ETFs

Jack-of-All-Trades

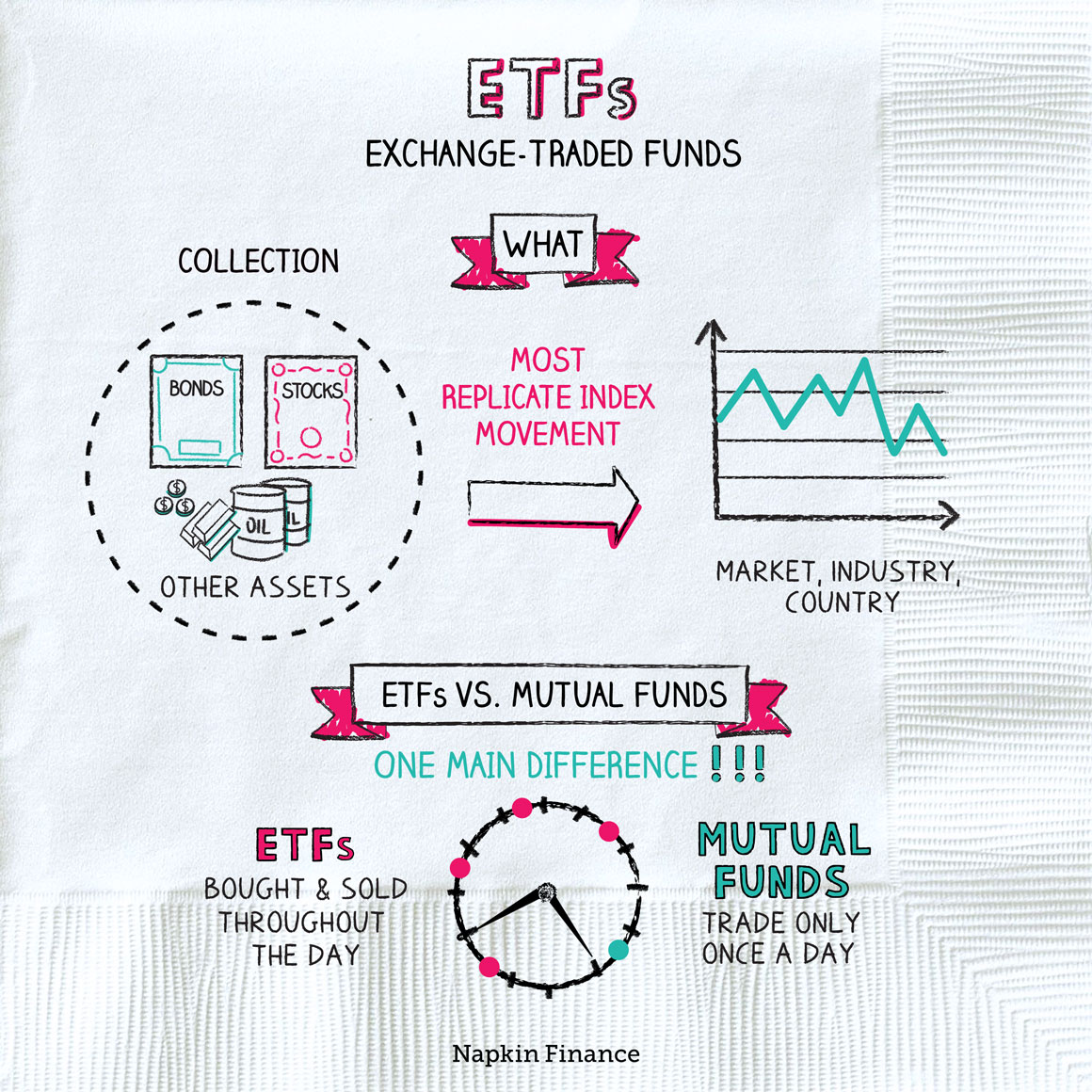

Exchange-traded funds (ETFs) are investment vehicles similar to mutual funds.

