Bonds

Bonds, James Bonds

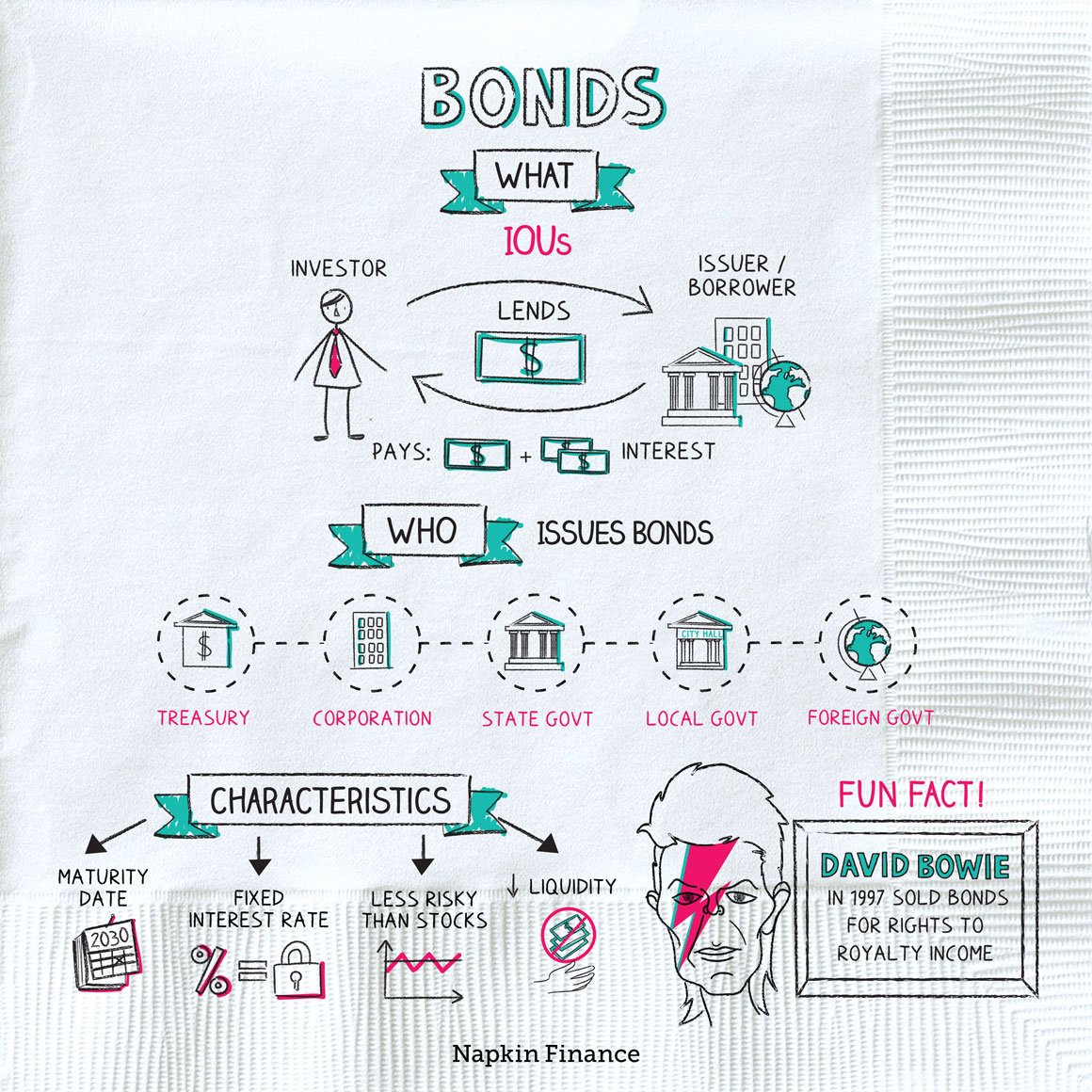

Bonds are essentially IOUs. When you buy a bond, you become a lender to whatever entity issued the bond. Typically, the borrower pays you a certain amount of interest periodically. When the bond matures, it also pays you back your initial investment, or the principal value of the bond.

