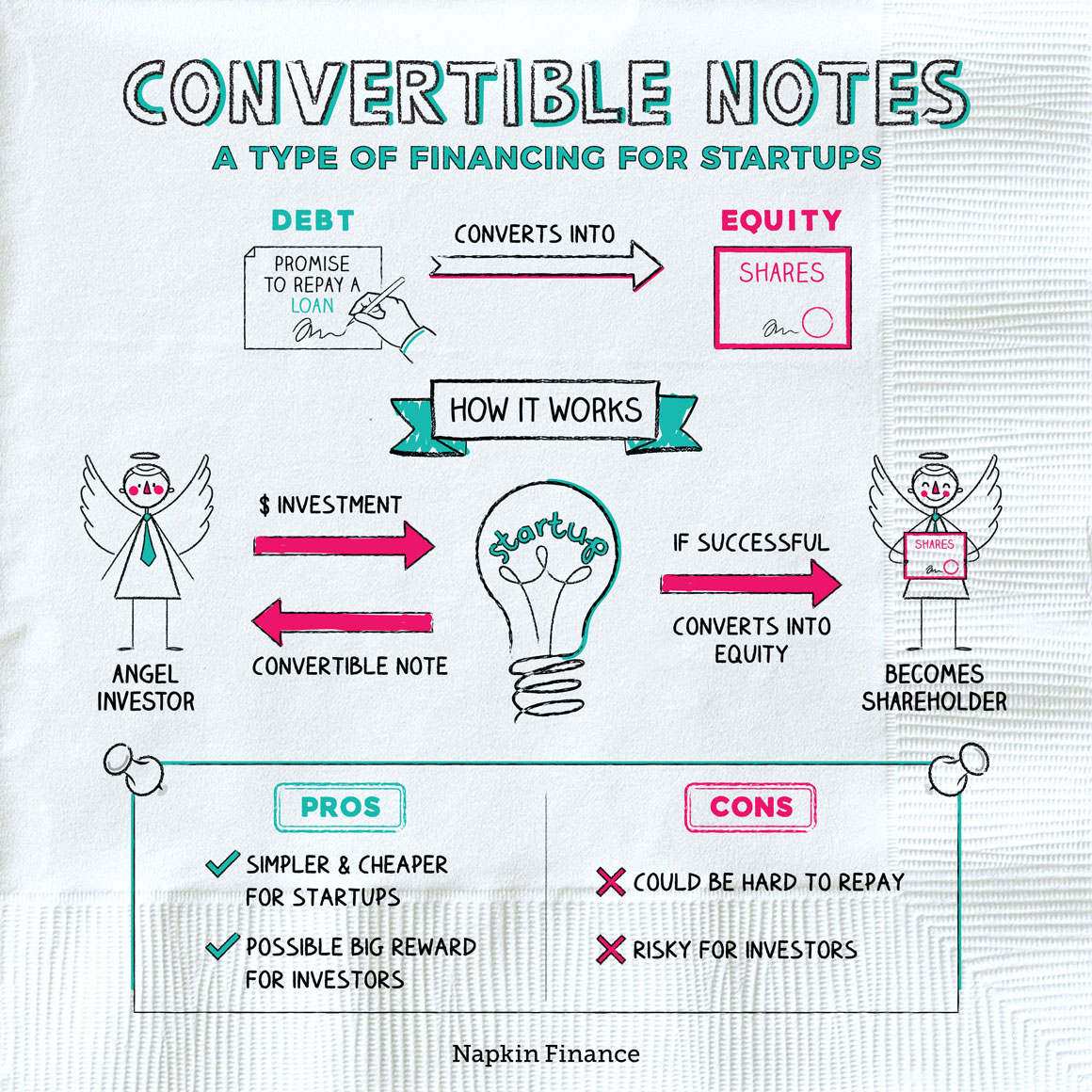

A convertible note is a type of short-term loan for a business. However, instead of being repaid in cash, the note converts into an ownership stake (i.e., equity) in the business.

Convertible notes are popular with startup companies. It helps them raise funds from investors who are willing to take a risk on an untested company.

As a reward, these investors may get to share in the company’s success. If the company does well, the shares the investors ultimately receive as payment will be worth more than the original loan.

Convertible notes can be a simpler and cheaper source of financing for startups compared with a traditional round of financing. They can also help startup founders avoid the thorny issue of coming up with a value for their company (which can be difficult for a startup that’s still just an idea trying to get off the ground).

Here’s what the life cycle of a convertible note typically looks like:

Startup begins its initial round of fund-raising

(seed round)

↓

Investor agrees to lend the business a certain amount of money,

with specific repayment terms (the convertible note)

↓

Startup seeks a second round of fund-raising

(Series A round)

↓

Company value is determined

↓

Convertible notes convert into shares as repayment (principal + interest)

based on the note’s terms

↓

Convertible note owner now has an ownership stake

(i.e., owns stock), just like the startup’s other investors

Like a traditional loan, a convertible note comes with set terms that the business and investor agree to. These terms often include:

- Maturity date: The date at which the note comes due, usually 12 to 24 months after issuance, at which point it either converts to equity or must be paid back in cash.

- Interest rate: This is usually lower than a traditional business loan and accrues over time rather than being paid monthly. If the note converts into equity, the investor will never receive cash interest and will instead receive a larger ownership stake (to cover the accrued interest).

- Valuation cap: The upper limit on the value of the business that’s used to determine the conversion rate.

- Discount rate: A bonus, which allows the note holder to convert their investment (plus interest) at a price lower than that paid by later investors; these typically range from 10% to 35%.

A note’s terms will spell out how the note’s conversion is determined. No matter how it’s calculated, convertible notes typically reward investors who get in early by giving them cheaper shares than those offered to later investors.

“All that matters in business is that you get it right once.

Then everyone can tell you how lucky you are.“—Mark Cuban

With a convertible note, an investor is taking a risk on a company but does so with the hope of a big payoff later. However, it doesn’t always work out.

If the note comes due but the business doesn’t have enough equity to meet the repayment terms, the investor has some options:

- Extend the maturity date of the note

- Convert the note to a different valuation cap

- Ask for repayment of the note in cash (both the principal and interest)

The last one is usually the worst option for the startup because repaying the loan might send the company into bankruptcy.

A convertible note is a short-term loan given to a business by an investor. In return, the investor receives equity in the company equal to their initial investment plus interest. Startup companies use this type of fund-raising because it’s often easier than a traditional funding round, and investors like it because they can make a significant profit if the company succeeds.

- Investors who purchase convertible notes or otherwise participate in the seed round of fund-raising are typically called “angel investors” because they take on huge risk to help new businesses get off the ground.

- Each month more than 500,000 new businesses are started, but only half of them will be around five years later.

- New companies issue convertible notes, a form of a short-term debt, as an easy way to raise money when they’re just getting started.

- Convertible notes are generally repaid with equity in the company.

- A convertible note is a risk for investors because the company might fail, but they also stand to profit if the company does well.

- If a company cannot pay back a convertible note when it reaches maturity, the note might be extended or the company might have to declare bankruptcy to pay the investor’s principal and interest.