Like mutual funds, ETFs are professionally managed baskets of investments that pool many investors’ money together. Also like mutual funds, ETFs can be great tools for putting together a broad, well-diversified portfolio.

However, there are some key differences between the two. Here are the important distinctions:

| ETFs | Mutual funds | |

| Main difference | Shares trade on exchanges just like stocks, meaning you can watch the price go up and down throughout the trading day | Shares are valued and traded once a day, not throughout the day |

| How and when you can trade | Buy and sell shares throughout the trading day with a broker just as you can with stocks | Buy or redeem shares once a day—with a broker or with the fund company itself |

| Index vs. active | Most are index funds—meaning they track an index’s performance instead of trying to beat the market | Some are index funds, but many are actively managed funds, meaning a manager tries to pick only the best investments |

| Taxes | Usually generate minimal tax bills as long as you hold onto your shares | Can generate substantial tax bills even if you hold onto your shares |

Most ETFs are “indexed,” which means they try to match the performance of a specific index (such as the Dow Jones, S&P 500, or Nasdaq) as closely as possible. The fund does this by buying all of the index’s stocks and bonds (or at least a good sample of them) and holding them in the same proportions as the index.

Other ETFs are actively managed. Their investment managers try to beat the performance of a market index by picking specific investments that they think will have above average returns. While that might sound like a great way to make more money, these sometimes come with a few downsides, including:

- Higher expenses

- Greater risk of poor performance

- More tax bills along the way

ETFs can also be good tools to help investors fill a portfolio niche or reflect a special interest. For example, some of the more narrowly focused ETFs may only invest in:

- Specific sectors or industries (e.g., technology, utilities)

- A single foreign country (e.g., Japan’s Nikkei, the UK’s FTSE)

- One or more commodities (e.g., gold, corn, oil)

- Currencies (e.g., euro, Canadian dollar)

- Real estate (e.g., warehouses, shopping centers, mortgages)

That’s why many investors like to use ETFs as building blocks for their portfolios.

ETFs have become incredibly popular in recent years for a few reasons:

- Index investing is popular.

- There’s good evidence to show that investors on average do better with index funds, which aim only to match the market’s returns, than they do with actively managed funds, which aim to beat the market’s returns.

- Fees can be even lower than with mutual funds.

- Although you can buy index mutual funds, index ETFs can have even lower fees (and higher fees = lower returns).

- Low initial investment.

- You can start investing for the price of just one share. (Mutual funds can require minimum initial investments in the thousands of dollars.)

- You can invest in almost anything with them.

- Just as with mutual funds, ETFs can hold traditional stocks and bonds. But you can also use them to invest in things that are further afield. For example, there are ETFs that hold physical gold, that track the day-to-day movements of oil prices, and that invest exclusively in biotech stocks.

An exchange-traded fund (ETF) is a collection of stocks and bonds (or other securities) pooled into a single fund. You can buy and sell shares of ETFs on a stock exchange the same way you buy and sell stocks. Although they’re very similar to mutual funds, unlike mutual funds, you can trade ETFs throughout the trading day.

- The SPDR Gold Shares ETF holds about 70,000 bars of gold (each weighing 400 ounces) in an HSBC vault in London. Once a year, it hires a firm to count every single bar in the vault to make sure they’re all there (hello, summer internship).

- There is more than $4 trillion invested in ETFs in the U.S.

- The world of ETFs can get pretty weird. See: the Obesity ETF, the Global X Millennials Thematic ETF, and the HealthShares Dermatology and Wound Care ETF.

- ETFs are similar to mutual funds, but unlike mutual funds, they trade throughout the day on stock exchanges.

- Most ETFs are index funds, meaning they track the performance of an index, such as the S&P 500.

- Some ETFs, however, are actively managed, meaning they try to beat the market or the performance of a specific index.

- ETFs have become wildly popular in recent years as investors have moved money into index funds and thanks to their lower cost and tax advantage over mutual funds.

*Definitions of fun may vary.