Bonds have some main characteristics that distinguish them from stocks:

- Fixed interest rate—Most bonds pay a set rate that never changes. If a bond has a face value of $1,000 and a 5% interest rate, it pays $50 per year.

- Maturity date—Some bonds mature after 30 years and some after one year. But most bonds have a specific end date on which they repay your initial investment.

- Credit rating—A credit rating assesses how likely a particular bond issuer is to make its interest and principal payments.

-

- Top-notch bonds are rated “AAA.”

- Low-rated bonds are called junk bonds. They pay higher interest rates, but because they’re issued by financially shaky companies, they’re more likely to default.

- Lower risk and lower returns—Bonds generally return less and are less risky than stocks.

- Harder to buy and sell—Stocks are easy to trade with any major broker. But it can be hard to buy individual bonds on your own, and you often don’t get a great price if you need to sell them.

The main categories of bonds are:

- Treasuries—Issued by the U.S. federal government. You get a tax break on your state and local taxes on your interest income from Treasuries.

- Municipals—Issued by state and local governments and related entities. You typically get a tax break on your federal taxes on interest income and sometimes on state and local taxes as well.

- Corporates—Issued by corporations. There are no tax breaks on interest income.

- Foreign—Issued by foreign governments or corporations. The risk and return characteristics of foreign bonds can vary widely, depending on the particular issuer.

While considered a safer option than stocks, bonds do have plenty of risks, including:

- Liquidity risk—This describes how easy it is to sell your bond for its market value. Liquid bonds, like Treasuries, are usually easier to sell than illiquid bonds, such as those from risky companies or small nations.

- Credit risk—Occasionally, a bond issuer runs into serious financial trouble and can’t pay its debts. (This is called defaulting.) Junk bonds have more credit risk, while U.S. Treasury bonds have almost no credit risk.

- Interest rate risk—When interest rates rise, bond prices fall and vice versa. Although bond prices are generally much less volatile than stocks, big rises in interest rates can (and sometimes do) cause even safe bonds to lose money.

- Inflation risk—Rising inflation can cause interest rates to rise—driving bond prices down. Low-returning bonds, such as Treasuries, also run the risk of failing to keep pace with inflation (like if a bond pays 2% interest but inflation is 3%).

- Prepayment risk—A bond issuer could decide to pay off a bond before it matures. This happens most often when interest rates fall. Although it may not sound so bad to get your money back early, the downside is that you’ll typically be stuck reinvesting that money in a different bond that pays a lower interest rate.

Instead of buying individual bonds, many people choose to invest in bond mutual funds. In a bond fund, the money of many investors is pooled together, and a professional manager invests it in a diversified array of individual bonds (often of the same type, e.g., municipal bonds, corporate bonds, etc.).

The benefits of investing through a fund can include:

- Fewer headaches, since a professional is running the show

- Less risk if any one bond issuer can’t make its payments, since your money is typically spread around with hundreds or even thousands of different bonds

Unlike an individual bond, a bond fund’s periodic interest payments can vary over time, depending on the performance of each bond within the fund. And unlike individual bonds, bond funds never mature. Instead, investors decide when to take their money out or reinvest it.

Bonds are like IOUs, usually issued by a government or company to interested investors. Bonds tend to be safer investments than stocks. Bondholders typically receive periodic interest payments and get their principal investments back when a bond matures.

- In 1997, David Bowie sold bonds that gave bondholders the right to his royalty income. The Bowie bonds paid 8%.

- Disney, Coca-Cola, and the countries of Argentina and Austria have all issued one-hundred-year bonds.

- Bonds are debts. When you buy a bond, you become a lender, and the issuer becomes a borrower.

- Bonds generally pay a set interest rate and mature on a particular date.

- They’re generally less risky than stocks and return less than stocks.

- Investing through a bond fund can be more convenient and less risky than holding individual bonds.