Tax Returns

Not-So-Happy Returns

Most people pay taxes throughout the year. When you file a tax return, you calculate how much you legally owed for the year and compare it to how much you paid. If you paid too little, then you send a check in for the rest with your return. If you paid too much, then you sit back and wait for your refund.

Filing your tax returns is important because you do not want to mess with the IRS. Ever.

“The only two things that scare me are God and the IRS.“

—Dr. Dre

Step 1: During the calendar year, you probably pay taxes through payroll. If you have other income, you may pay quarterly estimated taxes as well.

Step 2: In late January, your employer (or employers) and any financial institutions you have accounts with should send you your tax forms (such as W-2s and 1099s).

Step 3: By April 15 (but after you’ve exhausted every option for procrastination), you put together your return.

Step 4: If you owe money, you generally send in a payment with your return. If you’re due a refund, you’ll probably receive it in the weeks after you file.

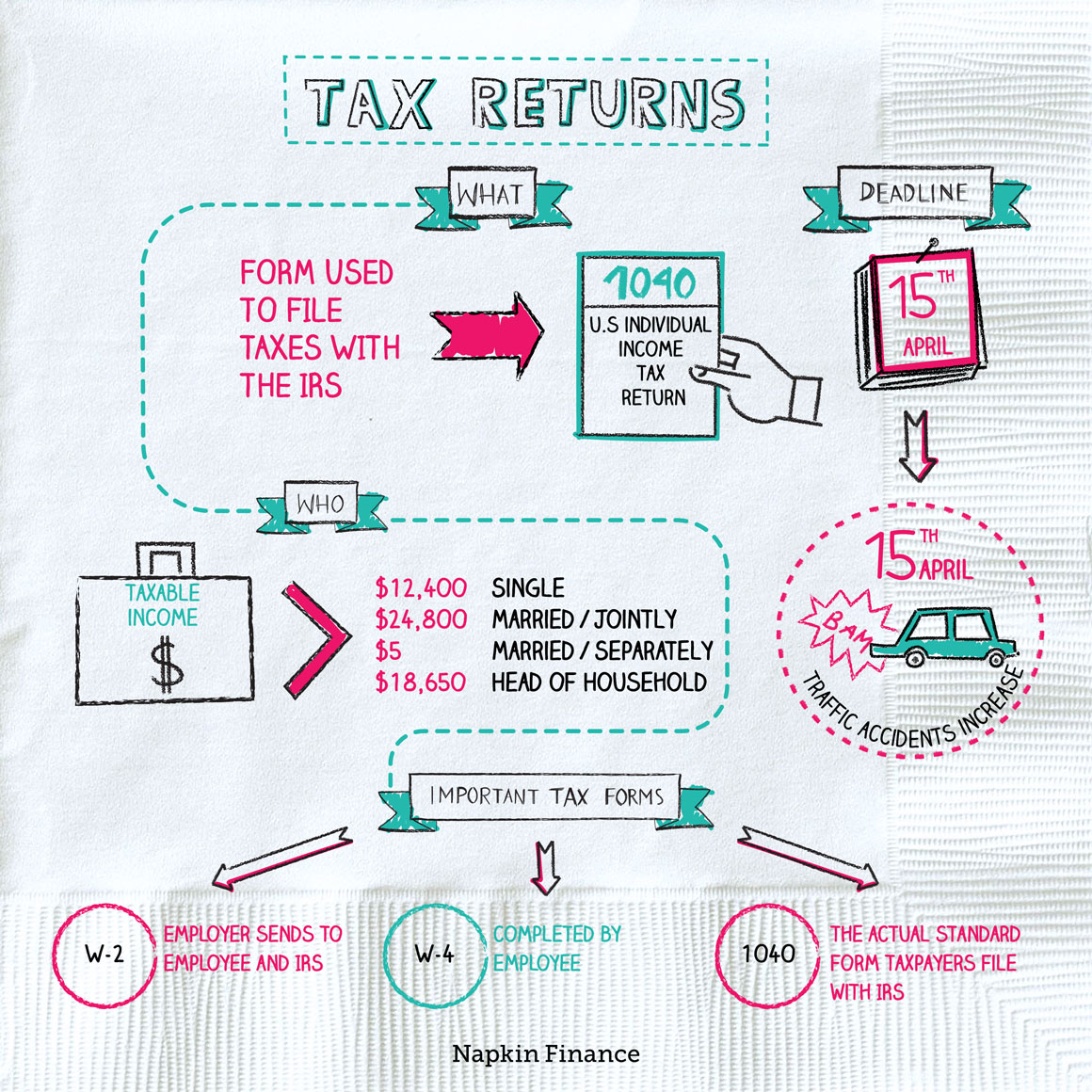

The good news is that not everyone files a tax return. The bad news is that the carve-outs are pretty narrow. You might not need to file if you meet all of the following criteria (emphasis on “all”):

- Under age 65

- Single

- Earn less than the standard deduction, and

- Don’t face any special circumstances, such as self-employment income

That said, it’s best to check with the IRS or a tax professional to be sure. And, keep in mind that even if you’re not legally required to file, it might still be worth it just in case you’re actually due a refund.

To put together your return, you’ll at least need:

- Your Social Security number

- Last year’s return

- Any W-2s or 1099s from employers

- Any 1099s from financial institutions

- Records for any deductions or credits you’ll be taking

(And a bottle of wine to help you forget the trauma of filing your taxes.)

When you file your taxes, you’ll choose which form is right for you. Some of the most common are:

| Tax form | What it is |

| 1040 | Standard filing form that most people use |

| 1040-SR | Alternative to the 1040 for filers aged 65 and older; uses larger font and points out specific rules and deductions available to retirees |

| 1041 | Tax return that a person’s trust or estate may need to file |

| 1040X | Form for amended returns; used for fixing mistakes on a return you already filed |

| 4868 | The form you can use to request an extension |

It’s no one’s favorite time of the year. But here are a few pointers to help you make it through tax season:

- You can file your taxes online with the IRS for free. Some tax software companies also offer free help with e-filing if your taxes are very simple or if you make less than a certain amount.

- If you can’t make the deadline, you can file for an extension to get another six months to put together your return. (An extension only gives you more time for the form. If you owe money, the IRS would still like that now, please.)

- If you’re in the gig economy, chances are you need to be filing and paying estimated taxes four times a year.

Your tax return lets you settle your tab with the IRS for a given calendar year. Because most people pay taxes throughout the year (via payroll or estimated taxes), a tax return tells you whether you need to send more money to the IRS or whether you can expect a refund. Not everyone is legally required to file a tax return. But even if you’re not, it may still make sense to do so to make sure you receive any refund you could be owed.

- Other countries have it better. Germany, Japan, and Spain are among the 36 countries in which citizens don’t have to file a tax return (the government does all the number crunching).

- The rate of fatal car crashes tends to go up on April 15. All the more reason to e-file.

- Your annual tax return is where you add up how much you owe the government for the last year and how much you already paid and reconcile the difference.

- Not everyone needs to file tax returns, including single people with very little or no income.

- You’ll need any W-2s, 1099s, other records of income, and records for deductions and credits in order to file your tax return.

- Most people use Form 1040 to file, but there are other tax forms to use if you need an extension, made a mistake, or if other special circumstances apply.